Hotel Excise Tax Form

ADVERTISEMENT

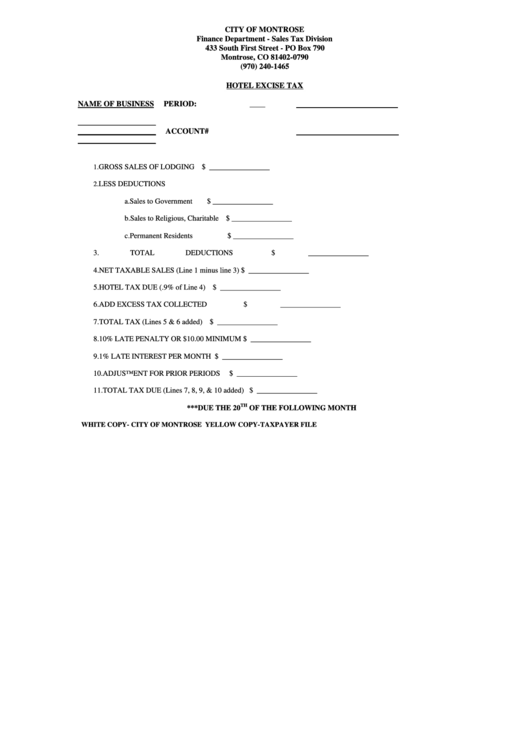

CITY OF MONTROSE

Finance Department - Sales Tax Division

433 South First Street - PO Box 790

Montrose, CO 81402-0790

(970) 240-1465

HOTEL EXCISE TAX

NAME OF BUSINESS

PERIOD:

____

____________________

____________________

ACCOUNT#

____________________

GROSS SALES OF LODGING

$ ________________

1.

LESS DEDUCTIONS

2.

a.

Sales to Government

$ ________________

b.

Sales to Religious, Charitable

$ ________________

c.

Permanent Residents

$ ________________

3.

TOTAL DEDUCTIONS

$ ________________

4.

NET TAXABLE SALES (Line 1 minus line 3)

$ ________________

5.

HOTEL TAX DUE (.9% of Line 4)

$ ________________

6.

ADD EXCESS TAX COLLECTED

$ ________________

7.

TOTAL TAX (Lines 5 & 6 added)

$ ________________

8.

10% LATE PENALTY OR $10.00 MINIMUM

$ ________________

9.

1% LATE INTEREST PER MONTH

$ ________________

10. ADJUSTMENT FOR PRIOR PERIODS

$ ________________

11. TOTAL TAX DUE (Lines 7, 8, 9, & 10 added)

$ ________________

TH

***DUE THE 20

OF THE FOLLOWING MONTH

WHITE COPY- CITY OF MONTROSE

YELLOW COPY-TAXPAYER FILE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1