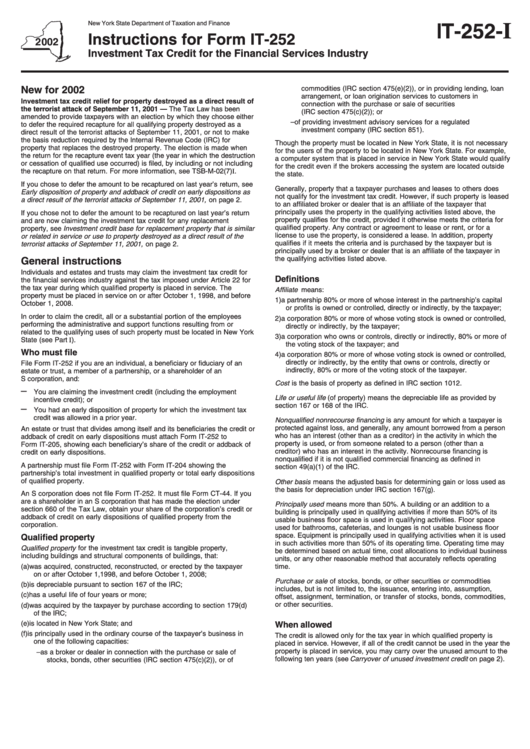

Instructions For Form It-252 - Investment Tax Credit For The Financial Services Industry - New York State Department Of Taxation And Finance - 2002

ADVERTISEMENT

New York State Department of Taxation and Finance

I

IT-252-

Instructions for Form IT-252

Investment Tax Credit for the Financial Services Industry

commodities (IRC section 475(e)(2)), or in providing lending, loan

New for 2002

arrangement, or loan origination services to customers in

Investment tax credit relief for property destroyed as a direct result of

connection with the purchase or sale of securities

the terrorist attack of September 11, 2001 — The Tax Law has been

(IRC section 475(c)(2)); or

amended to provide taxpayers with an election by which they choose either

– of providing investment advisory services for a regulated

to defer the required recapture for all qualifying property destroyed as a

investment company (IRC section 851).

direct result of the terrorist attacks of September 11, 2001, or not to make

the basis reduction required by the Internal Revenue Code (IRC) for

Though the property must be located in New York State, it is not necessary

property that replaces the destroyed property. The election is made when

for the users of the property to be located in New York State. For example,

the return for the recapture event tax year (the year in which the destruction

a computer system that is placed in service in New York State would qualify

or cessation of qualified use occurred) is filed, by including or not including

for the credit even if the brokers accessing the system are located outside

the recapture on that return. For more information, see TSB-M-02(7)I.

the state.

If you chose to defer the amount to be recaptured on last year’s return, see

Generally, property that a taxpayer purchases and leases to others does

Early disposition of property and addback of credit on early dispositions as

not qualify for the investment tax credit. However, if such property is leased

a direct result of the terrorist attacks of September 11, 2001, on page 2.

to an affiliated broker or dealer that is an affiliate of the taxpayer that

principally uses the property in the qualifying activities listed above, the

If you chose not to defer the amount to be recaptured on last year’s return

property qualifies for the credit, provided it otherwise meets the criteria for

and are now claiming the investment tax credit for any replacement

qualified property. Any contract or agreement to lease or rent, or for a

property, see Investment credit base for replacement property that is similar

license to use the property, is considered a lease. In addition, property

or related in service or use to property destroyed as a direct result of the

qualifies if it meets the criteria and is purchased by the taxpayer but is

terrorist attacks of September 11, 2001, on page 2.

principally used by a broker or dealer that is an affiliate of the taxpayer in

the qualifying activities listed above.

General instructions

Individuals and estates and trusts may claim the investment tax credit for

Definitions

the financial services industry against the tax imposed under Article 22 for

the tax year during which qualified property is placed in service. The

Affiliate means:

property must be placed in service on or after October 1, 1998, and before

1) a partnership 80% or more of whose interest in the partnership’s capital

October 1, 2008.

or profits is owned or controlled, directly or indirectly, by the taxpayer;

In order to claim the credit, all or a substantial portion of the employees

2) a corporation 80% or more of whose voting stock is owned or controlled,

performing the administrative and support functions resulting from or

directly or indirectly, by the taxpayer;

related to the qualifying uses of such property must be located in New York

3) a corporation who owns or controls, directly or indirectly, 80% or more of

State (see Part I).

the voting stock of the taxpayer; and

Who must file

4) a corporation 80% or more of whose voting stock is owned or controlled,

directly or indirectly, by the entity that owns or controls, directly or

File Form IT-252 if you are an individual, a beneficiary or fiduciary of an

indirectly, 80% or more of the voting stock of the taxpayer.

estate or trust, a member of a partnership, or a shareholder of an

S corporation, and:

Cost is the basis of property as defined in IRC section 1012.

–

You are claiming the investment credit (including the employment

Life or useful life (of property) means the depreciable life as provided by

incentive credit); or

section 167 or 168 of the IRC.

–

You had an early disposition of property for which the investment tax

credit was allowed in a prior year.

Nonqualified nonrecourse financing is any amount for which a taxpayer is

protected against loss, and generally, any amount borrowed from a person

An estate or trust that divides among itself and its beneficiaries the credit or

who has an interest (other than as a creditor) in the activity in which the

addback of credit on early dispositions must attach Form IT-252 to

property is used, or from someone related to a person (other than a

Form IT-205, showing each beneficiary’s share of the credit or addback of

creditor) who has an interest in the activity. Nonrecourse financing is

credit on early dispositions.

nonqualified if it is not qualified commercial financing as defined in

A partnership must file Form IT-252 with Form IT-204 showing the

section 49(a)(1) of the IRC.

partnership’s total investment in qualified property or total early dispositions

of qualified property.

Other basis means the adjusted basis for determining gain or loss used as

the basis for depreciation under IRC section 167(g).

An S corporation does not file Form IT-252. It must file Form CT-44. If you

are a shareholder in an S corporation that has made the election under

Principally used means more than 50%. A building or an addition to a

section 660 of the Tax Law, obtain your share of the corporation’s credit or

building is principally used in qualifying activities if more than 50% of its

addback of credit on early dispositions of qualified property from the

usable business floor space is used in qualifying activities. Floor space

corporation.

used for bathrooms, cafeterias, and lounges is not usable business floor

space. Equipment is principally used in qualifying activities when it is used

Qualified property

in such activities more than 50% of its operating time. Operating time may

Qualified property for the investment tax credit is tangible property,

be determined based on actual time, cost allocations to individual business

including buildings and structural components of buildings, that:

units, or any other reasonable method that accurately reflects operating

(a) was acquired, constructed, reconstructed, or erected by the taxpayer

time.

on or after October 1,1998, and before October 1, 2008;

Purchase or sale of stocks, bonds, or other securities or commodities

(b) is depreciable pursuant to section 167 of the IRC;

includes, but is not limited to, the issuance, entering into, assumption,

(c) has a useful life of four years or more;

offset, assignment, termination, or transfer of stocks, bonds, commodities,

or other securities.

(d) was acquired by the taxpayer by purchase according to section 179(d)

of the IRC;

(e) is located in New York State; and

When allowed

(f) is principally used in the ordinary course of the taxpayer’s business in

The credit is allowed only for the tax year in which qualified property is

one of the following capacities:

placed in service. However, if all of the credit cannot be used in the year the

property is placed in service, you may carry over the unused amount to the

– as a broker or dealer in connection with the purchase or sale of

following ten years (see Carryover of unused investment credit on page 2).

stocks, bonds, other securities (IRC section 475(c)(2)), or of

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4