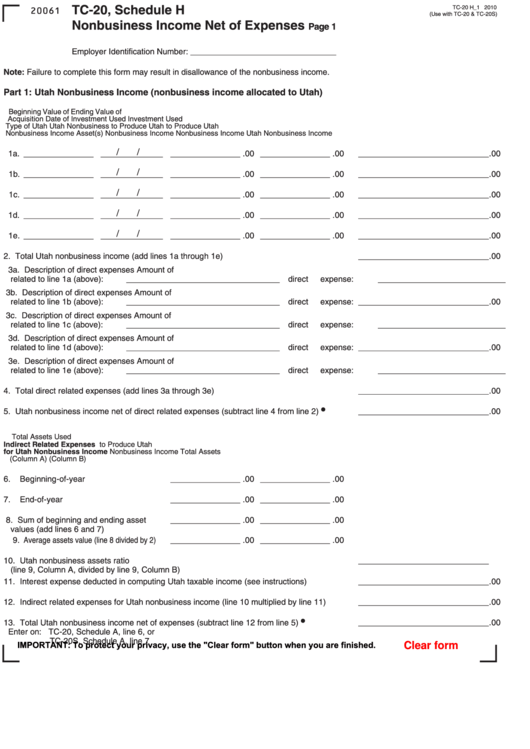

TC-20, Schedule H

TC-20 H_1 2010

20061

(Use with TC-20 & TC-20S)

Nonbusiness Income Net of Expenses

Page 1

Employer Identification Number: _ __________ __ __ __ __

Note: Failure to complete this form may result in disallowance of the nonbusiness income.

Part 1: Utah Nonbusiness Income (nonbusiness income allocated to Utah)

Beginning Value of

Ending Value of

Acquisition Date of

Investment Used

Investment Used

Type of Utah

Utah Nonbusiness

to Produce Utah

to Produce Utah

Nonbusiness Income

Asset(s)

Nonbusiness Income

Nonbusiness Income

Utah Nonbusiness Income

/

/

1a. __ _ __ _ _ __ __ _ __ _ _ _ _ _ _ __ ____ .00 __ __ __ __ _ .00

__ __ __ __ __ _ _ _ _ _ _ _ .00

/

/

1b. __ _ __ _ _ __ __ _ __ _ _ _ _ _ _ __ ____ .00 __ __ __ __ _ .00

__ __ __ __ __ _ _ _ _ _ _ _ .00

/

/

1c. __ _ __ _ _ __ __ _ __ _ _ _ _ _ _ __ ____ .00 __ __ __ __ _ .00

__ __ __ __ __ _ _ _ _ _ _ _ .00

/

/

1d. __ _ __ _ _ __ __ _ __ _ _ _ _ _ _ __ ____ .00 __ __ __ __ _ .00

__ __ __ __ __ _ _ _ _ _ _ _ .00

/

/

1e. __ _ __ _ _ __ __ _ __ _ _ _ _ _ _ __ ____ .00 __ __ __ __ _ .00

__ __ __ __ __ _ _ _ _ _ _ _ .00

2. Total Utah nonbusiness income (add lines 1a through 1e) .................................................

_ __ __ __ __ __ _ _ _ _ _ _ .00

3a. Description of direct expenses

Amount of

related to line 1a (above):

__ _ _ _ __ _ _ _ __________

direct expense:

____________________________ .00

3b. Description of direct expenses

Amount of

related to line 1b (above):

__ _ _ _ __ _ _ _ __________

direct expense:

_ __ __ __ __ __ _ _ _ _ _ _ .00

3c. Description of direct expenses

Amount of

related to line 1c (above):

__ _ _ _ __ _ _ _ __________

direct expense:

____________________________ .00

3d. Description of direct expenses

Amount of

related to line 1d (above):

__ _ _ _ __ _ _ _ __________

direct expense:

_ __ __ __ __ __ _ _ _ _ _ _ .00

3e. Description of direct expenses

Amount of

related to line 1e (above):

__ _ _ _ __ _ _ _ __________

direct expense:

____________________________ .00

4. Total direct related expenses (add lines 3a through 3e) .....................................................

_ __ __ __ __ __ _ _ _ _ _ _ .00

5. Utah nonbusiness income net of direct related expenses (subtract line 4 from line 2).......

__ __ __ __ __ _ _ _ _ _ _ _ .00

Total Assets Used

Indirect Related Expenses

to Produce Utah

for Utah Nonbusiness Income

Nonbusiness Income

Total Assets

(Column A)

(Column B)

6. Beginning-of-year assets .................

__ _ _ _ ____ .00 __ __ __ __ _ .00

7. End-of-year assets...........................

_ _ _ _ _ ____ .00 __ __ __ __ _ .00

8. Sum of beginning and ending asset

_ _ _ __ ____ .00 ___ __ __ __ .00

values (add lines 6 and 7)

9. Average assets value (line 8 divided by 2)

_ _ _ _ _____ .00 __ __ __ __ _ .00

10. Utah nonbusiness assets ratio ................ ..........................................................................

_ __ __ __ __ __ _ _ _ _ _ _

(line 9, Column A, divided by line 9, Column B)

11. Interest expense deducted in computing Utah taxable income (see instructions) ..............

__ __ __ __ __ _ _ _ _ _ _ _ .00

12. Indirect related expenses for Utah nonbusiness income (line 10 multiplied by line 11)......

__ __ __ __ __ _ _ _ _ _ _ _ .00

13. Total Utah nonbusiness income net of expenses (subtract line 12 from line 5) ..................

__ __ __ __ __ _ _ _ _ _ _ _ .00

Enter on: TC-20, Schedule A, line 6, or

TC-20S, Schedule A, line 7

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2