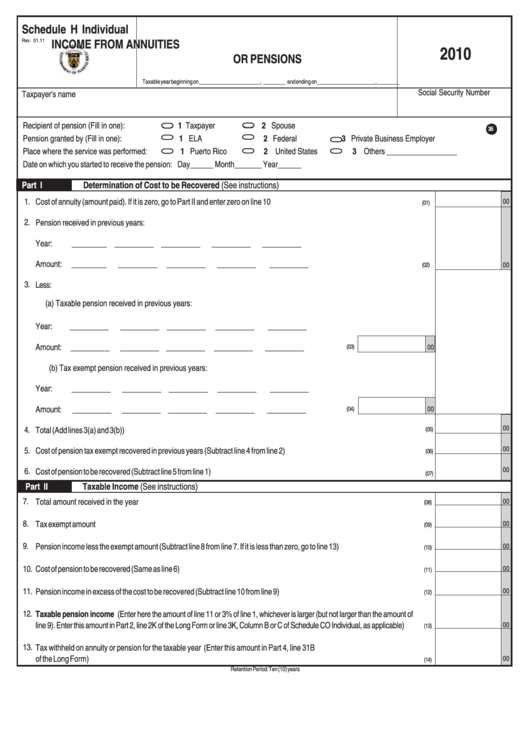

Schedule H Individual - Income From Annuities Or Pensions - 2010

ADVERTISEMENT

Schedule H Individual

INCOME FROM ANNUITIES

Rev. 01.11

2010

OR PENSIONS

Taxable year beginning on ______________________, ________ and ending on _____________________, ________

Social Security Number

Taxpayer's name

Recipient of pension (Fill in one):

1 Taxpayer

2 Spouse

35

Pension granted by (Fill in one):

1 ELA

2 Federal

3 Private Business Employer

Place where the service was performed:

1 Puerto Rico

2 United States

3 Others __________________

Date on which you started to receive the pension: Day______ Month_______ Year______

Part I

Determination of Cost to be Recovered (See instructions)

1.

Cost of annuity (amount paid). If it is zero, go to Part II and enter zero on line 10 ......................................................................

00

(01)

2.

Pension received in previous years:

Year:

_________

__________ __________

__________

__________

Amount: _________

__________ __________

__________

__________ ...................................................

(02)

00

3.

Less:

(a) Taxable pension received in previous years:

Year:

__________

__________ __________

__________

__________

Amount: __________

__________ __________ __________

__________

(03)

00

(b) Tax exempt pension received in previous years:

Year:

__________

__________ __________

__________

__________

Amount:

__________

__________ __________ __________

__________

00

(04)

00

4.

Total (Add lines 3(a) and 3(b)) ...................................................................................................................................................

(05)

00

5.

Cost of pension tax exempt recovered in previous years (Subtract line 4 from line 2) .................................................................

(06)

00

6.

Cost of pension to be recovered (Subtract line 5 from line 1) ........................................................................................................

(07)

Part II

Taxable Income (See instructions)

7.

Total amount received in the year ...............................................................................................................................................

00

(08)

8.

Tax exempt amount ....................................................................................................................................................................

00

(09)

9.

Pension income less the exempt amount (Subtract line 8 from line 7. If it is less than zero, go to line 13) .....................................

00

(10)

10.

Cost of pension to be recovered (Same as line 6) ......................................................................................................................

00

(11)

11.

Pension income in excess of the cost to be recovered (Subtract line 10 from line 9) ....................................................................

00

(12)

12.

Taxable pension income (Enter here the amount of line 11 or 3% of line 1, whichever is larger (but not larger than the amount of

line 9). Enter this amount in Part 2, line 2K of the Long Form or line 3K, Column B or C of Schedule CO Individual, as applicable) .....

00

(13)

13.

Tax withheld on annuity or pension for the taxable year (Enter this amount in Part 4, line 31B

of the Long Form) ....................................................................................................................................................................

00

(14)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1