Form Fid-1 - New Mexico Fiduciary Income Tax Return - 2009

ADVERTISEMENT

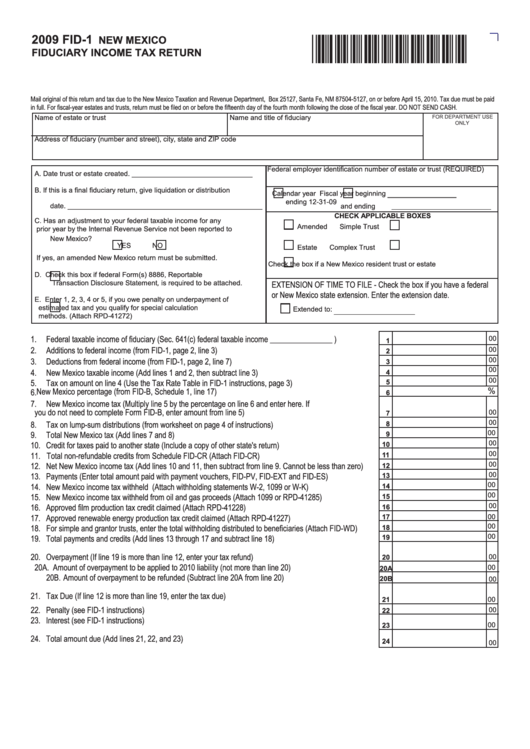

2009 FID-1

NEW MEXICO

*98080400*

FIDUCIARY INCOME TAX RETURN

Mail original of this return and tax due to the New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM 87504-5127, on or before April 15, 2010. Tax due must be paid

in full. For fiscal-year estates and trusts, return must be filed on or before the fifteenth day of the fourth month following the close of the fiscal year. DO NOT SEND CASH.

Name of estate or trust

Name and title of fiduciary

FOR DEPARTMENT USE

ONLY

Address of fiduciary (number and street), city, state and ZIP code

Federal employer identification number of estate or trust (REQUIRED)

A.

Date trust or estate created. _______________________________

____________

B.

If this is a final fiduciary return, give liquidation or distribution

Calendar year

Fiscal year beginning

ending 12-31-09

date. __________________________________________________

and ending

ChECk ApplICABlE BOXEs

C.

Has an adjustment to your federal taxable income for any

Amended

Simple Trust

prior year by the Internal Revenue Service not been reported to

New Mexico?

YES

NO

Estate

Complex Trust

If yes, an amended New Mexico return must be submitted.

Check the box if a New Mexico resident trust or estate

D.

Check this box if federal Form(s) 8886, Reportable

Transaction Disclosure Statement, is required to be attached.

EXTENSION OF TIME TO FILE - Check the box if you have a federal

or New Mexico state extension. Enter the extension date.

E.

Enter 1, 2, 3, 4 or 5, if you owe penalty on underpayment of

estimated tax and you qualify for special calculation

Extended to:

methods. (Attach RPD-41272)

1. Federal taxable income of fiduciary (Sec. 641(c) federal taxable income ________________ ) .................

00

1

2. Additions to federal income (from FID-1, page 2, line 3) ..............................................................................

00

2

3. Deductions from federal income (from FID-1, page 2, line 7) .......................................................................

00

3

00

4. New Mexico taxable income (Add lines 1 and 2, then subtract line 3) .........................................................

4

00

5. Tax on amount on line 4 (Use the Tax Rate Table in FID-1 instructions, page 3) .........................................

5

%

New Mexico percentage (from FID-B, Schedule 1, line 17)..........................................................................

6.

6

7. New Mexico income tax (Multiply line 5 by the percentage on line 6 and enter here. If

you do not need to complete Form FID-B, enter amount from line 5) ..........................................................

00

7

00

8. Tax on lump-sum distributions (from worksheet on page 4 of instructions) ..................................................

8

00

9. Total New Mexico tax (Add lines 7 and 8) ....................................................................................................

9

00

10. Credit for taxes paid to another state (Include a copy of other state's return) .............................................

10

11. Total non-refundable credits from Schedule FID-CR (Attach FID-CR) .........................................................

00

11

12. Net New Mexico income tax (Add lines 10 and 11, then subtract from line 9. Cannot be less than zero) ....

00

12

13. Payments (Enter total amount paid with payment vouchers, FID-PV, FID-EXT and FID-ES) ......................

00

13

14. New Mexico income tax withheld (Attach withholding statements W-2, 1099 or W-K) ................................

00

14

00

15. New Mexico income tax withheld from oil and gas proceeds (Attach 1099 or RPD-41285).........................

15

16. Approved film production tax credit claimed (Attach RPD-41228)................................................................

00

16

17. Approved renewable energy production tax credit claimed (Attach RPD-41227).........................................

00

17

00

18. For simple and grantor trusts, enter the total withholding distributed to beneficiaries (Attach FID-WD) ......

18

00

19. Total payments and credits (Add lines 13 through 17 and subtract line 18) .................................................

19

20. Overpayment (If line 19 is more than line 12, enter your tax refund) ...........................................................

00

20

20A. Amount of overpayment to be applied to 2010 liability (not more than line 20) ...................................

00

20A

20B. Amount of overpayment to be refunded (Subtract line 20A from line 20) ............................................

20B

00

21. Tax Due (If line 12 is more than line 19, enter the tax due) ..........................................................................

00

21

22. Penalty (see FID-1 instructions) ...................................................................................................................

00

22

23. Interest (see FID-1 instructions) ...................................................................................................................

00

23

24. Total amount due (Add lines 21, 22, and 23) ...............................................................................................

24

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4