Form 207hcc Esc -Estimated Health Care Center Tax Payment Coupon - Instructions

ADVERTISEMENT

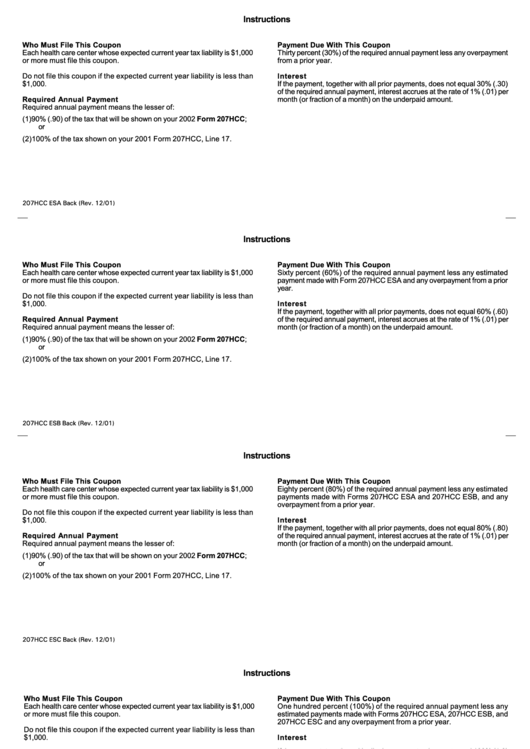

Instructions

Who Must File This Coupon

Payment Due With This Coupon

Each health care center whose expected current year tax liability is $1,000

Thirty percent (30%) of the required annual payment less any overpayment

or more must file this coupon.

from a prior year.

Do not file this coupon if the expected current year liability is less than

Interest

$1,000.

If the payment, together with all prior payments, does not equal 30% (.30)

of the required annual payment, interest accrues at the rate of 1% (.01) per

Required Annual Payment

month (or fraction of a month) on the underpaid amount.

Required annual payment means the lesser of:

(1) 90% (.90) of the tax that will be shown on your 2002 Form 207HCC;

or

(2) 100% of the tax shown on your 2001 Form 207HCC, Line 17.

207HCC ESA Back (Rev. 12/01)

Instructions

Who Must File This Coupon

Payment Due With This Coupon

Each health care center whose expected current year tax liability is $1,000

Sixty percent (60%) of the required annual payment less any estimated

or more must file this coupon.

payment made with Form 207HCC ESA and any overpayment from a prior

year.

Do not file this coupon if the expected current year liability is less than

$1,000.

Interest

If the payment, together with all prior payments, does not equal 60% (.60)

Required Annual Payment

of the required annual payment, interest accrues at the rate of 1% (.01) per

Required annual payment means the lesser of:

month (or fraction of a month) on the underpaid amount.

(1) 90% (.90) of the tax that will be shown on your 2002 Form 207HCC;

or

(2) 100% of the tax shown on your 2001 Form 207HCC, Line 17.

207HCC ESB Back (Rev. 12/01)

Instructions

Who Must File This Coupon

Payment Due With This Coupon

Each health care center whose expected current year tax liability is $1,000

Eighty percent (80%) of the required annual payment less any estimated

or more must file this coupon.

payments made with Forms 207HCC ESA and 207HCC ESB, and any

overpayment from a prior year.

Do not file this coupon if the expected current year liability is less than

$1,000.

Interest

If the payment, together with all prior payments, does not equal 80% (.80)

Required Annual Payment

of the required annual payment, interest accrues at the rate of 1% (.01) per

Required annual payment means the lesser of:

month (or fraction of a month) on the underpaid amount.

(1) 90% (.90) of the tax that will be shown on your 2002 Form 207HCC;

or

(2) 100% of the tax shown on your 2001 Form 207HCC, Line 17.

207HCC ESC Back (Rev. 12/01)

Instructions

Who Must File This Coupon

Payment Due With This Coupon

Each health care center whose expected current year tax liability is $1,000

One hundred percent (100%) of the required annual payment less any

or more must file this coupon.

estimated payments made with Forms 207HCC ESA, 207HCC ESB, and

207HCC ESC and any overpayment from a prior year.

Do not file this coupon if the expected current year liability is less than

$1,000.

Interest

If the payment, together with all prior payments, does not equal 100% (1.0)

Required Annual Payment

of the required annual payment, interest accrues at the rate of 1% (.01) per

Required annual payment means the lesser of:

month (or fraction of a month) on the underpaid amount.

(1) 90% (.90) of the tax that will be shown on your 2002 Form 207HCC;

or

(2) 100% of the tax shown on your 2001 Form 207HCC, Line 17.

207HCC ESD Back (Rev. 12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1