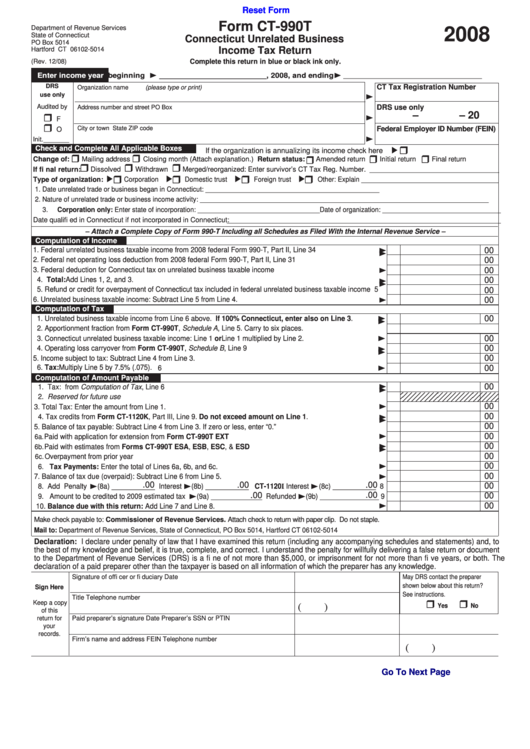

Reset Form

Form CT-990T

Department of Revenue Services

2008

State of Connecticut

Connecticut Unrelated Business

PO Box 5014

Income Tax Return

Hartford CT 06102-5014

Complete this return in blue or black ink only.

(Rev. 12/08)

Enter income year

beginning

_________________________ , 2008, and ending

_____________________________

DRS

CT Tax Registration Number

Organization name

(please type or print)

use only

Audited by

DRS use only

Address

number and street

PO Box

–

– 20

F

City or town

State

ZIP code

Federal Employer ID Number (FEIN)

O

Init._______

Check and Complete All Applicable Boxes

If the organization is annualizing its income check here

Change of:

Mailing address

Closing month (Attach explanation.) Return status:

Amended return

Initial return

Final return

If fi nal return:

Dissolved

Withdrawn

Merged/reorganized: Enter survivor’s CT Tax Reg. Number. ___________________________________

Type of organization:

Corporation

Domestic trust

Foreign trust

Other: Explain _____________________________________

1. Date unrelated trade or business began in Connecticut: _______________________________________________

2. Nature of unrelated trade or business income activity: ______________________________________________________________________________

3. Corporation only: Enter state of incorporation: _________________________________ Date of organization: ________________________________

Date qualifi ed in Connecticut if not incorporated in Connecticut: __________________________________________________________________________

– Attach a Complete Copy of Form 990-T Including all Schedules as Filed With the Internal Revenue Service –

Computation of Income

1. Federal unrelated business taxable income from 2008 federal Form 990-T, Part II, Line 34 ..........................

1

00

2. Federal net operating loss deduction from 2008 federal Form 990-T, Part II, Line 31 ....................................

2

00

3. Federal deduction for Connecticut tax on unrelated business taxable income ...............................................

3

00

4. Total: Add Lines 1, 2, and 3. ..........................................................................................................................

4

00

5. Refund or credit for overpayment of Connecticut tax included in federal unrelated business taxable income

5

00

6. Unrelated business taxable income: Subtract Line 5 from Line 4. ..................................................................

6

00

Computation of Tax

00

1. Unrelated business taxable income from Line 6 above. If 100% Connecticut, enter also on Line 3. .........

1

2. Apportionment fraction from Form CT-990T, Schedule A, Line 5. Carry to six places. ..................................

2

0.

00

3. Connecticut unrelated business taxable income: Line 1 or Line 1 multiplied by Line 2. .................................

3

00

4. Operating loss carryover from Form CT-990T, Schedule B, Line 9 ................................................................

4

00

5. Income subject to tax: Subtract Line 4 from Line 3. ........................................................................................

5

6. Tax: Multiply Line 5 by 7.5% (.075). ................................................................................................................

00

6

Computation of Amount Payable

00

1. Tax: from Computation of Tax, Line 6 ..............................................................................................................

1

2. Reserved for future use ...................................................................................................................................

2

00

3. Total Tax: Enter the amount from Line 1. .........................................................................................................

3

00

4. Tax credits from Form CT-1120K, Part III, Line 9. Do not exceed amount on Line 1. .................................

4

00

5. Balance of tax payable: Subtract Line 4 from Line 3. If zero or less, enter “0.” ...............................................

5

00

6a.

Paid with application for extension from Form CT-990T EXT

...........................................................................

6a

00

Paid with estimates from Forms CT-990T ESA, ESB, ESC, & ESD

6b.

..................................................................

6b

00

Overpayment from prior year

6c.

..................................................................................................................................

6c

00

6. Tax Payments: Enter the total of Lines 6a, 6b, and 6c. .................................................................................

6

00

7. Balance of tax due (overpaid): Subtract Line 6 from Line 5. ...........................................................................

7

.00

.00

.00

00

8. Add Penalty

(8a) ___________ Interest

(8b) ___________ CT-1120I Interest

(8c) ___________

8

.00

.00

00

9. Amount to be credited to 2009 estimated tax

(9a) _____________ Refunded

(9b) _______________

9

00

10. Balance due with this return: Add Line 7 and Line 8. .................................................................................

10

Make check payable to: Commissioner of Revenue Services. Attach check to return with paper clip. Do not staple.

Mail to: Department of Revenue Services, State of Connecticut, PO Box 5014, Hartford CT 06102-5014

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to

the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document

to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both. The

declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature of offi cer or fi duciary

Date

May DRS contact the preparer

shown below about this return?

Sign Here

See instructions.

Title

Telephone number

Keep a copy

(

)

Yes

No

of this

return for

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

your

records.

Firm’s name and address

FEIN

Telephone number

(

)

Go To Next Page

1

1 2

2