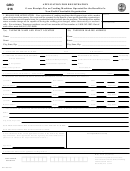

2009 Cigarette, Little Cigar, And Moist Snuff Floor Tax Return Wholesalers, Vending Machine Operators, Retailers And Street Vendors Page 2

ADVERTISEMENT

INSTRUCTIONS

Effective October 1, 2009, there will be an increase in the District of Columbia cigarette excise tax and

a new tax on “little cigars” and “moist snuff.” The cigarette excise tax will increase from 10¢ to 12.5¢ for

each cigarette which raises the tax to $2.50 per pack of 20 cigarettes and $3.125 per pack of 25

cigarettes. A tax is imposed on the sale or possession of “little cigars” at 12.5¢ per little cigar. “Little

cigar” means any cigar, other than a premium cigar, that weighs not more than 4 1/2 pounds per

thousand. In addition, a tax is imposed on the sale or possession of “moist snuff” at 30¢ per ounce.

“Moist snuff” means any finely cut, ground, or powdered tobacco that is not intended to be smoked and

not intended to be placed in the nasal cavity.

Check any Applicable Category:

Retail Dealer and Street Vendor – Complete lines 1 through 8 and line 11, 12 and 14

Wholesaler – Complete lines 1 through 12 and line 14

Vending Machine Operator – (see B below) Complete lines 1, 2, 13a, 13b, and 14 or complete

lines 1, 2, 13c and 14.

Retailer Dealer with Vending Machines - Complete lines 1 through 8, 13a, 13b, and 14 or lines 1

through 8, 13c, and 14.

A. Inventory all District of Columbia stamped cigarettes and/or loose tax stamps on hand beginning

on October 1, 2009 (include warehouse, racks, and vending machines, if applicable). If this is a

consolidated return, include a summary report of each subsidiary inventory subject to the

cigarette, little cigar and moist snuff floor tax.

B. Vending machine operators can either inventory all machines and enter the tax on lines 13a and

13b or use the “alternate method” fixed rate ($250.00) per machine on line 13c. A list of

vending machine locations must accompany this return.

C. Multiply the quantity on hand (A) by the additional tax (B) for each applicable line item. Enter

the result in the “Computed Tax” column (C). Total lines and enter the sum on line 14, total tax

due.

D. Make your check or money order payable to “DC Treasurer” (No Cash). Mail your payment and

this tax return by October 21, 2009 in the enclosed envelope to the Office of Tax and Revenue,

Audit Division, Cigarette Tax Enforcement Unit, P.O. Box 556, Washington, DC 20044. You

must file a return even though you have no taxes to report.

E. Failure to file this return and pay the floor tax due by October 21, 2009, will result in the

imposition of penalties and interest and may result in criminal prosecution and suspension or

revocation of your license. The penalty for failure to file a return on time or failure to pay any tax

when due is an additional 5 percent per month not to exceed 25 percent of the tax due. The

interest is computed from the due date of the tax return until the day the tax is paid. The rate is

10 percent per year compounded daily.

or via

F. Direct questions to Audit Division, Cigarette Tax Enforcement Unit at (202) 442-6602

email at sherri.weithers@dc.gov

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2