Form Dtf-406 - Claim For Highway Use Tax (Hut) Refund Instructions

ADVERTISEMENT

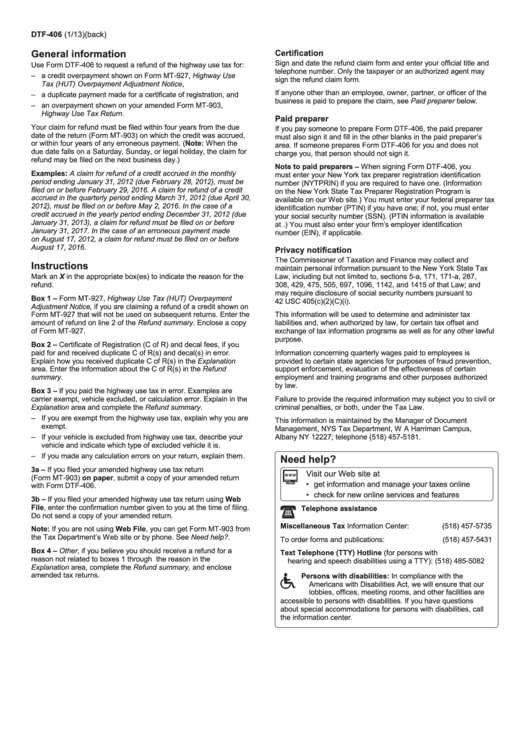

DTF-406 (1/13) (back)

General information

Certification

Sign and date the refund claim form and enter your official title and

Use Form DTF-406 to request a refund of the highway use tax for:

telephone number. Only the taxpayer or an authorized agent may

– a credit overpayment shown on Form MT-927, Highway Use

sign the refund claim form.

Tax (HUT) Overpayment Adjustment Notice,

If anyone other than an employee, owner, partner, or officer of the

– a duplicate payment made for a certificate of registration, and

business is paid to prepare the claim, see Paid preparer below.

– an overpayment shown on your amended Form MT-903,

Highway Use Tax Return.

Paid preparer

Your claim for refund must be filed within four years from the due

If you pay someone to prepare Form DTF-406, the paid preparer

date of the return (Form MT-903) on which the credit was accrued,

must also sign it and fill in the other blanks in the paid preparer’s

or within four years of any erroneous payment. (Note: When the

area. If someone prepares Form DTF-406 for you and does not

due date falls on a Saturday, Sunday, or legal holiday, the claim for

charge you, that person should not sign it.

refund may be filed on the next business day.)

Note to paid preparers – When signing Form DTF-406, you

Examples: A claim for refund of a credit accrued in the monthly

must enter your New York tax preparer registration identification

period ending January 31, 2012 (due February 28, 2012), must be

number (NYTPRIN) if you are required to have one. (Information

filed on or before February 29, 2016. A claim for refund of a credit

on the New York State Tax Preparer Registration Program is

accrued in the quarterly period ending March 31, 2012 (due April 30,

available on our Web site.) You must enter your federal preparer tax

2012), must be filed on or before May 2, 2016. In the case of a

identification number (PTIN) if you have one; if not, you must enter

credit accrued in the yearly period ending December 31, 2012 (due

your social security number (SSN). (PTIN information is available

January 31, 2013), a claim for refund must be filed on or before

at ) You must also enter your firm’s employer identification

January 31, 2017. In the case of an erroneous payment made

number (EIN), if applicable.

on August 17, 2012, a claim for refund must be filed on or before

August 17, 2016.

Privacy notification

The Commissioner of Taxation and Finance may collect and

Instructions

maintain personal information pursuant to the New York State Tax

Mark an X in the appropriate box(es) to indicate the reason for the

Law, including but not limited to, sections 5-a, 171, 171-a, 287,

refund.

308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and

may require disclosure of social security numbers pursuant to

Box 1 – Form MT-927, Highway Use Tax (HUT) Overpayment

42 USC 405(c)(2)(C)(i).

Adjustment Notice, if you are claiming a refund of a credit shown on

Form MT-927 that will not be used on subsequent returns. Enter the

This information will be used to determine and administer tax

amount of refund on line 2 of the Refund summary. Enclose a copy

liabilities and, when authorized by law, for certain tax offset and

of Form MT-927.

exchange of tax information programs as well as for any other lawful

purpose.

Box 2 – Certificate of Registration (C of R) and decal fees, if you

paid for and received duplicate C of R(s) and decal(s) in error.

Information concerning quarterly wages paid to employees is

Explain how you received duplicate C of R(s) in the Explanation

provided to certain state agencies for purposes of fraud prevention,

area. Enter the information about the C of R(s) in the Refund

support enforcement, evaluation of the effectiveness of certain

summary.

employment and training programs and other purposes authorized

by law.

Box 3 – If you paid the highway use tax in error. Examples are

carrier exempt, vehicle excluded, or calculation error. Explain in the

Failure to provide the required information may subject you to civil or

Explanation area and complete the Refund summary.

criminal penalties, or both, under the Tax Law.

– If you are exempt from the highway use tax, explain why you are

This information is maintained by the Manager of Document

exempt.

Management, NYS Tax Department, W A Harriman Campus,

– If your vehicle is excluded from highway use tax, describe your

Albany NY 12227; telephone (518) 457-5181.

vehicle and indicate which type of excluded vehicle it is.

– If you made any calculation errors on your return, explain them.

Need help?

3a – If you filed your amended highway use tax return

Visit our Web site at

(Form MT-903) on paper, submit a copy of your amended return

• get information and manage your taxes online

with Form DTF-406.

• check for new online services and features

3b – If you filed your amended highway use tax return using Web

File, enter the confirmation number given to you at the time of filing.

Telephone assistance

Do not send a copy of your amended return.

Miscellaneous Tax Information Center:

(518) 457-5735

Note: If you are not using Web File, you can get Form MT-903 from

the Tax Department’s Web site or by phone. See Need help?.

To order forms and publications:

(518) 457-5431

Box 4 – Other, if you believe you should receive a refund for a

Text Telephone (TTY) Hotline (for persons with

reason not related to boxes 1 through 3. Explain the reason in the

hearing and speech disabilities using a TTY): (518) 485-5082

Explanation area, complete the Refund summary, and enclose

amended tax returns.

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions

about special accommodations for persons with disabilities, call

the information center.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1