Form Op-186 - Connecticut Individual Use Tax Return - Connecticut Department Of Revenue

ADVERTISEMENT

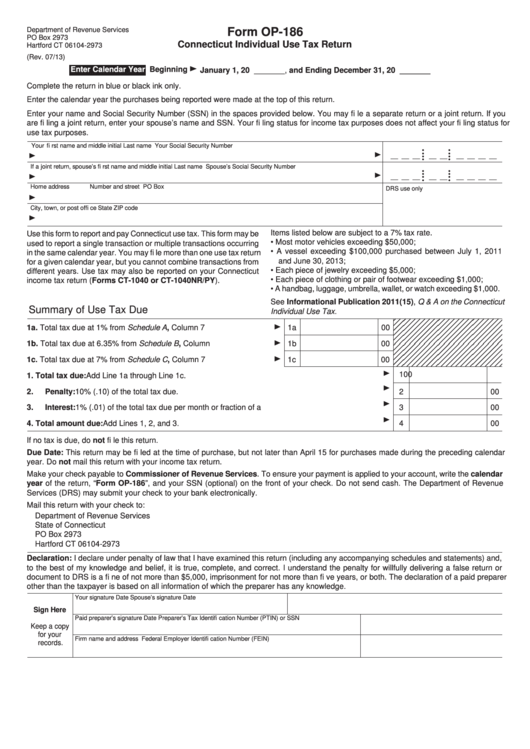

Department of Revenue Services

Form OP-186

PO Box 2973

Connecticut Individual Use Tax Return

Hartford CT 06104-2973

(Rev. 07/13)

Enter Calendar Year

Beginning

January 1, 20 _______, and Ending December 31, 20 _______

Complete the return in blue or black ink only.

Enter the calendar year the purchases being reported were made at the top of this return.

Enter your name and Social Security Number (SSN) in the spaces provided below. You may fi le a separate return or a joint return. If you

are fi ling a joint return, enter your spouse’s name and SSN. Your fi ling status for income tax purposes does not affect your fi ling status for

use tax purposes.

Your fi rst name and middle initial

Last name

Your Social Security Number

•

•

• •

• •

__ __ __

__ __

__ __ __ __

•

•

If a joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

•

•

• •

• •

__ __ __

__ __

__ __ __ __

•

•

Home address

Number and street

PO Box

DRS use only

City, town, or post offi ce

State

ZIP code

Items listed below are subject to a 7% tax rate.

Use this form to report and pay Connecticut use tax. This form may be

• Most motor vehicles exceeding $50,000;

used to report a single transaction or multiple transactions occurring

• A vessel exceeding $100,000 purchased between July 1, 2011

in the same calendar year. You may fi le more than one use tax return

and June 30, 2013;

for a given calendar year, but you cannot combine transactions from

• Each piece of jewelry exceeding $5,000;

different years. Use tax may also be reported on your Connecticut

• Each piece of clothing or pair of footwear exceeding $1,000;

income tax return (Forms CT-1040 or CT-1040NR/PY).

• A handbag, luggage, umbrella, wallet, or watch exceeding $1,000.

See Informational Publication 2011(15), Q & A on the Connecticut

Summary of Use Tax Due

Individual Use Tax.

1a. Total tax due at 1% from Schedule A, Column 7 ..............................

1a

00

1b. Total tax due at 6.35% from Schedule B, Column 7.........................

1b

00

1c. Total tax due at 7% from Schedule C, Column 7 .............................

1c

00

1.

Total tax due: Add Line 1a through Line 1c. .....................................................................................

1

00

2.

Penalty: 10% (.10) of the total tax due. .............................................................................................

2

00

3.

Interest: 1% (.01) of the total tax due per month or fraction of a month............................................

3

00

4.

Total amount due: Add Lines 1, 2, and 3. ........................................................................................

4

00

If no tax is due, do not fi le this return.

Due Date: This return may be fi led at the time of purchase, but not later than April 15 for purchases made during the preceding calendar

year. Do not mail this return with your income tax return.

Make your check payable to Commissioner of Revenue Services. To ensure your payment is applied to your account, write the calendar

year of the return, “Form OP-186”, and your SSN (optional) on the front of your check. Do not send cash. The Department of Revenue

Services (DRS) may submit your check to your bank electronically.

Mail this return with your check to:

Department of Revenue Services

State of Connecticut

PO Box 2973

Hartford CT 06104-2973

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and,

to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or

document to DRS is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer

other than the taxpayer is based on all information of which the preparer has any knowledge.

Your signature

Date

Spouse’s signature

Date

Sign Here

Paid preparer’s signature

Date

Preparer’s Tax Identifi cation Number (PTIN) or SSN

Keep a copy

for your

Firm name and address

Federal Employer Identifi cation Number (FEIN)

records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2