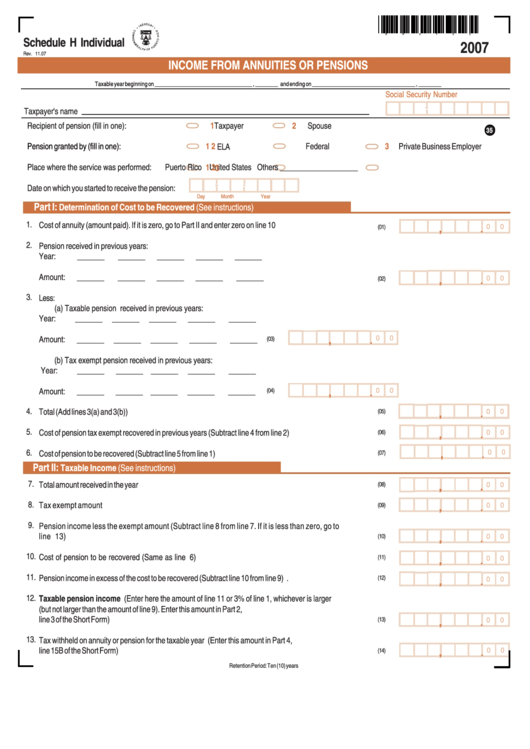

Schedule H Individual - Income From Annuities Or Pensions - 2007

ADVERTISEMENT

E

H

0

7

0

0

Schedule H Individual

2007

Rev. 11.07

INCOME FROM ANNUITIES OR PENSIONS

Taxable year beginning on __________________________________ , ________ and ending on ____________________________________ , ________

Social Security Number

Taxpayer's name

Recipient of pension (fill in one):

1

Taxpayer

2

Spouse

35

Pension granted by (fill in one):

1

2

Federal

3

Private Business Employer

ELA

Place where the service was performed:

1

Puerto Rico

2

United States

Others ____________________

3

Date on which you started to receive the pension:

Day

Month

Year

Part I:

Determination of Cost to be Recovered (See instructions)

1.

Cost of annuity (amount paid). If it is zero, go to Part II and enter zero on line 10 ................................................

(01)

.

0

0

,

2.

Pension received in previous years:

Year:

_______

_______

_______

_______

_______

Amount:

_______

_______

_______

_______

_______

................................................

(02)

.

0

0

,

3.

Less:

(a) Taxable pension received in previous years:

Year:

_______

_______

_______

_______

_______

Amount:

_______

_______

_______

_______

_______

(03)

.

0

0

,

(b) Tax exempt pension received in previous years:

Year:

_______

_______ _______

_______

_______

Amount:

_______

_______ _______ _______

_______

(04)

.

0

0

,

4.

Total (Add lines 3(a) and 3(b)) ............................................................................................................................

(05)

.

0

0

,

5.

Cost of pension tax exempt recovered in previous years (Subtract line 4 from line 2) .........................................

(06)

.

0

0

,

6.

Cost of pension to be recovered (Subtract line 5 from line 1) ...............................................................................

.

(07)

0

0

,

Part II:

Taxable Income (See instructions)

7.

Total amount received in the year .......................................................................................................................

(08)

.

.

0

0

,

,

8.

Tax exempt amount .............................................................................................................................

(09)

.

0

0

,

9.

Pension income less the exempt amount (Subtract line 8 from line 7. If it is less than zero, go to

line 13)

...............................................................................................................................................

(10)

.

0

0

,

10.

Cost of pension to be recovered (Same as line 6)

.............................................................................................

(11)

.

0

0

,

11.

Pension income in excess of the cost to be recovered (Subtract line 10 from line 9) ............................................

(12)

.

0

0

,

12.

Taxable pension income (Enter here the amount of line 11 or 3% of line 1, whichever is larger

(but not larger than the amount of line 9). Enter this amount in Part 2,

line 3 of the Short Form) ......................................................................................................................................

(13)

.

0

0

,

13.

Tax withheld on annuity or pension for the taxable year (Enter this amount in Part 4,

line 15B of the Short Form) .................................................................................................................................

(14)

.

0

0

,

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1