Individual Return Of Occupation License Fee Return Form - City Of Auburn

ADVERTISEMENT

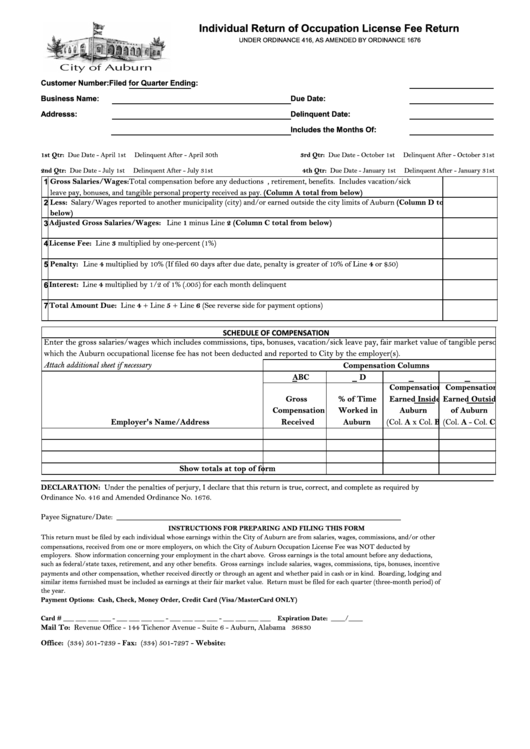

Individual Return of Occupation License Fee Return

UNDER ORDINANCE 416, AS AMENDED BY ORDINANCE 1676

Customer Number:

Filed for Quarter Ending:

Business Name:

Due Date:

Addresss:

Delinquent Date:

Includes the Months Of:

1st Qtr: Due Date - April 1st

Delinquent After - April 30th

3rd Qtr: Due Date - October 1st

Delinquent After - October 31st

2nd Qtr: Due Date - July 1st

4th Qtr: Due Date - January 1st

Delinquent After - July 31st

Delinquent After - January 31st

Gross Salaries/Wages: Total compensation before any deductions i.e. federal/state taxes, retirement, benefits. Includes vacation/sick

1

leave pay, bonuses, and tangible personal property received as pay.

(Column A total from below)

2

Less: Salary/Wages reported to another municipality (city) and/or earned outside the city limits of Auburn (Column D total from

below)

3 Adjusted Gross Salaries/Wages: Line 1 minus Line 2 (Column C total from below)

4 License Fee: Line 3 multiplied by one-percent (1%)

5

Penalty: Line 4 multiplied by 10% (If filed 60 days after due date, penalty is greater of 10% of Line 4 or $50)

6 Interest: Line 4 multiplied by 1/2 of 1% (.005) for each month delinquent

7 Total Amount Due: Line 4 + Line 5 + Line 6 (See reverse side for payment options)

SCHEDULE OF COMPENSATION

Enter the gross salaries/wages which includes commissions, tips, bonuses, vacation/sick leave pay, fair market value of tangible personal property from

which the Auburn occupational license fee has not been deducted and reported to City by the employer(s).

Attach additional sheet if necessary

Compensation Columns

A

B

C

D

Compensation

Compensation

Gross

% of Time

Earned Inside

Earned Outside

Compensation

Worked in

Auburn

of Auburn

Employer's Name/Address

Received

Auburn

(Col. A x Col. B)

(Col. A - Col. C)

Show totals at top of form

DECLARATION: Under the penalties of perjury, I declare that this return is true, correct, and complete as required by

Ordinance No. 416 and Amended Ordinance No. 1676.

Payee Signature/Date: _________________________________________________________________________

INSTRUCTIONS FOR PREPARING AND FILING THIS FORM

This return must be filed by each individual whose earnings within the City of Auburn are from salaries, wages, commissions, and/or other

compensations, received from one or more employers, on which the City of Auburn Occupation License Fee was NOT deducted by

employers.

Show information concerning your employment in the chart above.

Gross earnings is the total amount before any deductions,

such as federal/state taxes, retirement, and any other benefits.

Gross earnings

include salaries, wages, commissions, tips, bonuses, incentive

payments and other compensation, whether received directly or through an agent and whether paid in cash or in kind.

Boarding, lodging and

similar items furnished must be included as earnings at their fair market value.

Return must be filed for each quarter (three-month period) of

the year.

Payment Options: Cash, Check, Money Order, Credit Card (Visa/MasterCard ONLY)

Card # ___ ___ ___ ___ - ___ ___ ___ ___ - ___ ___ ___ ___ - ___ ___ ___ ___

Expiration Date: ____/____

Mail To: Revenue Office - 144 Tichenor Avenue - Suite 6 - Auburn, Alabama 36830

Office: (334) 501-7239 - Fax: (334) 501-7297 - Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1