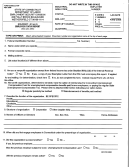

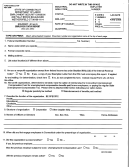

Form Ncui 604 Instructions - Employer Status Report Page 2

ADVERTISEMENT

Page 2 – NCUI 604 Instructions

16. EMPLOYEE LEASING

20. GOVERNMENTAL ENTITIES:

24. If the “Yes” box is checked,

COMPANIES: An employee

Check the appropriate block if

attach a list of independent

leasing company is an employee

this business is an agency or

contractor(s) who do not have a

service or temporary help service

department of federal, state or

Federal Employer Identification

that, under contract, supplies

local government.

Number. Include name(s),

individuals to perform services for

address(es), telephone number(s),

clients or customers.

and Social Security number(s).

21. Check this item to voluntarily

cover employees for

17. AGRICULTURAL

unemployment insurance, when

25. Provide for ALL general partners,

EMPLOYERS:

the business is not otherwise

principal corporate officers, or

subject to the unemployment

members full name(s), title(s),

insurance tax law.

Social Security Number(s), home

a.

Consider only monetary

address(es) (do not use a post

payments to all individuals

office box), and telephone

who performed services in

22. If the business has paid, or is

number(s) including the area

agricultural labor.

required to pay Federal

code. If additional space is

Unemployment Tax (FUTA),

needed, attach a list. Do not

check this item. Enter the calendar

provide information for limited

b.

Count any week in which as

year(s) for which FUTA is/was

partners.

many as 10 individuals were

required.

employed in agricultural

labor on any day.

Be sure all applicable items are

23. Complete this section if the

completed. Date and sign the form.

business has acquired or merged

Include the title of the person signing

18. DOMESTIC EMPLOYERS:

with another business, or any

the form. Mail the completed form to

Domestic employment includes

other changes have been made in

the address shown on page one of

all service for a person in the

the ownership of the business.

these instructions.

operation and maintenance of a

This includes changes, such as

private household, local college

from a sole proprietorship to a

club or local chapter of a college

corporation or a partnership.

fraternity or sorority. Domestic

Please call (919) 733-7156 if you have

employees include such workers

any questions.

as chauffeurs, cooks, babysitters,

a.

Enter the Name of the

gardeners, maids, butlers, and

Former Owner.

home nurses. Include only

b.

Enter the Former Owner’s

monetary payments made to

NC UI Tax Number.

individuals who performed

domestic service.

c.

Enter the Former Owner’s

Address.

19. NON-PROFIT

d.

Enter the date of the

ORGANIZATIONS: Answer this

acquisition or change.

question only if this business is a

e.

Check the appropriate box to

non- profit organization exempt

indicate if the acquisition or

from federal income tax under

change was total or partial.

Section 501(c)(3) of the Internal

Revenue Code. Attach a copy of

f.

Check the appropriate box to

the IRS letter that grants this

indicate if the business was

exemption. Non-profit

operating at the time that it

organizations with tax

was acquired. If applicable,

exemptions other than under

enter the date the business

Section 501(c)(3) should

closed.

complete item 12, general

g.

Check the appropriate box

business employment.

to indicate if the former

owner continues to have

employees.

Be sure to provide all the requested

information about the previous owner.

NCUI 604 (Rev. 12/2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2