Technical Bulletin Form - New Jersey Division Of Taxation

ADVERTISEMENT

NEW JERSEY DIVISION OF TAXATION

TECHNICAL BULLETIN

DISTRIBUTION:

C, INCLUDING FIELD

TB-21 (R)

FOR RELEASE:

INTERNAL ONLY

ISSUED:

3-9-01

OUTSIDE DIVISION

X

EXPIRES:

7-1-01*

TOPIC:

INTEREST RATE ASSESSED FOR SECOND QUARTER 2001

The assessed interest rate for the second quarter of 2001 is 12.50%.

The rate is calculated as follows: 9.50% (Prime Rate) + 3% = 12.50%, compounded annually.

Under the Taxpayers’ Bill of Rights, interest assessed on outstanding tax balances is Prime Rate plus 3%. Prime

Rate for this purpose is the average predominant prime rate, as determined by the Board of Governors of the

Federal Reserve System, that was in effect on December 1 of the year prior to the year in which the tax became

due. The Prime Rate is reviewed each calendar quarter and may change only if there has been a cumulative

change in the Federal Reserve prime rate of more than one percent (up or down) since the last time the interest

rate was set. To change a rate, the Director will consider the Federal Reserve prime rate as it existed 30 days

prior to the beginning of the calendar quarter in question.

At the end of each calendar year any tax, penalties and interest remaining due (unpaid) will become part of the

balance on which interest is charged.

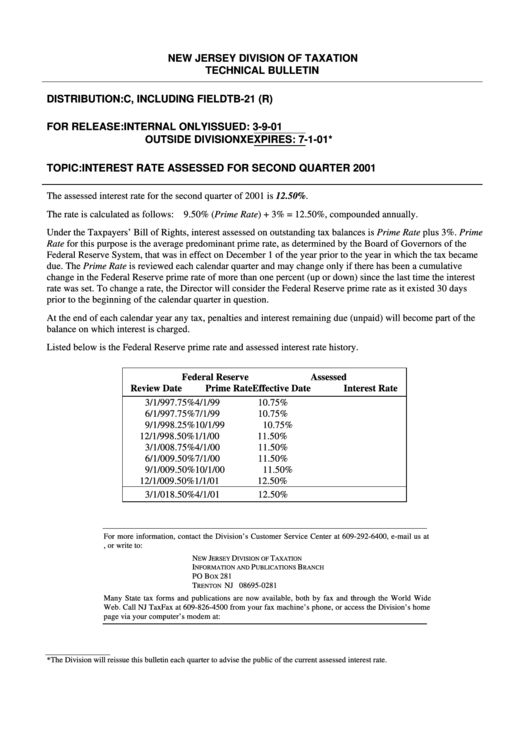

Listed below is the Federal Reserve prime rate and assessed interest rate history.

Federal Reserve

Assessed

Review Date

Prime Rate

Effective Date

Interest Rate

3/1/99

7.75%

4/1/99

10.75%

6/1/99

7.75%

7/1/99

10.75%

9/1/99

8.25%

10/1/99

10.75%

12/1/99

8.50%

1/1/00

11.50%

3/1/00

8.75%

4/1/00

11.50%

6/1/00

9.50%

7/1/00

11.50%

9/1/00

9.50%

10/1/00

11.50%

12/1/00

9.50%

1/1/01

12.50%

3/1/01

8.50%

4/1/01

12.50%

For more information, contact the Division’s Customer Service Center at 609-292-6400, e-mail us at

taxation@tax.state.nj.us, or write to:

N

J

D

T

EW

ERSEY

IVISION OF

AXATION

I

P

B

NFORMATION AND

UBLICATIONS

RANCH

PO B

281

OX

T

NJ 08695-0281

RENTON

Many State tax forms and publications are now available, both by fax and through the World Wide

Web. Call NJ TaxFax at 609-826-4500 from your fax machine’s phone, or access the Division’s home

page via your computer’s modem at:

*The Division will reissue this bulletin each quarter to advise the public of the current assessed interest rate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1