Occupational License Tax Renewal Form - City Of Oak Grove

ADVERTISEMENT

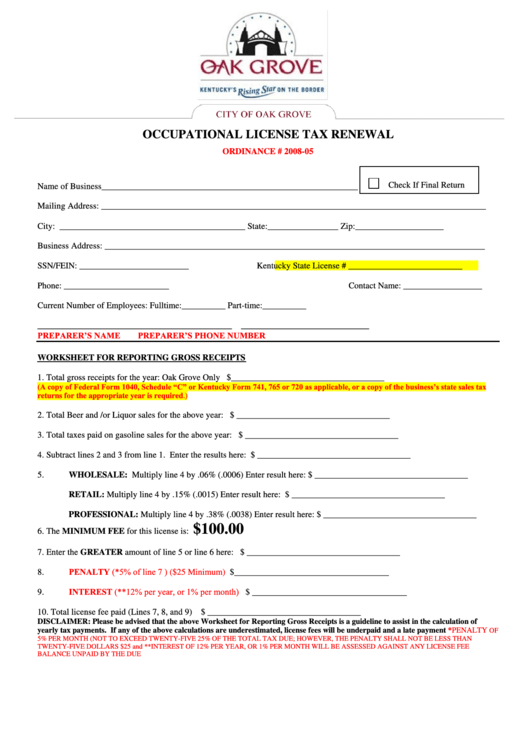

OCCUPATIONAL LICENSE TAX RENEWAL

ORDINANCE # 2008-05

Check If Final Return

Name of Business__________________________________________________________

Mailing Address: _______________________________________________________________________________________

City:

__________________________________________ State:________________ Zip:____________________

Business Address: ______________________________________________________________________________________

SSN/FEIN:

_________________________

Kentucky State License # __________________________

Phone: ________________________

Contact Name: __________________

Current Number of Employees:

Fulltime:__________

Part-time:__________

____________________________________________

_____________________________

PREPARER’S NAME

PREPARER’S PHONE NUMBER

WORKSHEET FOR REPORTING GROSS RECEIPTS

1.

Total gross receipts for the year: Oak Grove Only

$___________________________________

(A copy of Federal Form 1040, Schedule “C” or Kentucky Form 741, 765 or 720 as applicable, or a copy of the business’s state sales tax

returns for the appropriate year is required.)

2.

Total Beer and /or Liquor sales for the above year:

$ ___________________________________

3.

Total taxes paid on gasoline sales for the above year:

$ ___________________________________

4.

Subtract lines 2 and 3 from line 1. Enter the results here:

$ ___________________________________

5.

WHOLESALE: Multiply line 4 by .06% (.0006) Enter result here:

$ ___________________________________

RETAIL: Multiply line 4 by .15% (.0015) Enter result here:

$ ___________________________________

PROFESSIONAL: Multiply line 4 by .38% (.0038) Enter result here: $ ___________________________________

$100.00

6.

The MINIMUM FEE for this license is:

7.

Enter the GREATER amount of line 5 or line 6 here:

$ ___________________________________

PENALTY (*5% of line 7 ) ($25 Minimum)

8.

$___________________________________

INTEREST (**12% per year, or 1% per month)

9.

$ ___________________________________

10.

Total license fee paid (Lines 7, 8, and 9)

$ ___________________________________

DISCLAIMER:

Please be advised that the above Worksheet for Reporting Gross Receipts is a guideline to assist in the calculation of

yearly tax payments. If any of the above calculations are underestimated, license fees will be underpaid and a late payment

*PENALTY

OF

5% PER MONTH (NOT TO EXCEED TWENTY-FIVE 25% OF THE TOTAL TAX DUE; HOWEVER, THE PENALTY SHALL NOT BE LESS THAN

TWENTY-FIVE DOLLARS $25 and **INTEREST OF 12% PER YEAR, OR 1% PER MONTH WILL BE ASSESSED AGAINST ANY LICENSE FEE

BALANCE UNPAID BY THE DUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2