Form 8960 - Cheat Sheet

ADVERTISEMENT

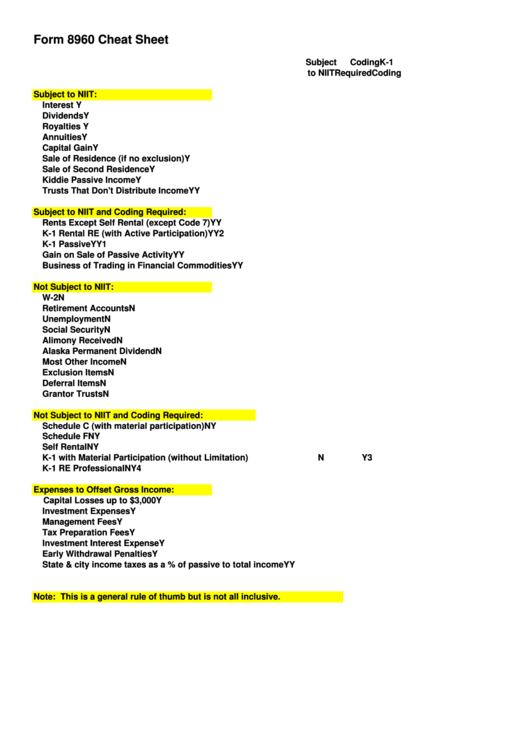

Form 8960 Cheat Sheet

Subject

Coding

K-1

to NIIT

Required

Coding

Subject to NIIT:

Interest

Y

Dividends

Y

Royalties

Y

Annuities

Y

Capital Gain

Y

Sale of Residence (if no exclusion)

Y

Sale of Second Residence

Y

Kiddie Passive Income

Y

Trusts That Don't Distribute Income

Y

Y

Subject to NIIT and Coding Required:

Rents Except Self Rental (except Code 7)

Y

Y

K-1 Rental RE (with Active Participation)

Y

Y

2

K-1 Passive

Y

Y

1

Gain on Sale of Passive Activity

Y

Y

Business of Trading in Financial Commodities

Y

Y

Not Subject to NIIT:

W-2

N

Retirement Accounts

N

Unemployment

N

Social Security

N

Alimony Received

N

Alaska Permanent Dividend

N

Most Other Income

N

Exclusion Items

N

Deferral Items

N

Grantor Trusts

N

Not Subject to NIIT and Coding Required:

Schedule C (with material participation)

N

Y

Schedule F

N

Y

Self Rental

N

Y

K-1 with Material Participation (without Limitation)

N

Y

3

K-1 RE Professional

N

Y

4

Expenses to Offset Gross Income:

Capital Losses up to $3,000

Y

Investment Expenses

Y

Management Fees

Y

Tax Preparation Fees

Y

Investment Interest Expense

Y

Early Withdrawal Penalties

Y

State & city income taxes as a % of passive to total income

Y

Y

Note: This is a general rule of thumb but is not all inclusive.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1