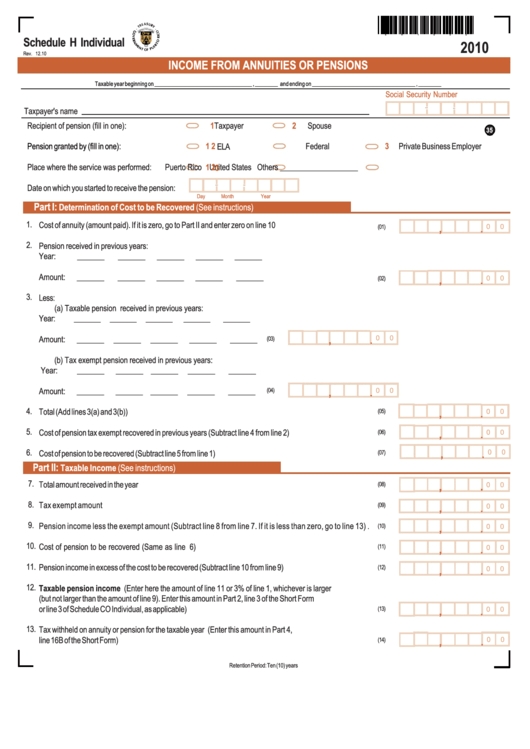

Schedule H Individual - Income From Annuities Or Pensions - 2010

ADVERTISEMENT

E

H

1

0

0

0

Schedule H Individual

2010

Rev. 12.10

INCOME FROM ANNUITIES OR PENSIONS

Taxable year beginning on __________________________________ , ________ and ending on ____________________________________ , ________

Social Security Number

Taxpayer's name

Recipient of pension (fill in one):

1

Taxpayer

2

Spouse

35

Pension granted by (fill in one):

1

2

Federal

3

Private Business Employer

ELA

Place where the service was performed:

1

Puerto Rico

2

United States

Others ____________________

3

Date on which you started to receive the pension:

Day

Month

Year

Part I:

Determination of Cost to be Recovered (See instructions)

1.

Cost of annuity (amount paid). If it is zero, go to Part II and enter zero on line 10 ...............................................

.

0

0

(01)

,

2.

Pension received in previous years:

Year:

_______

_______

_______

_______

_______

Amount:

_______

_______

_______

_______

_______

...............................................

.

0

0

,

(02)

3.

Less:

(a) Taxable pension received in previous years:

Year:

_______

_______

_______

_______

_______

.

Amount:

_______

_______

_______

_______

_______

,

0

0

(03)

(b) Tax exempt pension received in previous years:

Year:

_______

_______ _______

_______

_______

.

Amount:

_______

_______ _______ _______

_______

(04)

,

0

0

4.

.

Total (Add lines 3(a) and 3(b)) ...........................................................................................................................

(05)

0

0

,

5.

Cost of pension tax exempt recovered in previous years (Subtract line 4 from line 2) ........................................

.

(06)

0

0

,

.

6.

Cost of pension to be recovered (Subtract line 5 from line 1) ..............................................................................

,

0

0

(07)

Part II:

Taxable Income (See instructions)

7.

Total amount received in the year ......................................................................................................................

.

.

(08)

0

0

,

,

8.

Tax exempt amount ............................................................................................................................

.

(09)

0

0

,

9.

Pension income less the exempt amount (Subtract line 8 from line 7. If it is less than zero, go to line 13)

.

.

(10)

,

0

0

10.

Cost of pension to be recovered (Same as line 6)

............................................................................................

.

(11)

,

0

0

11.

Pension income in excess of the cost to be recovered (Subtract line 10 from line 9) ...........................................

.

(12)

0

0

,

12.

Taxable pension income (Enter here the amount of line 11 or 3% of line 1, whichever is larger

(but not larger than the amount of line 9). Enter this amount in Part 2, line 3 of the Short Form

or line 3 of Schedule CO Individual, as applicable) ............................................................................................

.

(13)

0

0

,

13.

Tax withheld on annuity or pension for the taxable year (Enter this amount in Part 4,

.

line 16B of the Short Form) ................................................................................................................................

,

0

0

(14)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1