Form Fid-Es - 1998 Estimated Fiduciary Income Tax Instructions

ADVERTISEMENT

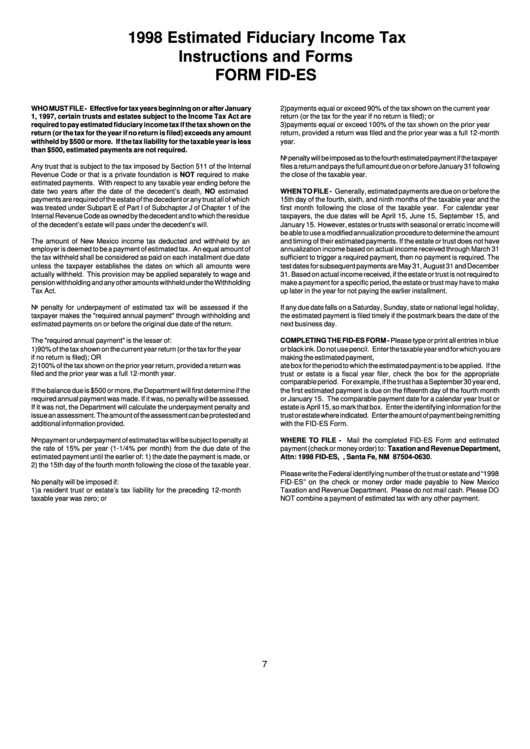

1998 Estimated Fiduciary Income Tax

Instructions and Forms

FORM FID-ES

WHO MUST FILE - Effective for tax years beginning on or after January

2)

payments equal or exceed 90% of the tax shown on the current year

1, 1997, certain trusts and estates subject to the Income Tax Act are

return (or the tax for the year if no return is filed); or

required to pay estimated fiduciary income tax if the tax shown on the

3)

payments equal or exceed 100% of the tax shown on the prior year

return (or the tax for the year if no return is filed) exceeds any amount

return, provided a return was filed and the prior year was a full 12-month

withheld by $500 or more. If the tax liability for the taxable year is less

year.

than $500, estimated payments are not required.

No penalty will be imposed as to the fourth estimated payment if the taxpayer

Any trust that is subject to the tax imposed by Section 511 of the Internal

files a return and pays the full amount due on or before January 31 following

Revenue Code or that is a private foundation is NOT required to make

the close of the taxable year.

estimated payments. With respect to any taxable year ending before the

date two years after the date of the decedent’s death, NO estimated

WHEN TO FILE - Generally, estimated payments are due on or before the

payments are required of the estate of the decedent or any trust all of which

15th day of the fourth, sixth, and ninth months of the taxable year and the

was treated under Subpart E of Part I of Subchapter J of Chapter 1 of the

first month following the close of the taxable year. For calendar year

Internal Revenue Code as owned by the decedent and to which the residue

taxpayers, the due dates will be April 15, June 15, September 15, and

of the decedent’s estate will pass under the decedent’s will.

January 15. However, estates or trusts with seasonal or erratic income will

be able to use a modified annualization procedure to determine the amount

The amount of New Mexico income tax deducted and withheld by an

and timing of their estimated payments. If the estate or trust does not have

employer is deemed to be a payment of estimated tax. An equal amount of

annualization income based on actual income received through March 31

the tax withheld shall be considered as paid on each installment due date

sufficient to trigger a required payment, then no payment is required. The

unless the taxpayer establishes the dates on which all amounts were

test dates for subsequent payments are May 31, August 31 and December

actually withheld. This provision may be applied separately to wage and

31. Based on actual income received, if the estate or trust is not required to

pension withholding and any other amounts withheld under the Withholding

make a payment for a specific period, the estate or trust may have to make

Tax Act.

up later in the year for not paying the earlier installment.

No penalty for underpayment of estimated tax will be assessed if the

If any due date falls on a Saturday, Sunday, state or national legal holiday,

taxpayer makes the "required annual payment" through withholding and

the estimated payment is filed timely if the postmark bears the date of the

estimated payments on or before the original due date of the return.

next business day.

The "required annual payment" is the lesser of:

COMPLETING THE FID-ES FORM - Please type or print all entries in blue

1)

90% of the tax shown on the current year return (or the tax for the year

or black ink. Do not use pencil. Enter the taxable year end for which you are

if no return is filed); OR

making the estimated payment, e.g. 12/31/98. Please check the appropri-

2)

100% of the tax shown on the prior year return, provided a return was

ate box for the period to which the estimated payment is to be applied. If the

filed and the prior year was a full 12-month year.

trust or estate is a fiscal year filer, check the box for the appropriate

comparable period. For example, if the trust has a September 30 year end,

If the balance due is $500 or more, the Department will first determine if the

the first estimated payment is due on the fifteenth day of the fourth month

required annual payment was made. If it was, no penalty will be assessed.

or January 15. The comparable payment date for a calendar year trust or

If it was not, the Department will calculate the underpayment penalty and

estate is April 15, so mark that box. Enter the identifying information for the

issue an assessment. The amount of the assessment can be protested and

trust or estate where indicated. Enter the amount of payment being remitting

additional information provided.

with the FID-ES Form.

Nonpayment or underpayment of estimated tax will be subject to penalty at

WHERE TO FILE - Mail the completed FID-ES Form and estimated

the rate of 15% per year (1-1/4% per month) from the due date of the

payment (check or money order) to: Taxation and Revenue Department,

estimated payment until the earlier of: 1) the date the payment is made, or

Attn: 1998 FID-ES, P.O. Box 630, Santa Fe, NM 87504-0630.

2) the 15th day of the fourth month following the close of the taxable year.

Please write the Federal identifying number of the trust or estate and “1998

No penalty will be imposed if:

FID-ES” on the check or money order made payable to New Mexico

1)

a resident trust or estate’s tax liability for the preceding 12-month

Taxation and Revenue Department. Please do not mail cash. Please DO

taxable year was zero; or

NOT combine a payment of estimated tax with any other payment.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1