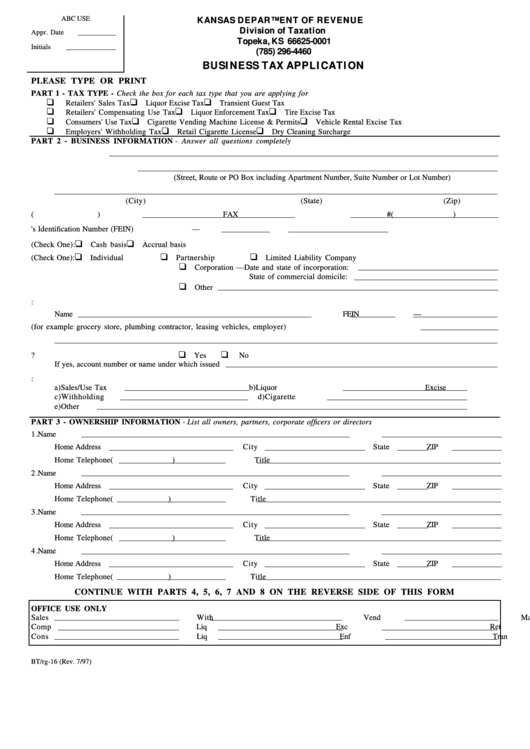

ABC USE

KANSAS DEPARTMENT OF REVENUE

Division of Taxation

Appr. Date

Topeka, KS 66625-0001

Initials

(785) 296-4460

BUSINESS TAX APPLICATION

PLEASE TYPE OR PRINT

PART 1 - TAX TYPE - Check the box for each tax type that you are applying for

Retailers' Sales Tax

Liquor Excise Tax

Transient Guest Tax

Retailers' Compensating Use Tax

Liquor Enforcement Tax

Tire Excise Tax

Consumers' Use Tax

Cigarette Vending Machine License & Permits

Vehicle Rental Excise Tax

Employers' Withholding Tax

Retail Cigarette License

Dry Cleaning Surcharge

PART 2 - BUSINESS INFORMATION - Answer all questions completely

1 .

Business Name

2 .

Business Mailing Address

(Street, Route or PO Box including Apartment Number, Suite Number or Lot Number)

(City)

(State)

(Zip)

3 .

Business Phone Number (

)

FAX # (

)

4 .

Federal Employer's Identification Number (FEIN)

—

5 .

Accounting Method (Check One):

Cash basis

Accrual basis

6 .

Type of Ownership (Check One):

Individual

Partnership

Limited Liability Company

Corporation — Date and state of incorporation:

State of commercial domicile:

Other

7 .

List the name and FEIN of your parent company if applicable:

Name

FEIN

—

8 .

Describe your business activity (for example grocery store, plumbing contractor, leasing vehicles, employer)

9 .

Have you or any member of your firm previously held a Kansas number?.................................................

Yes

No

If yes, account number or name under which issued

10.

List all registration numbers currently used for reporting Kansas taxes:

a)

Sales/Use Tax

b)

Liquor Excise

c)

Withholding

d)

Cigarette

e)

Other

PART 3 - OWNERSHIP INFORMATION - List all owners, partners, corporate officers or directors

1 .

Name

SSN

-

-

Home Address

City

State

ZIP

Home Telephone (

)

Title

2 .

Name

SSN

-

-

Home Address

City

State

ZIP

Home Telephone (

)

Title

3 .

Name

SSN

-

-

Home Address

City

State

ZIP

Home Telephone (

)

Title

4 .

Name

SSN

-

-

Home Address

City

State

ZIP

Home Telephone (

)

Title

CONTINUE WITH PARTS 4, 5, 6, 7 AND 8 ON THE REVERSE SIDE OF THIS FORM

OFFICE USE ONLY

Sales

With

Vend Machine

Comp

Liq Exc

Ret Cig

Cons

Liq Enf

Tran Gst

BT/rg-16 (Rev. 7/97)

1

1 2

2