RESET FORM

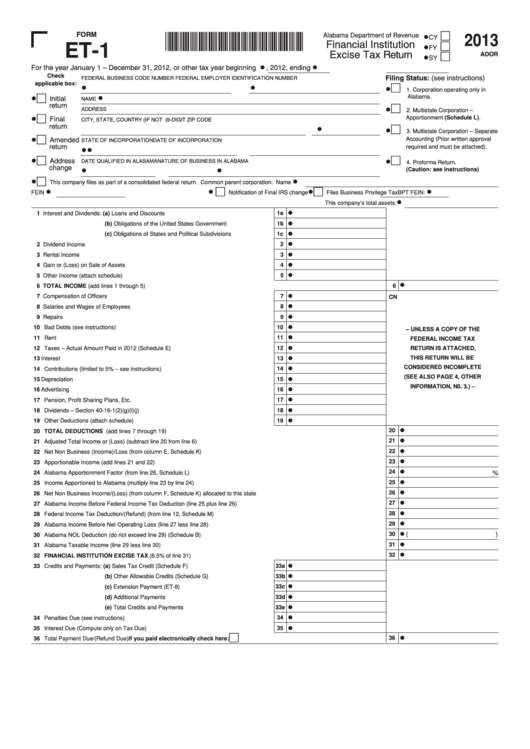

2013

FORM

130001E11283

Alabama Department of Revenue

•CY

ET-1

Financial Institution

•FY

Excise Tax Return

ADOR

•SY

•

•

For the year January 1 – December 31, 2012, or other tax year beginning

, 2012, ending

Check

Filing Status: (see instructions)

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

applicable box:

•

•

•

1. Corporation operating only in

•

Alabama.

•

Initial

NAME

return

•

ADDRESS

2. Multistate Corporation –

Apportionment (Schedule L).

•

Final

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

return

•

•

3. Multistate Corporation – Separate

•

Accounting (Prior written approval

Amended

STATE OF INCORPORATION

DATE OF INCORPORATION

required and must be attached).

return

•

•

•

•

Address

DATE QUALIFIED IN ALABAMA

NATURE OF BUSINESS IN ALABAMA

4. Proforma Return.

change

•

•

(Caution: see instructions)

•

•

This company files as part of a consolidated federal return. Common parent corporation: Name

•

•

•

•

FEIN

Notification of Final IRS change

Files Business Privilege Tax

BPT FEIN:

•

This company’s total assets:

•

1a

1 Interest and Dividends: (a) Loans and Discounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

1b

(b) Obligations of the United States Government. . . . . . . . . . . . . . . .

•

1c

(c) Obligations of States and Political Subdivisions. . . . . . . . . . . . . .

•

2

2 Dividend Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

3

3 Rental Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

4

4 Gain or (Loss) on Sale of Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

5

5 Other Income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

6

6 TOTAL INCOME (add lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

7

7 Compensation of Officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CN

•

8

8 Salaries and Wages of Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

9 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

10 Bad Debts (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

– UNLESS A COPY OF THE

•

11 Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

FEDERAL INCOME TAX

•

12 Taxes – Actual Amount Paid in 2012 (Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

RETURN IS ATTACHED,

•

THIS RETURN WILL BE

13 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

•

CONSIDERED INCOMPLETE

14 Contributions (limited to 5% – see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

(SEE ALSO PAGE 4, OTHER

•

15 Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

INFORMATION, N0. 3.) –

•

16 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

•

17 Pension, Profit Sharing Plans, Etc.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

•

18 Dividends – Section 40-16-1(2)(g)(i)(j) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

•

19 Other Deductions (attach schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

•

20

20 TOTAL DEDUCTIONS (add lines 7 through 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

21

21 Adjusted Total Income or (Loss) (subtract line 20 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

22

22 Net Non Business (Income)/Loss (from column E, Schedule K) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

23

23 Apportionable Income (add lines 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

24

24 Alabama Apportionment Factor (from line 26, Schedule L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

•

25

25 Income Apportioned to Alabama (multiply line 23 by line 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

26

26 Net Non Business Income/(Loss) (from column F, Schedule K) allocated to this state. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

27

27 Alabama Income Before Federal Income Tax Deduction (line 25 plus line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

28

28 Federal Income Tax Deduction/(Refund) (from line 12, Schedule M) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

29

29 Alabama Income Before Net Operating Loss (line 27 less line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

30

(

)

30 Alabama NOL Deduction (do not exceed line 29) (Schedule B). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

31

31 Alabama Taxable Income (line 29 less line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

32

32 FINANCIAL INSTITUTION EXCISE TAX (6.5% of line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

33 Credits and Payments: (a) Sales Tax Credit (Schedule F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33a

•

(b) Other Allowable Credits (Schedule G). . . . . . . . . . . . . . . . . . . . . . .

33b

•

(c) Extension Payment (ET-8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33c

•

(d) Additional Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33d

•

(e) Total Credits and Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33e

•

34 Penalties Due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

•

35 Interest Due (Compute only on Tax Due) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

•

36

36 Total Payment Due/(Refund Due) . . . . . . . . . . If you paid electronically check here:

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3 4

4