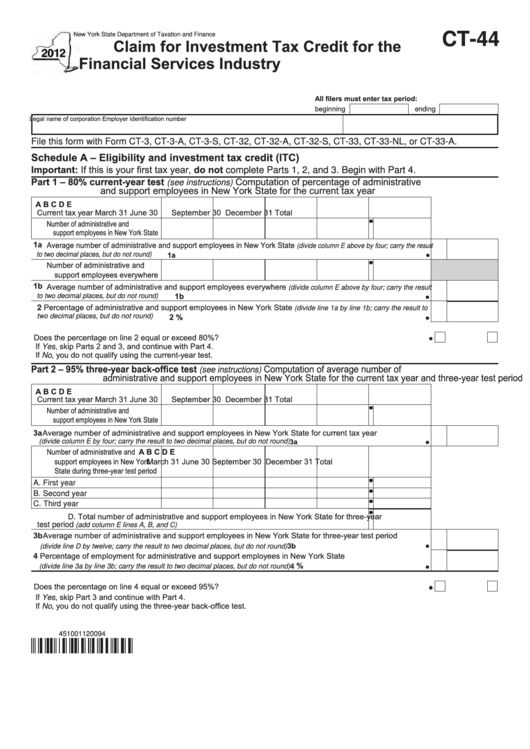

Form Ct-44 - Claim For Investment Tax Credit For The Financial Services Industry - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

CT-44

New York State Department of Taxation and Finance

Claim for Investment Tax Credit for the

Financial Services Industry

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-NL, or CT-33-A.

Schedule A – Eligibility and investment tax credit (ITC)

Important: If this is your first tax year, do not complete Parts 1, 2, and 3. Begin with Part 4.

Part 1 – 80% current-year test

Computation of percentage of administrative

(see instructions)

and support employees in New York State for the current tax year

A

B

C

D

E

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and

support employees in New York State

1a Average number of administrative and support employees in New York State

(divide column E above by four; carry the result

1a

to two decimal places, but do not round)

.....................................................................................................................

Number of administrative and

support employees everywhere

1b Average number of administrative and support employees everywhere

(divide column E above by four; carry the result

1b

to two decimal places, but do not round)

..................................................................................................................

2 Percentage of administrative and support employees in New York State

(divide line 1a by line 1b; carry the result to

2

%

two decimal places, but do not round)

.....................................................................................................................

Does the percentage on line 2 equal or exceed 80%? ....................................................................................Yes

No

If Yes, skip Parts 2 and 3, and continue with Part 4.

If No, you do not qualify using the current-year test.

Part 2 – 95% three-year back-office test

Computation of average number of

(see instructions)

administrative and support employees in New York State for the current tax year and three-year test period

A

B

C

D

E

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and

support employees in New York State

3a Average number of administrative and support employees in New York State for current tax year

3a

.......................................................

(divide column E by four; carry the result to two decimal places, but do not round)

Number of administrative and

A

B

C

D

E

support employees in New York

March 31

June 30

September 30 December 31

Total

State during three-year test period

A. First year

B. Second year

C. Third year

D. Total number of administrative and support employees in New York State for three-year

test period

......................................................................

(add column E lines A, B, and C)

3b Average number of administrative and support employees in New York State for three-year test period

3b

........................................................

(divide line D by twelve; carry the result to two decimal places, but do not round)

4 Percentage of employment for administrative and support employees in New York State

%

.......................................................

(divide line 3a by line 3b; carry the result to two decimal places, but do not round)

4

Does the percentage on line 4 equal or exceed 95%? ....................................................................................Yes

No

If Yes, skip Part 3 and continue with Part 4.

If No, you do not qualify using the three-year back-office test.

451001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4