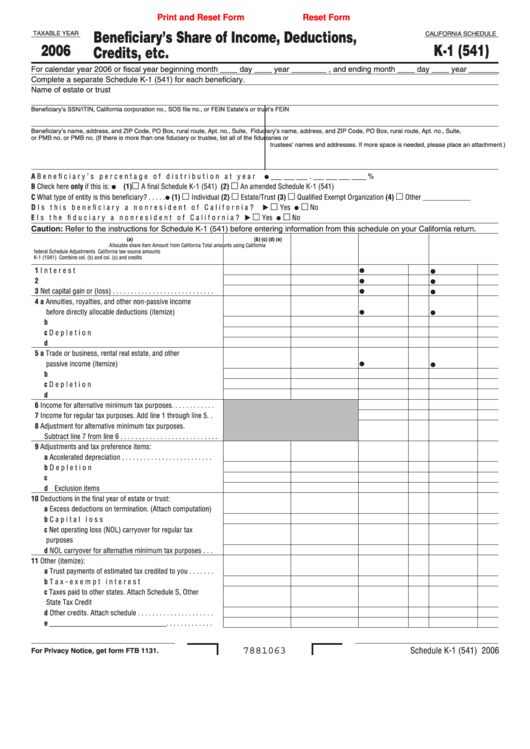

California Schedule K-1 (541) - Beneficiary'S Share Of Income, Deductions, Credits, Etc. - 2006

ADVERTISEMENT

Print and Reset Form

Reset Form

Beneficiary’s Share of Income, Deductions,

TAXABLE YEAR

CALIFORNIA SCHEDULE

2006

K-1 (541)

Credits, etc.

For calendar year 2006 or fiscal year beginning month ____ day ____ year ________ , and ending month ____ day ____ year _______

Complete a separate Schedule K-1 (541) for each beneficiary.

Name of estate or trust

Beneficiary’s SSN/ITIN, California corporation no., SOS file no., or FEIN

Estate’s or trust’s FEIN

Beneficiary’s name, address, and ZIP Code, PO Box, rural route, Apt. no., Suite,

Fiduciary’s name, address, and ZIP Code, PO Box, rural route, Apt. no., Suite,

or PMB no.

or PMB no. (If there is more than one fiduciary or trustee, list all of the fiduciaries or

trustees’ names and addresses. If more space is needed, please place an attachment.)

.

A Beneficiary’s percentage of distribution at year end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___ ___ ___

___ ___ ___ ____ %

B Check here only if this is:

(1)

A final Schedule K-1 (541)

(2)

An amended Schedule K-1 (541)

C What type of entity is this beneficiary? . . . . .

(1)

Individual (2)

Estate/Trust (3)

Qualified Exempt Organization (4)

Other _____________

D Is this beneficiary a nonresident of California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

E Is the fiduciary a nonresident of California?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Caution: Refer to the instructions for Schedule K-1 (541) before entering information from this schedule on your California return.

(a)

(b)

(c)

(d)

(e)

Allocable share item

Amount from

California

Total amounts using

California

federal Schedule

Adjustments

California law

source amounts

K-1 (1041)

Combine col. (b) and col. (c)

and credits

1 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Net capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 a Annuities, royalties, and other non-passive income

before directly allocable deductions (itemize) . . . . . . . . .

b Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 a Trade or business, rental real estate, and other

passive income (itemize) . . . . . . . . . . . . . . . . . . . . . . . . .

b Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Income for alternative minimum tax purposes. . . . . . . . . . . .

7 Income for regular tax purposes. Add line 1 through line 5 . .

8 Adjustment for alternative minimum tax purposes.

Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Adjustments and tax preference items:

a Accelerated depreciation . . . . . . . . . . . . . . . . . . . . . . . . .

b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Exclusion items . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Deductions in the final year of estate or trust:

a Excess deductions on termination. (Attach computation)

b Capital loss carryover. . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Net operating loss (NOL) carryover for regular tax

purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d NOL carryover for alternative minimum tax purposes . . .

11 Other (itemize):

a Trust payments of estimated tax credited to you . . . . . . .

b Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Taxes paid to other states. Attach Schedule S, Other

State Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Other credits. Attach schedule . . . . . . . . . . . . . . . . . . . . .

e ________________________________. . . . . . . . . . . . .

7881063

Schedule K-1 (541) 2006

For Privacy Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1