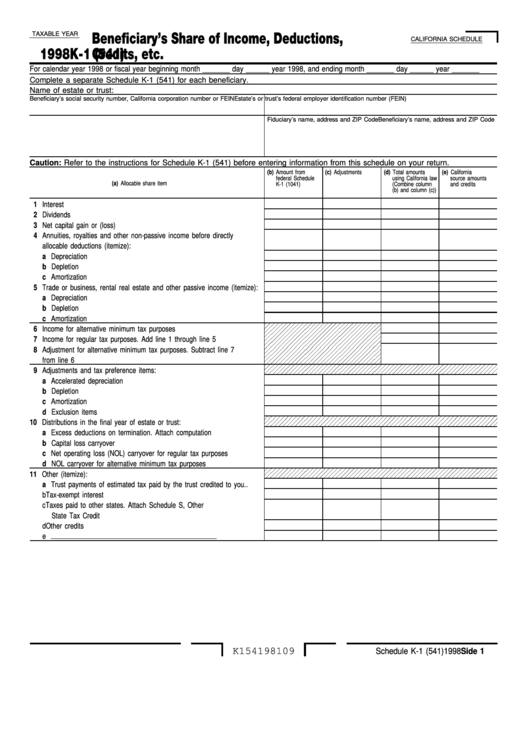

TAXABLE YEAR

Beneficiary’s Share of Income, Deductions,

CALIFORNIA SCHEDULE

1998

Credits, etc.

K-1 (541)

For calendar year 1998 or fiscal year beginning month _______ day ______ year 1998, and ending month _______ day ______ year _______

Complete a separate Schedule K-1 (541) for each beneficiary.

Name of estate or trust:

Beneficiary’s social security number, California corporation number or FEIN

Estate’s or trust’s federal employer identification number (FEIN)

Beneficiary’s name, address and ZIP Code

Fiduciary’s name, address and ZIP Code

Caution: Refer to the instructions for Schedule K-1 (541) before entering information from this schedule on your return.

(b) Amount from

(c) Adjustments

(d) Total amounts

(e) California

federal Schedule

using California law

source amounts

(a) Allocable share item

K-1 (1041)

(Combine column

and credits

(b) and column (c))

1 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Net capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Annuities, royalties and other non-passive income before directly

allocable deductions (itemize):

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Trade or business, rental real estate and other passive income (itemize):

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Income for alternative minimum tax purposes . . . . . . . . . . . . . . . .

7 Income for regular tax purposes. Add line 1 through line 5 . . . . . . . .

8 Adjustment for alternative minimum tax purposes. Subtract line 7

from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Adjustments and tax preference items:

a Accelerated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . .

b Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Exclusion items. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Distributions in the final year of estate or trust:

a Excess deductions on termination. Attach computation . . . . . . . . .

b Capital loss carryover . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Net operating loss (NOL) carryover for regular tax purposes. . . . . .

d NOL carryover for alternative minimum tax purposes . . . . . . . . . .

11 Other (itemize):

a Trust payments of estimated tax paid by the trust credited to you . .

b Tax-exempt interest . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Taxes paid to other states. Attach Schedule S, Other

State Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d Other credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e

. . . . . . . .

K154198109

Schedule K-1 (541) 1998 Side 1

1

1