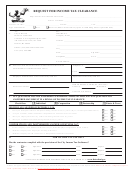

Requirements For Income Tax Clearance

.

Background

The City of Detroit is authorized to levy an income tax under the Uniform City

Income Tax Ordinance (No.900-F) set forth in Chapter 2 of Act 284 of the Public Acts of 1964,

known as the “City Income Tax Act.” “No bid shall be accepted from or contract awarded to any

person who is in arrears to the City…” see Detroit codes: Sec.18-5-13, Sec. 18-10-25 and General

Conditions# 28.

What Is An Income Tax Clearance?

An approved Income Tax Clearance states that an

individual, business or subcontractor seeking employment or contracts with the City of Detroit has

complied with all the provisions of the City Income Tax Ordinance. Contractors (individuals,

businesses or Subcontractors) cannot be awarded a contract and are not authorized to perform

services until they are in compliance with the City Income Tax Ordinance. The “Request for

Income Tax Clearance” form should be submitted 30 days prior to the submission for

new bids or renewals of contract extensions.

Please e-mail your completed request form

(preferably in pdf format) to: IncomeTaxClearance@detroitmi.gov

Requirements For Individuals.

Individuals must file returns and pay income taxes, and not

have any unpaid assessments. Detroit residents must file formD-1040(R). If a taxpayer claims a

non-resident status, proof will be required (copy of lease, mortgage closing statements, drivers

license, voter’s registration, ect.). If an individual seeking a tax clearance reside within the City,

but claimed dependent status on another person’s tax return, or received assistance, proof may

be required.

Requirements For Businesses. Businesses must file Corporation (D-1120) or Partnership

(D-1065) returns, regardless of net profit or loss. Non-profit organizations are required to file

D-1120 tax return based on non-related income. All employers located in the City or “doing

business within the City” must withhold City of Detroit income taxes from employees”

compensation. Employers subject to withholding tax must file monthly or quarterly forms

D-941/501, as well as, form DW-3 (Annual Reconciliation) with W2’s. All assessments must

be paid. New employers must request an Employer’s Package and register with the City by

completing and submitting an Employer’s Withholding Registration form DSS-4. Contractors

must supply a list of subcontractors with federal identification numbers or social security

numbers. Contractors must also supply the federal identification numbers used for their

leased employees.

Income Tax Clearance Denials. Income Tax Clearances are denied based on one or more

of the following reasons:

1. Missing withholding payments, DW-3 Annual Reconciliation with W2’s,

2. Unpaid assessments

3. Missing tax returns

Related data regarding taxpayers are confidential, therefore, reasons for denial are given

only to the taxpayer or authorized representative with power of attorney. Taxpayers

with denied clearances may visit our office to obtain information about their account or

to submit requested information.

Appointments are not necessary. For additional information contact the Clearance Section

at (313) 224-3328 or (313) 224-3329. Our office is located in the Coleman A. Young

Municipal Center, 2 Woodward Avenue, Suite 1220. Office hours are 8:00 a.m. to 4:00 p.m.,

Monday through Friday.

Rev 12/14

1

1 2

2