Verification Of Employment Income Form

ADVERTISEMENT

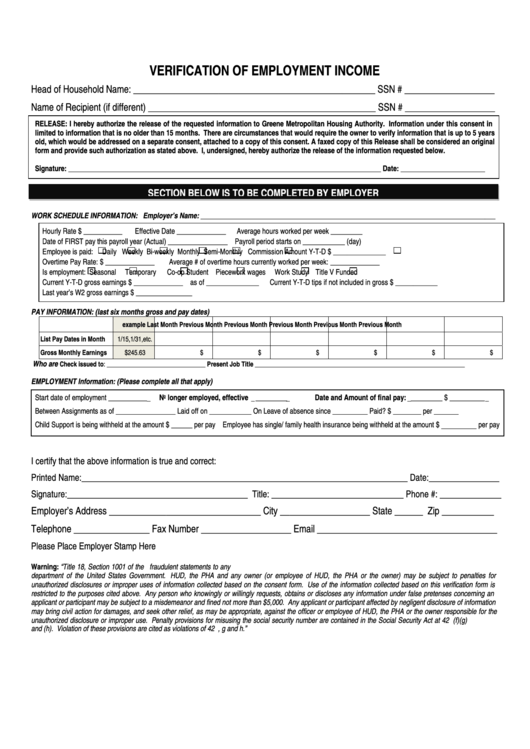

VERIFICATION OF EMPLOYMENT INCOME

Head of Household Name: ___________________________________________________ SSN # ___________________

Name of Recipient (if different) ________________________________________________ SSN # ___________________

RELEASE: I hereby authorize the release of the requested information to Greene Metropolitan Housing Authority. Information under this consent in

limited to information that is no older than 15 months. There are circumstances that would require the owner to verify information that is up to 5 years

old, which would be addressed on a separate consent, attached to a copy of this consent. A faxed copy of this Release shall be considered an original

form and provide such authorization as stated above. I, undersigned, hereby authorize the release of the information requested below.

Signature: _________________________________________________________________________________________ Date: ________________________

SECTION BELOW IS TO BE COMPLETED BY EMPLOYER

WORK SCHEDULE INFORMATION: Employer’s Name: ____________________________________________________________________________________

Hourly Rate $ ___________

Effective Date ______________

Average hours worked per week _________

Date of FIRST pay this payroll year (Actual) _________________ Payroll period starts on ____________ (day)

Employee is paid:

Daily

Weekly

Bi-weekly

Monthly

Semi-Monthly

Commission Amount Y-T-D $ ____ ___________

Overtime Pay Rate: $ ______________

Average # of overtime hours currently worked per week: ______________

Is employment:

Seasonal

Temporary

Co-op Student

Piecework wages

Work Study

Title V Funded

Current Y-T-D gross earnings $ ______________ as of _______________

Current Y-T-D tips if not included in gross $ ____________

Last year’s W2 gross earnings $ ________________

PAY INFORMATION: (last six months gross and pay dates)

example

Last Month

Previous Month

Previous Month

Previous Month

Previous Month

Previous Month

List Pay Dates in Month

1/15,1/31,etc.

Gross Monthly Earnings

$245.63

$

$

$

$

$

$

Who are

Check issued to: _______________________________ Present Job Title __________________________________________________________________

EMPLOYMENT Information: (Please complete all that apply)

Start date of employment ____________

No longer employed, effective ___________

Date and Amount of final pay: __________ $ ___________

Between Assignments as of _________________

Laid off on ____________

On Leave of absence since __________ Paid? $ ________ per _______

Child Support is being withheld at the amount $ ______ per pay Employee has single/ family health insurance being withheld at the amount $ _________ per pay

I certify that the above information is true and correct:

Printed Name:__________________________________________________________________________ Date:________________

Signature:_________________________________________ Title: ______________________________ Phone #: ______________

Employer’s Address ________________________________ City ___________________ State ______ Zip ___________

Telephone ________________ Fax Number ___________________ Email ______________________________________

Please Place Employer Stamp Here

Warning: “Title 18, Section 1001 of the U.S. Code states that a person is guilty of a felony for knowingly and willingly making false or fraudulent statements to any

department of the United States Government. HUD, the PHA and any owner (or employee of HUD, the PHA or the owner) may be subject to penalties for

unauthorized disclosures or improper uses of information collected based on the consent form. Use of the information collected based on this verification form is

restricted to the purposes cited above. Any person who knowingly or willingly requests, obtains or discloses any information under false pretenses concerning an

applicant or participant may be subject to a misdemeanor and fined not more than $5,000. Any applicant or participant affected by negligent disclosure of information

may bring civil action for damages, and seek other relief, as may be appropriate, against the officer or employee of HUD, the PHA or the owner responsible for the

unauthorized disclosure or improper use. Penalty provisions for misusing the social security number are contained in the Social Security Act at 42 U.S.C208 (f)(g)

and (h). Violation of these provisions are cited as violations of 42 U.S.C. 408 f, g and h.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1