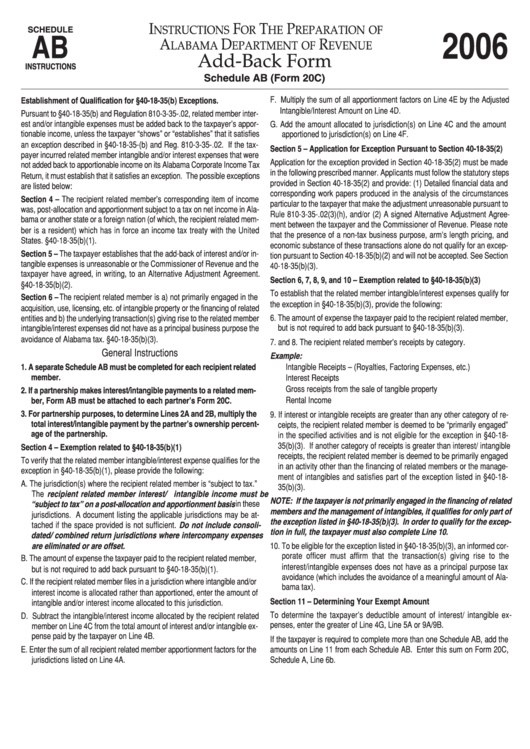

Instructions For The Preparation Of Alabama Department Of Revenue Add-Back Form Schedule Ab (Form 20c) 2006

ADVERTISEMENT

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

SCHEDULE

2006

AB

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Add-Back Form

INSTRUCTIONS

Schedule AB (Form 20C)

Establishment of Qualification for §40-18-35(b) Exceptions.

F. Multiply the sum of all apportionment factors on Line 4E by the Adjusted

Intangible/Interest Amount on Line 4D.

Pursuant to §40-18-35(b) and Regulation 810-3-35-.02, related member inter-

est and/or intangible expenses must be added back to the taxpayer’s appor-

G. Add the amount allocated to jurisdiction(s) on Line 4C and the amount

tionable income, unless the taxpayer “shows” or “establishes” that it satisfies

apportioned to jurisdiction(s) on Line 4F.

an exception described in §40-18-35-(b) and Reg. 810-3-35-.02. If the tax-

Section 5 – Application for Exception Pursuant to Section 40-18-35(2)

payer incurred related member intangible and/or interest expenses that were

Application for the exception provided in Section 40-18-35(2) must be made

not added back to apportionable income on its Alabama Corporate Income Tax

in the following prescribed manner. Applicants must follow the statutory steps

Return, it must establish that it satisfies an exception. The possible exceptions

provided in Section 40-18-35(2) and provide: (1) Detailed financial data and

are listed below:

corresponding work papers produced in the analysis of the circumstances

Section 4 – The recipient related member’s corresponding item of income

particular to the taxpayer that make the adjustment unreasonable pursuant to

was, post-allocation and apportionment subject to a tax on net income in Ala-

Rule 810-3-35-.02(3)(h), and/or (2) A signed Alternative Adjustment Agree-

bama or another state or a foreign nation (of which, the recipient related mem-

ment between the taxpayer and the Commissioner of Revenue. Please note

ber is a resident) which has in force an income tax treaty with the United

that the presence of a non-tax business purpose, arm’s length pricing, and

States. §40-18-35(b)(1).

economic substance of these transactions alone do not qualify for an excep-

Section 5 – The taxpayer establishes that the add-back of interest and/or in-

tion pursuant to Section 40-18-35(b)(2) and will not be accepted. See Section

tangible expenses is unreasonable or the Commissioner of Revenue and the

40-18-35(b)(3).

taxpayer have agreed, in writing, to an Alternative Adjustment Agreement.

Section 6, 7, 8, 9, and 10 – Exemption related to §40-18-35(b)(3)

§40-18-35(b)(2).

To establish that the related member intangible/interest expenses qualify for

Section 6 – The recipient related member is a) not primarily engaged in the

the exception in §40-18-35(b)(3), provide the following:

acquisition, use, licensing, etc. of intangible property or the financing of related

6. The amount of expense the taxpayer paid to the recipient related member,

entities and b) the underlying transaction(s) giving rise to the related member

but is not required to add back pursuant to §40-18-35(b)(3).

intangible/interest expenses did not have as a principal business purpose the

avoidance of Alabama tax. §40-18-35(b)(3).

7. and 8. The recipient related member’s receipts by category.

General Instructions

Example:

1. A separate Schedule AB must be completed for each recipient related

Intangible Receipts – (Royalties, Factoring Expenses, etc.)

member.

Interest Receipts

Gross receipts from the sale of tangible property

2. If a partnership makes interest/intangible payments to a related mem-

ber, Form AB must be attached to each partner’s Form 20C.

Rental Income

3. For partnership purposes, to determine Lines 2A and 2B, multiply the

9. If interest or intangible receipts are greater than any other category of re-

total interest/intangible payment by the partner’s ownership percent-

ceipts, the recipient related member is deemed to be “primarily engaged”

age of the partnership.

in the specified activities and is not eligible for the exception in §40-18-

35(b)(3). If another category of receipts is greater than interest/ intangible

Section 4 – Exemption related to §40-18-35(b)(1)

receipts, the recipient related member is deemed to be primarily engaged

To verify that the related member intangible/interest expense qualifies for the

in an activity other than the financing of related members or the manage-

exception in §40-18-35(b)(1), please provide the following:

ment of intangibles and satisfies part of the exception listed in §40-18-

A. The jurisdiction(s) where the recipient related member is “subject to tax.”

35(b)(3).

The recipient related member interest/ intangible income must be

NOTE: If the taxpayer is not primarily engaged in the financing of related

“subject to tax” on a post-allocation and apportionment basis in these

members and the management of intangibles, it qualifies for only part of

jurisdictions. A document listing the applicable jurisdictions may be at-

the exception listed in §40-18-35(b)(3). In order to qualify for the excep-

tached if the space provided is not sufficient. Do not include consoli-

tion in full, the taxpayer must also complete Line 10.

dated/ combined return jurisdictions where intercompany expenses

are eliminated or are offset.

10. To be eligible for the exception listed in §40-18-35(b)(3), an informed cor-

porate officer must affirm that the transaction(s) giving rise to the

B. The amount of expense the taxpayer paid to the recipient related member,

interest/intangible expenses does not have as a principal purpose tax

but is not required to add back pursuant to §40-18-35(b)(1).

avoidance (which includes the avoidance of a meaningful amount of Ala-

C. If the recipient related member files in a jurisdiction where intangible and/or

bama tax).

interest income is allocated rather than apportioned, enter the amount of

Section 11 – Determining Your Exempt Amount

intangible and/or interest income allocated to this jurisdiction.

To determine the taxpayer’s deductible amount of interest/ intangible ex-

D. Subtract the intangible/interest income allocated by the recipient related

penses, enter the greater of Line 4G, Line 5A or 9A/9B.

member on Line 4C from the total amount of interest and/or intangible ex-

pense paid by the taxpayer on Line 4B.

If the taxpayer is required to complete more than one Schedule AB, add the

E. Enter the sum of all recipient related member apportionment factors for the

amounts on Line 11 from each Schedule AB. Enter this sum on Form 20C,

jurisdictions listed on Line 4A.

Schedule A, Line 6b.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1