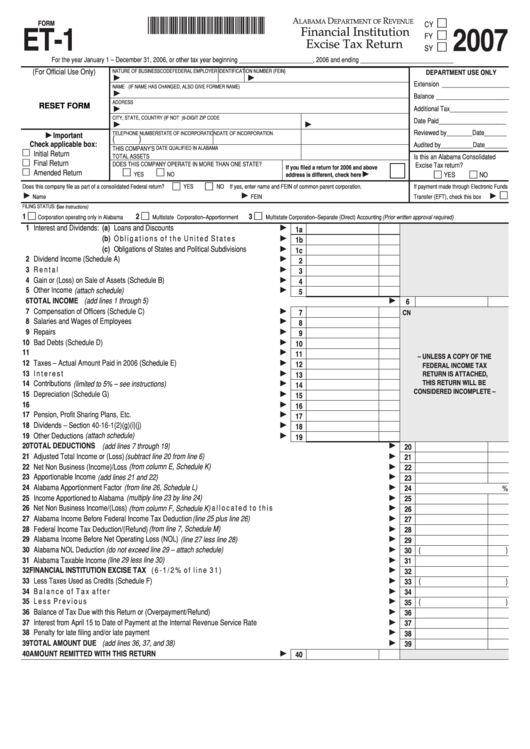

*07128301ET1*

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FORM

CY

Financial Institution

ET-1

2007

FY

Excise Tax Return

SY

For the year January 1 – December 31, 2006, or other tax year beginning _______________________, 2006 and ending _____________________________

NATURE OF BUSINESS

CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

(For Official Use Only)

DEPARTMENT USE ONLY

Extension _____________________

NAME (IF NAME HAS CHANGED, ALSO GIVE FORMER NAME)

Balance _______________________

ADDRESS

RESET FORM

Additional Tax __________________

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

Date Paid ______________________

Reviewed by________ Date_______

TELEPHONE NUMBER

STATE OF INCORPORATION

DATE OF INCORPORATION

Important

(

)

Check applicable box:

Audited by__________ Date_______

DATE QUALIFIED IN ALABAMA

THIS COMPANY’S

Initial Return

TOTAL ASSETS

Is this an Alabama Consolidated

Final Return

DOES THIS COMPANY OPERATE IN MORE THAN ONE STATE?

Excise Tax return?

If you filed a return for 2006 and above

Amended Return

YES

NO

YES

NO

address is different, check here

Does this company file as part of a consolidated Federal return?

YES

NO

If yes, enter name and FEIN of common parent corporation.

If payment made through Electronic Funds

Name

FEIN

Transfer (EFT), check this box

FILING STATUS: ( See Instructions)

1

2

3

Multistate Corporation–Separate (Direct) Accounting (Prior written approval required)

Corporation operating only in Alabama

Multistate Corporation–Apportionment

1 Interest and Dividends: (a) Loans and Discounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

(b) Obligations of the United States Government . . . . . . . . . . . .

1b

(c) Obligations of States and Political Subdivisions . . . . . . . . . .

1c

2 Dividend Income (Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Rental Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Gain or (Loss) on Sale of Assets (Schedule B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Other Income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 TOTAL INCOME (add lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Compensation of Officers (Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

CN

8 Salaries and Wages of Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Bad Debts (Schedule D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

– UNLESS A COPY OF THE

12 Taxes – Actual Amount Paid in 2006 (Schedule E). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

FEDERAL INCOME TAX

13 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

RETURN IS ATTACHED,

13

THIS RETURN WILL BE

14 Contributions (limited to 5% – see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

CONSIDERED INCOMPLETE –

15 Depreciation (Schedule G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Pension, Profit Sharing Plans, Etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Dividends – Section 40-16-1(2)(g)(i)(j) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Other Deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 TOTAL DEDUCTIONS (add lines 7 through 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21 Adjusted Total Income or (Loss) (subtract line 20 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Net Non Business (Income)/Loss (from column E, Schedule K) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Apportionable Income (add lines 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Alabama Apportionment Factor (from line 26, Schedule L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

%

25 Income Apportioned to Alabama (multiply line 23 by line 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Net Non Business Income/(Loss) (from column F, Schedule K) allocated to this state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 Alabama Income Before Federal Income Tax Deduction (line 25 plus line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Federal Income Tax Deduction/(Refund) (from line 7, Schedule M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Alabama Income Before Net Operating Loss (NOL) (line 27 less line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Alabama NOL Deduction (do not exceed line 29 – attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

30

31 Alabama Taxable Income (line 29 less line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

32 FINANCIAL INSTITUTION EXCISE TAX (6-1/2% of line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33 Less Taxes Used as Credits (Schedule F). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

33

34 Balance of Tax after Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

35 Less Previous Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

35

36 Balance of Tax Due with this Return or (Overpayment/Refund) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

37 Interest from April 15 to Date of Payment at the Internal Revenue Service Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

38 Penalty for late filing and/or late payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

39 TOTAL AMOUNT DUE (add lines 36, 37, and 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

39

40 AMOUNT REMITTED WITH THIS RETURN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

1

1 2

2 3

3 4

4 5

5