Report Of Hotel Occupancy Tax Form - Village Of Salado And Its Etj

ADVERTISEMENT

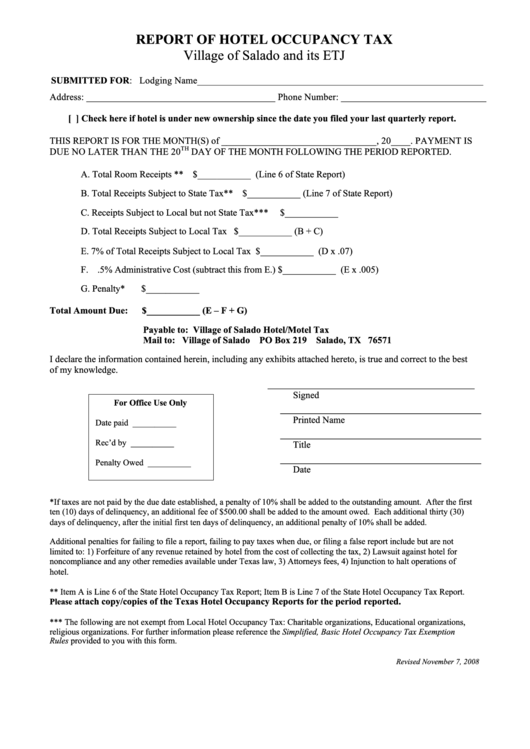

REPORT OF HOTEL OCCUPANCY TAX

Village of Salado and its ETJ

SUBMITTED FOR: Lodging Name___________________________________________________________

Address: _______________________________________ Phone Number: ______________________________

[ ] Check here if hotel is under new ownership since the date you filed your last quarterly report.

THIS REPORT IS FOR THE MONTH(S) of ________________________________, 20____. PAYMENT IS

TH

DUE NO LATER THAN THE 20

DAY OF THE MONTH FOLLOWING THE PERIOD REPORTED.

A. Total Room Receipts **

$___________ (Line 6 of State Report)

B. Total Receipts Subject to State Tax**

$___________ (Line 7 of State Report)

C. Receipts Subject to Local but not State Tax***

$___________

D. Total Receipts Subject to Local Tax

$___________ (B + C)

E. 7% of Total Receipts Subject to Local Tax

$___________ (D x .07)

F. .5% Administrative Cost (subtract this from E.)

$___________ (E x .005)

G. Penalty*

$___________

Total Amount Due:

$___________ (E – F + G)

Payable to:

Village of Salado Hotel/Motel Tax

Mail to:

Village of Salado

PO Box 219 Salado, TX 76571

I declare the information contained herein, including any exhibits attached hereto, is true and correct to the best

of my knowledge.

__________________________________

Signed

For Office Use Only

_________________________________

Printed Name

Date paid

__________

_________________________________

Rec’d by

__________

Title

_________________________________

Penalty Owed

__________

Date

*If taxes are not paid by the due date established, a penalty of 10% shall be added to the outstanding amount. After the first

ten (10) days of delinquency, an additional fee of $500.00 shall be added to the amount owed. Each additional thirty (30)

days of delinquency, after the initial first ten days of delinquency, an additional penalty of 10% shall be added.

Additional penalties for failing to file a report, failing to pay taxes when due, or filing a false report include but are not

limited to: 1) Forfeiture of any revenue retained by hotel from the cost of collecting the tax, 2) Lawsuit against hotel for

noncompliance and any other remedies available under Texas law, 3) Attorneys fees, 4) Injunction to halt operations of

hotel.

** Item A is Line 6 of the State Hotel Occupancy Tax Report; Item B is Line 7 of the State Hotel Occupancy Tax Report.

ttach copy/copies of the Texas Hotel Occupancy Reports for the period reported.

Please a

*** The following are not exempt from Local Hotel Occupancy Tax: Charitable organizations, Educational organizations,

religious organizations. For further information please reference the Simplified, Basic Hotel Occupancy Tax Exemption

Rules provided to you with this form.

Revised November 7, 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1