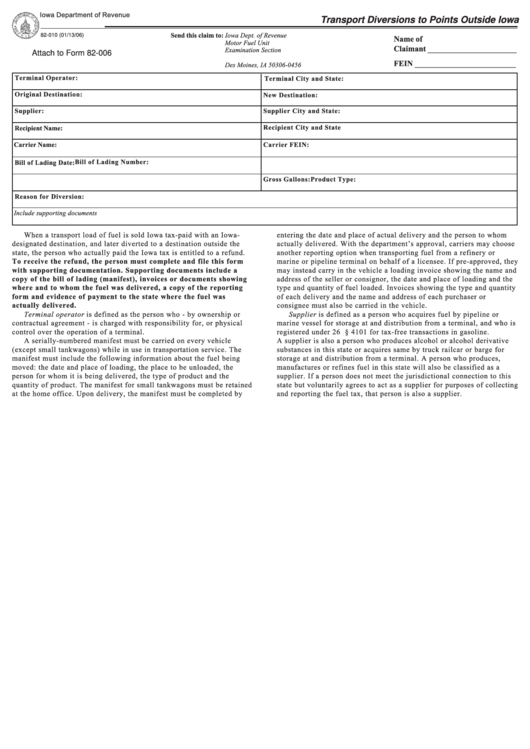

Form 82-010 - Transport Diversions Points Outside Iowa - 2006

ADVERTISEMENT

Iowa Department of Revenue

Transport Diversions to Points Outside Iowa

Send this claim to: Iowa Dept. of Revenue

82-010 (01/13/06)

Name of

Motor Fuel Unit

Claimant ______________________

Examination Section

Attach to Form 82-006

P.O. Box 10456

FEIN _________________________

Des Moines, IA 50306-0456

Terminal Operator:

Terminal City and State:

Original Destination:

New Destination:

Supplier:

Supplier City and State:

Recipient City and State

Recipient Name:

Carrier Name:

Carrier FEIN:

Bill of Lading Number:

Bill of Lading Date:

Product Type:

Gross Gallons:

Reason for Diversion:

Include supporting documents

When a transport load of fuel is sold Iowa tax-paid with an Iowa-

entering the date and place of actual delivery and the person to whom

designated destination, and later diverted to a destination outside the

actually delivered. With the department’s approval, carriers may choose

state, the person who actually paid the Iowa tax is entitled to a refund.

another reporting option when transporting fuel from a refinery or

To receive the refund, the person must complete and file this form

marine or pipeline terminal on behalf of a licensee. If pre-approved, they

with supporting documentation. Supporting documents include a

may instead carry in the vehicle a loading invoice showing the name and

copy of the bill of lading (manifest), invoices or documents showing

address of the seller or consignor, the date and place of loading and the

where and to whom the fuel was delivered, a copy of the reporting

type and quantity of fuel loaded. Invoices showing the type and quantity

form and evidence of payment to the state where the fuel was

of each delivery and the name and address of each purchaser or

actually delivered.

consignee must also be carried in the vehicle.

Terminal operator is defined as the person who - by ownership or

Supplier is defined as a person who acquires fuel by pipeline or

contractual agreement - is charged with responsibility for, or physical

marine vessel for storage at and distribution from a terminal, and who is

control over the operation of a terminal.

registered under 26 U.S.C. § 4101 for tax-free transactions in gasoline.

A serially-numbered manifest must be carried on every vehicle

A supplier is also a person who produces alcohol or alcohol derivative

(except small tankwagons) while in use in transportation service. The

substances in this state or acquires same by truck railcar or barge for

manifest must include the following information about the fuel being

storage at and distribution from a terminal. A person who produces,

moved: the date and place of loading, the place to be unloaded, the

manufactures or refines fuel in this state will also be classified as a

person for whom it is being delivered, the type of product and the

supplier. If a person does not meet the jurisdictional connection to this

quantity of product. The manifest for small tankwagons must be retained

state but voluntarily agrees to act as a supplier for purposes of collecting

at the home office. Upon delivery, the manifest must be completed by

and reporting the fuel tax, that person is also a supplier.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1