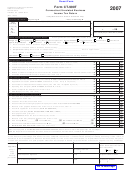

Form M-990t Draft - Unrelated Business Income Tax Return - 2007 Page 2

ADVERTISEMENT

Excise After Credits

34 Excise due before voluntary contribution. Subtract line 33 from line 18. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

35 Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 35

36 Total excise plus voluntary contribution. Add lines 34 and 35 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 36

Payments

37 2006 overpayment applied to 2007 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 37

38 2007 Massachusetts estimated tax payments (do not include amount in line 37) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 38

39 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 39

40 Total payments. Add lines 37 through 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Refund or Balance Due

41 Amount overpaid. Subtract line 36 from line 40 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Amount overpaid to be credited to 2008 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 42

43 Amount overpaid to be refunded. Subtract line 42 from line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 43

44 Balance due. Subtract line 40 from line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

45 M-2220 penalty 3 $ _______________________ ; Other penalties 3 $_______________________. . . . . . . . . Total penalty 45

46 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 46

47 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 47

DRAFT AS OF

AUGUST 1, 2007

(SUBJECT TO CHANGE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2