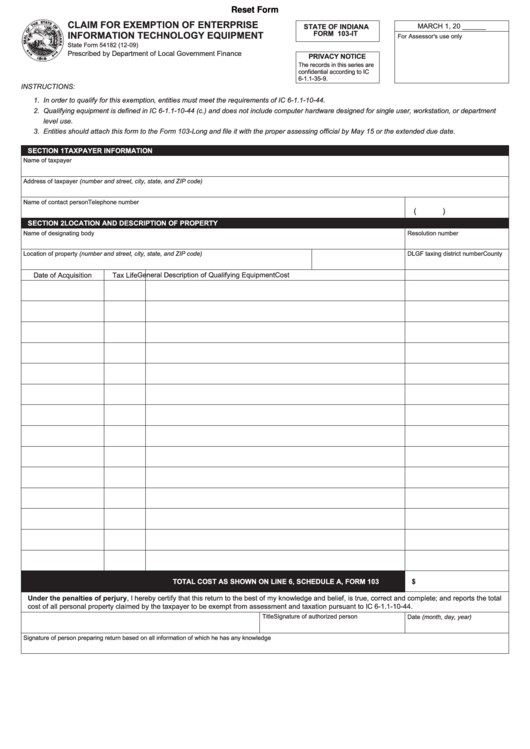

Reset Form

CLAIM FOR EXEMPTION OF ENTERPRISE

MARCH 1, 20 ______

STATE OF INDIANA

INFORMATION TECHNOLOGY EQUIPMENT

FORM 103-IT

For Assessor's use only

State Form 54182 (12-09)

Prescribed by Department of Local Government Finance

PRIVACY NOTICE

The records in this series are

confidential according to IC

6-1.1-35-9.

INSTRUCTIONS:

1. In order to qualify for this exemption, entities must meet the requirements of IC 6-1.1-10-44.

2. Qualifying equipment is defined in IC 6-1.1-10-44 (c.) and does not include computer hardware designed for single user, workstation, or department

level use.

3. Entities should attach this form to the Form 103-Long and file it with the proper assessing official by May 15 or the extended due date.

SECTION 1

TAXPAYER INFORMATION

Name of taxpayer

Address of taxpayer (number and street, city, state, and ZIP code)

Name of contact person

Telephone number

(

)

SECTION 2

LOCATION AND DESCRIPTION OF PROPERTY

Name of designating body

Resolution number

Location of property (number and street, city, state, and ZIP code)

County

DLGF taxing district number

General Description of Qualifying Equipment

Cost

Date of Acquisition

Tax Life

TOTAL COST AS SHOWN ON LINE 6, SCHEDULE A, FORM 103

$

Under the penalties of perjury, I hereby certify that this return to the best of my knowledge and belief, is true, correct and complete; and reports the total

cost of all personal property claimed by the taxpayer to be exempt from assessment and taxation pursuant to IC 6-1.1-10-44.

Signature of authorized person

Title

Date (month, day, year)

Signature of person preparing return based on all information of which he has any knowledge

1

1