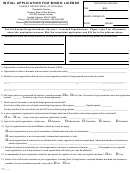

SECTION B - INSTANT BINGO TICKETS (PULL-TABS) PURCHASED OR RETURNED DURING THE MONTH

(List each game separately based on invoices dated during the month being reported.)

Total Retail Price

Distributor’s

Invoice

Invoice

Manufacturer’s

Serial Number

Distributor’s Name

Registration

Date

of Tickets in

Number

Name

of Game

Number

Game

Copy this amount to Section B on reverse side

Total

INSTRUCTIONS

Section A - For each purchase of call bingo paper during the month, enter the data indicated by the column headings. Purchases

should be reported in the same month as the date on the distributor’s invoice, not the date received or the date paid.

The data should be entered on a single line for each distributor’s invoice. Be sure to total each column.

Section B - For each instant bingo (pull-tab) game purchased during the month, enter the data indicated by the column headings

above (page 2). The far right column, “Total Retail Price of Tickets in Game,” is calculated by multiplying the number of

tickets in the game by the denomination of the tickets (25 cents, 50 cents, etc.). This is the gross revenue which you will

receive if you sell all of the tickets in the game to the players. Do not report the wholesale price that your organization

paid to the distributor for the game. Also write the total for Section B in the block on the reverse side (page 1).

Section C - Report the total gross receipts from the sale of all call bingo disposable paper faces to the players for all bingo sessions

conducted during the month. Do not include receipts from the sale of instant bingo tickets (pull-tabs) or daubers.

Section D - Line 1, enter your total gross receipts from re-usable or hard card sales and any admission fees charged. Line 2, A 3

percent tax is due on the gross receipts from re-usable or hard cards and any admission fees or charges. Write the

amount in Section D, Line 2 and enclose a check for that amount made payable to the Kansas Department of Revenue.

No. of times played this month: How many sessions did the organization host bingo during the month?

Average attendance per time: What was the average attendance for the month?

Total Net Proceeds: Add revenue from pull-tabs and faces. Subtract from that number, any purchases for pull-tabs or faces

purchased during the month, payouts on faces and pull-tabs. That number is the answer.

Number of drawings this month: Organizations are allowed 4 drawings pr. Yr. Only one drawing per session is allowed.

Number of times played off limits: Organization requested to play at another location other than address on their license. Allowed

5 times per year and must be in the same county. EX: county fair. Notify this office 3 days in advance in writing.

1

1 2

2