Form Pse Instruction Sheet

ADVERTISEMENT

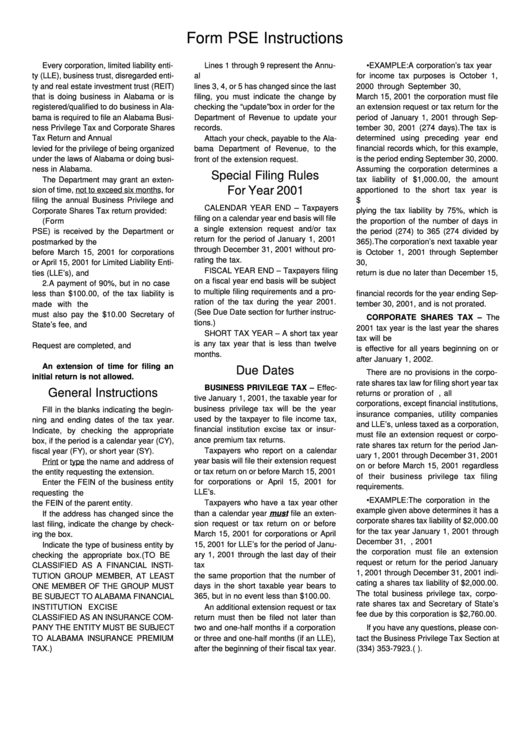

Form PSE Instructions

Every corporation, limited liability enti-

Lines 1 through 9 represent the Annu-

• EXAMPLE: A corporation’s tax year

ty (LLE), business trust, disregarded enti-

al Report. If any of the information on

for income tax purposes is October 1,

ty and real estate investment trust (REIT)

lines 3, 4, or 5 has changed since the last

2000 through September 30, 2001. On

that is doing business in Alabama or is

filing, you must indicate the change by

March 15, 2001 the corporation must file

registered/qualified to do business in Ala-

checking the “update” box in order for the

an extension request or tax return for the

bama is required to file an Alabama Busi-

Department of Revenue to update your

period of January 1, 2001 through Sep-

ness Privilege Tax and Corporate Shares

records.

tember 30, 2001 (274 days). The tax is

Tax Return and Annual Report. The tax is

determined using preceding year end

Attach your check, payable to the Ala-

levied for the privilege of being organized

bama Department of Revenue, to the

financial records which, for this example,

under the laws of Alabama or doing busi-

is the period ending September 30, 2000.

front of the extension request.

ness in Alabama.

Assuming the corporation determines a

Special Filing Rules

The Department may grant an exten-

tax liability of $1,000.00, the amount

For Year 2001

sion of time, not to exceed six months, for

apportioned to the short tax year is

filing the annual Business Privilege and

$750.00. This was determined by multi-

CALENDAR YEAR END – Taxpayers

Corporate Shares Tax return provided:

plying the tax liability by 75%, which is

filing on a calendar year end basis will file

the proportion of the number of days in

1. The Extension Request (Form

a single extension request and/or tax

PSE) is received by the Department or

the period (274) to 365 (274 divided by

return for the period of January 1, 2001

postmarked by the U.S. Post Office on or

365). The corporation’s next taxable year

through December 31, 2001 without pro-

before March 15, 2001 for corporations

is October 1, 2001 through September

rating the tax.

or April 15, 2001 for Limited Liability Enti-

30, 2002. The extension request or tax

FISCAL YEAR END – Taxpayers filing

ties (LLE’s), and

return is due no later than December 15,

on a fiscal year end basis will be subject

2. A payment of 90%, but in no case

2001. The tax is determined using the

to multiple filing requirements and a pro-

financial records for the year ending Sep-

less than $100.00, of the tax liability is

ration of the tax during the year 2001.

made with the request. Corporations

tember 30, 2001, and is not prorated.

(See Due Date section for further instruc-

must also pay the $10.00 Secretary of

CORPORATE SHARES TAX – The

tions.)

State’s fee, and

2001 tax year is the last year the shares

SHORT TAX YEAR – A short tax year

3. All sections of the Extension

tax will be due. The repeal of shares tax

is any tax year that is less than twelve

Request are completed, and

is effective for all years beginning on or

months.

4. The Extension Request is signed.

after January 1, 2002.

An extension of time for filing an

Due Dates

There are no provisions in the corpo-

initial return is not allowed.

rate shares tax law for filing short year tax

BUSINESS PRIVILEGE TAX – Effec-

General Instructions

returns or proration of tax. Therefore, all

tive January 1, 2001, the taxable year for

corporations, except financial institutions,

business privilege tax will be the year

Fill in the blanks indicating the begin-

insurance companies, utility companies

used by the taxpayer to file income tax,

ning and ending dates of the tax year.

and LLE’s, unless taxed as a corporation,

financial institution excise tax or insur-

Indicate, by checking the appropriate

must file an extension request or corpo-

ance premium tax returns.

box, if the period is a calendar year (CY),

rate shares tax return for the period Jan-

Taxpayers who report on a calendar

fiscal year (FY), or short year (SY).

uary 1, 2001 through December 31, 2001

year basis will file their extension request

Print or type the name and address of

on or before March 15, 2001 regardless

or tax return on or before March 15, 2001

the entity requesting the extension.

of their business privilege tax filing

for corporations or April 15, 2001 for

Enter the FEIN of the business entity

requirements.

LLE’s.

requesting the extension. Do not enter

• EXAMPLE: The corporation in the

the FEIN of the parent entity.

Taxpayers who have a tax year other

example given above determines it has a

than a calendar year must file an exten-

If the address has changed since the

corporate shares tax liability of $2,000.00

sion request or tax return on or before

last filing, indicate the change by check-

for the tax year January 1, 2001 through

March 15, 2001 for corporations or April

ing the box.

December 31, 2001. On March 15, 2001

15, 2001 for LLE’s for the period of Janu-

Indicate the type of business entity by

the corporation must file an extension

ary 1, 2001 through the last day of their

checking the appropriate box. (TO BE

request or return for the period January

tax year. The tax shall be apportioned in

CLASSIFIED AS A FINANCIAL INSTI-

1, 2001 through December 31, 2001 indi-

TUTION GROUP MEMBER, AT LEAST

the same proportion that the number of

cating a shares tax liability of $2,000.00.

days in the short taxable year bears to

ONE MEMBER OF THE GROUP MUST

The total business privilege tax, corpo-

365, but in no event less than $100.00.

BE SUBJECT TO ALABAMA FINANCIAL

rate shares tax and Secretary of State’s

INSTITUTION EXCISE TAX. TO BE

An additional extension request or tax

fee due by this corporation is $2,760.00.

CLASSIFIED AS AN INSURANCE COM-

return must then be filed not later than

PANY THE ENTITY MUST BE SUBJECT

two and one-half months if a corporation

If you have any questions, please con-

TO ALABAMA INSURANCE PREMIUM

or three and one-half months (if an LLE),

tact the Business Privilege Tax Section at

TAX.)

after the beginning of their fiscal tax year.

(334) 353-7923. ( ).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1