Military Service Widow And Widower Exemption Application - Municipality Of Anchorage, Alaska - 2017 Page 2

ADVERTISEMENT

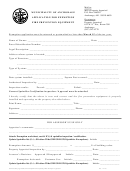

Municipality of Anchorage Military Service Widow and Widower Exemption

AS 29.45.050 (s) and Municipal Code 12.15.015(E)(3)

th

Timely application for this exemption will be accepted through March 15

of the exemption year.

You may mail your exemption application to Municipality of Anchorage, Property Appraisal

Division, PO Box 196650, Anchorage, AK 99519 or you may fax an exemption application to (907)

343-6599.

st

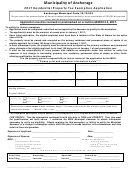

1. Applicant must be the surviving spouse of a person whose death occurred prior to January 1

of

the exemption year, during United States military service, under conditions which are not

dishonorable.

2. Applicant must provide one form of written proof the deceased passed away during military

service. Examples of written proof include; Report of Casualty (DD1300), or Line of Duty

Determinations issued by the United States military are acceptable forms of documentation.

3. If the applicant’s last name is different than the deceased spouse, please provide a Marriage

License documenting both parties legal names.

4. The application must be filled out completely.

5. Applicant must own and occupy the property as their primary residence and permanent place of

abode on January 1 of the assessment year for which the exemption is sought. Each subsequent

year the property must be owned and occupied a minimum of 185 days as the primary residence in

order to receive this exemption.

6. The applicant may not receive an exemption on more than one property that is currently, or will

be receiving, a Residential, Senior Citizen, or Disable Veteran exemption either in Alaska or in

another State.

7. Applicant must be a resident of Alaska for the entire year prior to the exemption year.

8. If property ownership is a trust, we do not require a copy of the entire trust. However, please

include the following pages of the trust document; the first page of the trust, the page(s) designating

the sole owner/trustee, page that specifically identifies the property placed into trust, and the

signature/date witness page.

9. Change notification: It is the responsibility of every person who obtains an exemption under this

section to notify the assessor of any change in ownership, property use, residency, permanent

place of abode, subsequent marriage, or other factor affecting qualification for the exemption.

10. Up to $150,000 of the assessed value of real property may be exempt for the applicant’s primary

residence and permanent place of abode if the applicant meets all of the required criteria.

11. Property Appraisal staff may contact you with further questions regarding your application.

12. Please review your tax bill for an approved exemption (State Credit). If you do not see “State Credit”

on your tax bill, please immediately contact Property Appraisal.

Mail to: Municipality of Anchorage

OR

Submit in person to:

Property Appraisal

Property Appraisal

P.O. Box 196650

632 West 6th Avenue, Suite 300

Anchorage, AK 99519-6650

For Information call: (907) 343-6770

G:\Propapr\Customer Service\Customer Service Forms\Military Service Widow and Widower Exemption

rev 2/11/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2