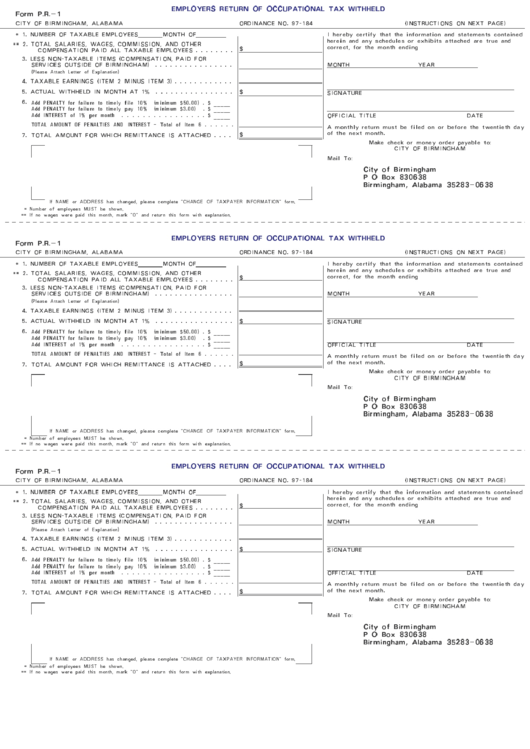

Form P.r.-1 - Employers Return Of Occupational Tax Withheld

ADVERTISEMENT

EMPLOYERS RETURN OF OCCUPATIONAL TAX WITHHELD

Form P.R.−1

CITY OF BIRMINGHAM, ALABAMA

ORDINANCE NO. 97−184

(INSTRUCTIONS ON NEXT PAGE)

* 1. NUMBER OF TAXABLE EMPLOYEES____MONTH OF_____

I hereby certify that the information and statements contained

herein and any schedules or exhibits attached are true and

** 2. TOTAL SALARIES, WAGES, COMMISSION, AND OTHER

$

correct, for the month ending

COMPENSATION PAID ALL TAXABLE EMPLOYEES . . . . . . . .

3. LESS NON−TAXABLE ITEMS (COMPENSATION, PAID FOR

SERVICES OUTSIDE OF BIRMINGHAM) . . . . . . . . . . . . . . . .

MONTH

YEAR

(Please Attach Letter of Explanation)

4. TAXABLE EARNINGS (ITEM 2 MINUS ITEM 3) . . . . . . . . . . . .

5. ACTUAL WITHHELD IN MONTH AT 1% . . . . . . . . . . . . . . . . $

SIGNATURE

6.

Add PENALTY for failure to timely file 10%

(minimum $50.00) . $ _____

Add PENALTY for failure to timely pay 10%

(minimum $3.00)

. $ _____

OFFICIAL TITLE

DATE

Add INTEREST of 1% per month

. . . . . . . . . . . . . . . . $ _____

TOTAL AMOUNT OF PENALTIES AND INTEREST − Total of Item 6 . . . . . .

A monthly return must be filed on or before the twentieth day

$

of the next month.

7. TOTAL AMOUNT FOR WHICH REMITTANCE IS ATTACHED . . . .

Make check or money order payable to:

CITY OF BIRMINGHAM

Mail To:

City of Birmingham

P O Box 830638

Birmingham, Alabama 35283−0638

If NAME or ADDRESS has changed, please complete "CHANGE OF TAXPAYER INFORMATION" form.

* Number of employees MUST be shown.

** If no wages were paid this month, mark "0" and return this form with explanation.

EMPLOYERS RETURN OF OCCUPATIONAL TAX WITHHELD

Form P.R.−1

CITY OF BIRMINGHAM, ALABAMA

ORDINANCE NO. 97−184

(INSTRUCTIONS ON NEXT PAGE)

* 1. NUMBER OF TAXABLE EMPLOYEES____MONTH OF_____

I hereby certify that the information and statements contained

herein and any schedules or exhibits attached are true and

** 2. TOTAL SALARIES, WAGES, COMMISSION, AND OTHER

$

correct, for the month ending

COMPENSATION PAID ALL TAXABLE EMPLOYEES . . . . . . . .

3. LESS NON−TAXABLE ITEMS (COMPENSATION, PAID FOR

SERVICES OUTSIDE OF BIRMINGHAM) . . . . . . . . . . . . . . . .

MONTH

YEAR

(Please Attach Letter of Explanation)

4. TAXABLE EARNINGS (ITEM 2 MINUS ITEM 3) . . . . . . . . . . . .

5. ACTUAL WITHHELD IN MONTH AT 1% . . . . . . . . . . . . . . . . $

SIGNATURE

6.

Add PENALTY for failure to timely file 10%

(minimum $50.00) . $ _____

Add PENALTY for failure to timely pay 10%

(minimum $3.00)

. $ _____

OFFICIAL TITLE

DATE

Add INTEREST of 1% per month

. . . . . . . . . . . . . . . . $ _____

TOTAL AMOUNT OF PENALTIES AND INTEREST − Total of Item 6 . . . . . .

A monthly return must be filed on or before the twentieth day

of the next month.

$

7. TOTAL AMOUNT FOR WHICH REMITTANCE IS ATTACHED . . . .

Make check or money order payable to:

CITY OF BIRMINGHAM

Mail To:

City of Birmingham

P O Box 830638

Birmingham, Alabama 35283−0638

If NAME or ADDRESS has changed, please complete "CHANGE OF TAXPAYER INFORMATION" form.

* Number of employees MUST be shown.

** If no wages were paid this month, mark "0" and return this form with explanation.

EMPLOYERS RETURN OF OCCUPATIONAL TAX WITHHELD

Form P.R.−1

CITY OF BIRMINGHAM, ALABAMA

ORDINANCE NO. 97−184

(INSTRUCTIONS ON NEXT PAGE)

* 1. NUMBER OF TAXABLE EMPLOYEES____MONTH OF_____

I hereby certify that the information and statements contained

herein and any schedules or exhibits attached are true and

** 2. TOTAL SALARIES, WAGES, COMMISSION, AND OTHER

correct, for the month ending

$

COMPENSATION PAID ALL TAXABLE EMPLOYEES . . . . . . . .

3. LESS NON−TAXABLE ITEMS (COMPENSATION, PAID FOR

SERVICES OUTSIDE OF BIRMINGHAM) . . . . . . . . . . . . . . . .

MONTH

YEAR

(Please Attach Letter of Explanation)

4. TAXABLE EARNINGS (ITEM 2 MINUS ITEM 3) . . . . . . . . . . . .

5. ACTUAL WITHHELD IN MONTH AT 1% . . . . . . . . . . . . . . . . $

SIGNATURE

6.

Add PENALTY for failure to timely file 10%

(minimum $50.00) . $ _____

Add PENALTY for failure to timely pay 10%

(minimum $3.00)

. $ _____

OFFICIAL TITLE

DATE

Add INTEREST of 1% per month

. . . . . . . . . . . . . . . . $ _____

TOTAL AMOUNT OF PENALTIES AND INTEREST − Total of Item 6 . . . . . .

A monthly return must be filed on or before the twentieth day

$

of the next month.

7. TOTAL AMOUNT FOR WHICH REMITTANCE IS ATTACHED . . . .

Make check or money order payable to:

CITY OF BIRMINGHAM

Mail To:

City of Birmingham

P O Box 830638

Birmingham, Alabama 35283−0638

If NAME or ADDRESS has changed, please complete "CHANGE OF TAXPAYER INFORMATION" form.

* Number of employees MUST be shown.

** If no wages were paid this month, mark "0" and return this form with explanation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1