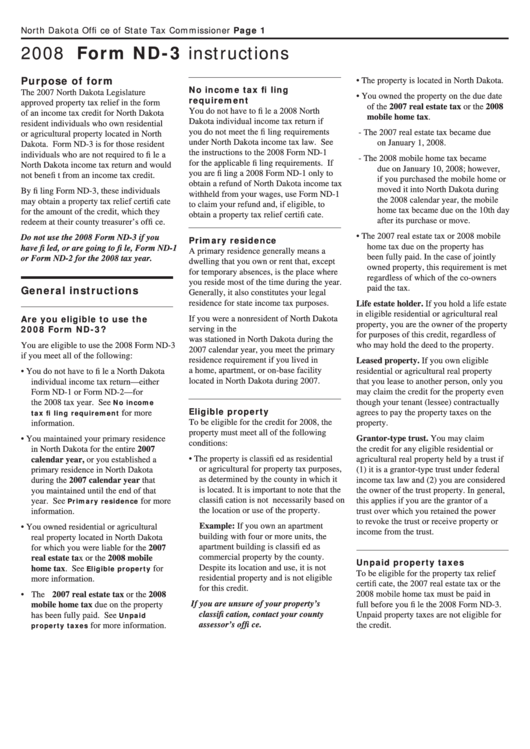

Form Nd-3 Instructions - North Dakota Offi Ce Of State Tax Commissioner - 2008

ADVERTISEMENT

North Dakota Offi ce of State Tax Commissioner

Page 1

2008 Form ND-3 instructions

Purpose of form

• The property is located in North Dakota.

No income tax fi ling

The 2007 North Dakota Legislature

• You owned the property on the due date

requirement

approved property tax relief in the form

of the 2007 real estate tax or the 2008

You do not have to fi le a 2008 North

of an income tax credit for North Dakota

mobile home tax.

Dakota individual income tax return if

resident individuals who own residential

you do not meet the fi ling requirements

- The 2007 real estate tax became due

or agricultural property located in North

under North Dakota income tax law. See

on January 1, 2008.

Dakota. Form ND-3 is for those resident

the instructions to the 2008 Form ND-1

individuals who are not required to fi le a

- The 2008 mobile home tax became

for the applicable fi ling requirements. If

North Dakota income tax return and would

due on January 10, 2008; however,

you are fi ling a 2008 Form ND-1 only to

not benefi t from an income tax credit.

if you purchased the mobile home or

obtain a refund of North Dakota income tax

moved it into North Dakota during

By fi ling Form ND-3, these individuals

withheld from your wages, use Form ND-1

the 2008 calendar year, the mobile

may obtain a property tax relief certifi cate

to claim your refund and, if eligible, to

home tax became due on the 10th day

for the amount of the credit, which they

obtain a property tax relief certifi cate.

after its purchase or move.

redeem at their county treasurer’s offi ce.

• The 2007 real estate tax or 2008 mobile

Do not use the 2008 Form ND-3 if you

Primary residence

home tax due on the property has

have fi led, or are going to fi le, Form ND-1

A primary residence generally means a

been fully paid. In the case of jointly

or Form ND-2 for the 2008 tax year.

dwelling that you own or rent that, except

owned property, this requirement is met

for temporary absences, is the place where

regardless of which of the co-owners

you reside most of the time during the year.

General instructions

paid the tax.

Generally, it also constitutes your legal

residence for state income tax purposes.

Life estate holder. If you hold a life estate

in eligible residential or agricultural real

Are you eligible to use the

If you were a nonresident of North Dakota

property, you are the owner of the property

2008 Form ND-3?

serving in the U.S. armed forces who

for purposes of this credit, regardless of

was stationed in North Dakota during the

You are eligible to use the 2008 Form ND-3

who may hold the deed to the property.

2007 calendar year, you meet the primary

if you meet all of the following:

residence requirement if you lived in

Leased property. If you own eligible

a home, apartment, or on-base facility

residential or agricultural real property

• You do not have to fi le a North Dakota

located in North Dakota during 2007.

that you lease to another person, only you

individual income tax return—either

may claim the credit for the property even

Form ND-1 or Form ND-2—for

No income

the 2008 tax year. See

though your tenant (lessee) contractually

Eligible property

tax fi ling requirement

agrees to pay the property taxes on the

for more

To be eligible for the credit for 2008, the

property.

information.

property must meet all of the following

Grantor-type trust. You may claim

• You maintained your primary residence

conditions:

the credit for any eligible residential or

in North Dakota for the entire 2007

• The property is classifi ed as residential

calendar year, or you established a

agricultural real property held by a trust if

or agricultural for property tax purposes,

(1) it is a grantor-type trust under federal

primary residence in North Dakota

as determined by the county in which it

income tax law and (2) you are considered

during the 2007 calendar year that

is located. It is important to note that the

the owner of the trust property. In general,

you maintained until the end of that

Primary residence

classifi cation is not necessarily based on

this applies if you are the grantor of a

year. See

for more

the location or use of the property.

information.

trust over which you retained the power

to revoke the trust or receive property or

Example: If you own an apartment

• You owned residential or agricultural

income from the trust.

building with four or more units, the

real property located in North Dakota

apartment building is classifi ed as

for which you were liable for the 2007

commercial property by the county.

real estate tax or the 2008 mobile

Unpaid property taxes

Eligible property

Despite its location and use, it is not

home tax. See

for

To be eligible for the property tax relief

residential property and is not eligible

more information.

certifi cate, the 2007 real estate tax or the

for this credit.

2008 mobile home tax must be paid in

• The 2007 real estate tax or the 2008

If you are unsure of your property’s

full before you fi le the 2008 Form ND-3.

mobile home tax due on the property

Unpaid

classifi cation, contact your county

Unpaid property taxes are not eligible for

has been fully paid. See

property taxes

assessor’s offi ce.

for more information.

the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4