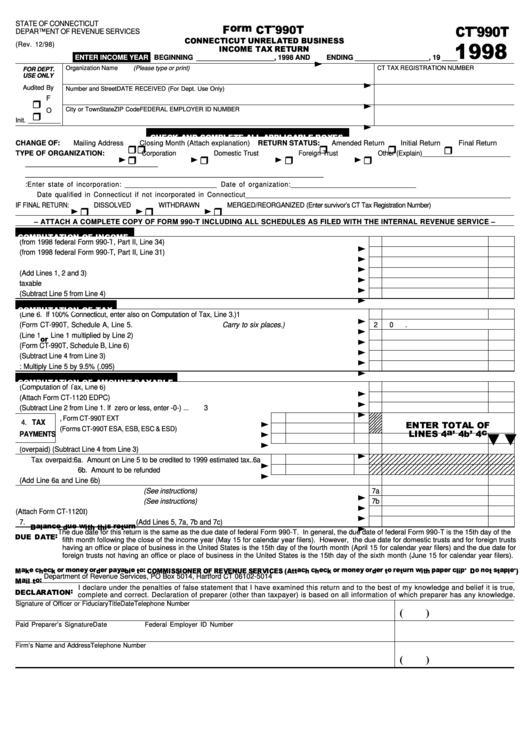

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

ENTER INCOME YEAR

BEGINNING ____________________, 1998 AND

ENDING ___________________, 19 ____

Organization Name

(Please type or print)

CT TAX REGISTRATION NUMBER

FOR DEPT.

USE ONLY

Audited By

Number and Street

DATE RECEIVED (For Dept. Use Only)

F

City or Town

State

ZIP Code

FEDERAL EMPLOYER ID NUMBER

O

Init. _________

CHANGE OF:

Mailing Address

Closing Month (Attach explanation)

RETURN STATUS:

Amended Return

Initial Return

Final Return

TYPE OF ORGANIZATION:

Corporation

Domestic Trust

Foreign Trust

Other (Explain) ________________________

1. Date unrelated trade or business commenced in Connecticut ____________________________________

2. Nature of unrelated trade or business income activity _________________________________________________________________________________

3. CORPORATIONS ONLY: Enter state of incorporation: _________________________ Date of organization: __________________________________

Date qualified in Connecticut if not incorporated in Connecticut ________________________________________________________________________

IF FINAL RETURN:

DISSOLVED

WITHDRAWN

MERGED/REORGANIZED (Enter survivor’s CT Tax Registration Number)

– ATTACH A COMPLETE COPY OF FORM 990-T INCLUDING ALL SCHEDULES AS FILED WITH THE INTERNAL REVENUE SERVICE –

1. Federal unrelated business taxable income (from 1998 federal Form 990-T, Part II, Line 34) .......................

1

2. Federal net operating loss deduction (from 1998 federal Form 990-T, Part II, Line 31) .................................

2

3. Federal deduction for Connecticut tax on unrelated business taxable income .................................................

3

4. TOTAL (Add Lines 1, 2 and 3) .........................................................................................................................

4

5. Refund or credit for overpayment of Connecticut tax included in federal unrelated business taxable income .....

5

6. Unrelated business taxable income (Subtract Line 5 from Line 4) ....................................................................

6

1. Unrelated business taxable income (Line 6. If 100% Connecticut, enter also on Computation of Tax, Line 3.)

1

2. Apportionment fraction (Form CT-990T, Schedule A, Line 5. Carry to six places.) ......................................

2

0.

3. Connecticut unrelated business taxable income (Line 1

Line 1 multiplied by Line 2) ................................

3

4. Operating loss carryover (Form CT-990T, Schedule B, Line 6) ........................................................................

4

5. Income subject to tax (Subtract Line 4 from Line 3) ..........................................................................................

5

6. TAX: Multiply Line 5 by 9.5% (.095) .................................................................................................................

6

1. Tax (Computation of Tax, Line 6) ......................................................................................................................

1

2. Electronic Data Processing Equipment Property Tax Credit (Attach Form CT-1120 EDPC) ............................

2

3. Balance of tax payable (Subtract Line 2 from Line 1. If zero or less, enter -0-) ...............................................

3

1 2 3 4 5 6

1 2 3 4 5 6

4a. Paid with application for extension, Form CT-990T EXT ..................

4a

1 2 3 4 5 6

1 2 3 4 5 6

4. TAX

1 2 3 4 5 6

1 2 3 4 5 6

4b. Paid with estimates (Forms CT-990T ESA, ESB, ESC & ESD) ........

4b

1 2 3 4 5 6

1 2 3 4 5 6

PAYMENTS

4c. Overpayment from prior year ..........................................................

4c

4

5. Balance of tax due (overpaid) (Subtract Line 4 from Line 3) .............................................................................

5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

Tax overpaid: 6a. Amount on Line 5 to be credited to 1999 estimated tax ..

6a

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1

6b. Amount to be refunded ...................................................

6b

6. Total tax overpaid (Add Line 6a and Line 6b) ....................................................................................................... 6

7a. Penalty for late payment or late filing (See instructions) ...................................................................................

7a

7b. Interest for late payment or late filing (See instructions) ...................................................................................

7b

7c. Interest on underpayment of estimated tax (Attach Form CT-1120I) ................................................................

7c

7.

(Add Lines 5, 7a, 7b and 7c) .....................................................................

7

The due date for this return is the same as the due date of federal Form 990-T. In general, the due date of federal Form 990-T is the 15th day of the

fifth month following the close of the income year (May 15 for calendar year filers). However, the due date for domestic trusts and for foreign trusts

having an office or place of business in the United States is the 15th day of the fourth month (April 15 for calendar year filers) and the due date for

foreign trusts not having an office or place of business in the United States is the 15th day of the sixth month (June 15 for calendar year filers).

Department of Revenue Services, PO Box 5014, Hartford CT 06102-5014

I declare under the penalties of false statement that I have examined this return and to the best of my knowledge and belief it is true,

complete and correct. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of Officer or Fiduciary

Title

Date

Telephone Number

(

)

Paid Preparer’s Signature

Date

Federal Employer ID Number

Firm’s Name and Address

Telephone Number

(

)

1

1 2

2