Form Fid-1 - New Mexico Fiduciary Income Tax Return - 2006

ADVERTISEMENT

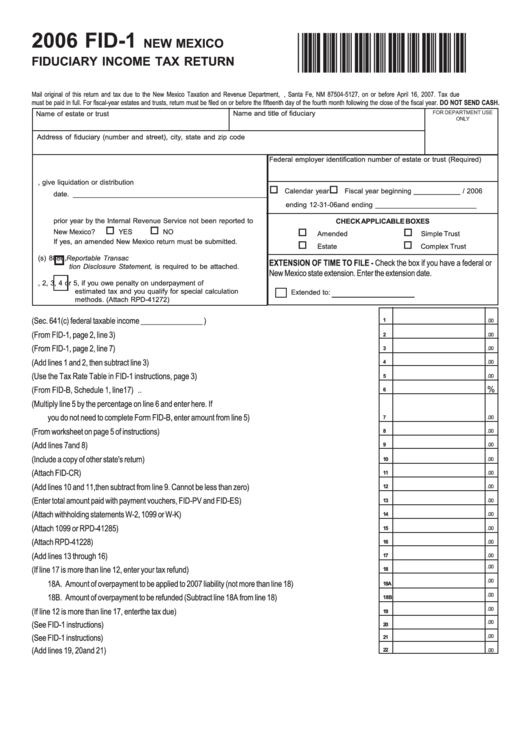

2006 FID-1

*68080200*

NEW MEXICO

FIDUCIARY INCOME TAX RETURN

Mail original of this return and tax due to the New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM 87504-5127, on or before April 16, 2007. Tax due

must be paid in full. For fiscal-year estates and trusts, return must be filed on or before the fifteenth day of the fourth month following the close of the fiscal year. DO NOT SEND CASH.

Name and title of fiduciary

FOR DEPARTMENT USE

Name of estate or trust

ONLY

Address of fiduciary (number and street), city, state and zip code

Federal employer identification number of estate or trust (Required)

A.

Date trust or estate created. _______________________________

B.

If this is a final fiduciary return, give liquidation or distribution

Calendar year

Fiscal year beginning ____________ / 2006

date. __________________________________________________

ending 12-31-06

and ending __________________________

C.

Has an adjustment to your federal taxable income for any

prior year by the Internal Revenue Service not been reported to

CHECK APPLICABLE BOXES

New Mexico?

YES

NO

Amended

Simple Trust

If yes, an amended New Mexico return must be submitted.

Estate

Complex Trust

D.

Check this box if federal Form(s) 8886, Reportable Transac

EXTENSION OF TIME TO FILE - Check the box if you have a federal or

tion Disclosure Statement, is required to be attached.

New Mexico state extension. Enter the extension date.

E.

Enter 1, 2, 3, 4 or 5, if you owe penalty on underpayment of

estimated tax and you qualify for special calculation

Extended to:

methods. (Attach RPD-41272)

1.

Federal taxable income of fiduciary (Sec. 641(c) federal taxable income ________________ ) ....................

1

.00

2.

Additions to federal income (From FID-1, page 2, line 3) ..............................................................................

2

.00

3.

Deductions from federal income (From FID-1, page 2, line 7) .......................................................................

3

.00

4.

New Mexico taxable income (Add lines 1 and 2, then subtract line 3) ............................................................

4

.00

5.

Tax on amount on line 4 (Use the Tax Rate Table in FID-1 instructions, page 3) ...........................................

5

.00

%

6.

New Mexico percentage (From FID-B, Schedule 1, line 17) ........................................................................

6

7.

New Mexico income tax (Multiply line 5 by the percentage on line 6 and enter here. If

you do not need to complete Form FID-B, enter amount from line 5) .............................................................

7

.00

8.

Tax on lump-sum distributions (From worksheet on page 5 of instructions) ....................................................

8

.00

9.

Total New Mexico tax (Add lines 7 and 8) ....................................................................................................

9

.00

10. Credit for taxes paid to another state (Include a copy of other state's return) ..................................................

10

.00

11. Total non-refundable credits from Schedule FID-CR (Attach FID-CR) ...........................................................

11

.00

12. Net New Mexico income tax (Add lines 10 and 11, then subtract from line 9. Cannot be less than zero) .........

12

.00

13. Payments (Enter total amount paid with payment vouchers, FID-PV and FID-ES) .........................................

13

.00

14. New Mexico income tax withheld (Attach withholding statements W-2, 1099 or W-K) ....................................

14

.00

15. New Mexico income tax withheld from oil and gas proceeds (Attach 1099 or RPD-41285) ............................

15

.00

16. Approved film production tax credit claimed (Attach RPD-41228) ..................................................................

16

.00

17. Total payments and credits (Add lines 13 through 16) ...................................................................................

17

.00

.00

18. Overpayment (If line 17 is more than line 12, enter your tax refund) .............................................................

18

.00

18A. Amount of overpayment to be applied to 2007 liability (not more than line 18) .......................................

18A

.00

18B. Amount of overpayment to be refunded (Subtract line 18A from line 18) ...............................................

18B

.00

19. Tax Due (If line 12 is more than line 17, enter the tax due) ...........................................................................

19

.00

20. Penalty (See FID-1 instructions) ..................................................................................................................

20

21. Interest (See FID-1 instructions) ...................................................................................................................

.00

21

22. Total amount due (Add lines 19, 20 and 21) .................................................................................................

22

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4