Senior Citizen Homeowners' Exemption Initial Application For 2018/2019 - New York Department Of Finance

ADVERTISEMENT

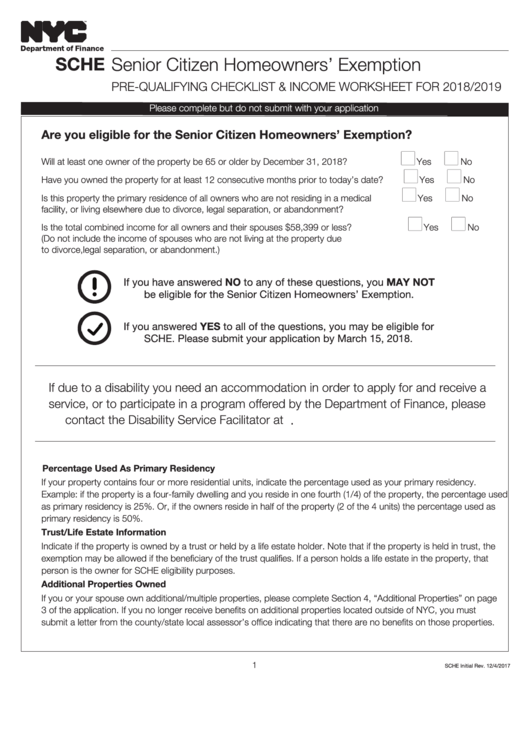

SCHE

Senior Citizen Homeowners’ Exemption

PRE-QUALIFYING CHECKLIST & INCOME WORKSHEET FOR 2018/2019

Please complete but do not submit with your application

Are you eligible for the Senior Citizen Homeowners’ Exemption?

n

n

n

n

Will at least one owner of the property be 65 or older by December 31, 2018?

Yes

No

n

n

Have you owned the property for at least 12 consecutive months prior to today’s date?

Yes

No

Is this property the primary residence of all owners who are not residing in a medical

Yes

No

n

n

facility, or living elsewhere due to divorce, legal separation, or abandonment?

Is the total combined income for all owners and their spouses $58,399 or less?

Yes

No

(Do not include the income of spouses who are not living at the property due

to divorce,legal separation, or abandonment.)

If you have answered NO to any of these questions, you MAY NOT

be eligible for the Senior Citizen Homeowners’ Exemption.

If you answered YES to all of the questions, you may be eligible for

SCHE. Please submit your application by March 15, 2018.

If due to a disability you need an accommodation in order to apply for and receive a

service, or to participate in a program offered by the Department of Finance, please

.

contact the Disability Service Facilitator at nyc.gov/contactdofeeo or call 311

1. Property Information

Percentage Used As Primary Residency

If your property contains four or more residential units, indicate the percentage used as your primary residency.

Example: if the property is a four-family dwelling and you reside in one fourth (1/4) of the property, the percentage used

as primary residency is 25%. Or, if the owners reside in half of the property (2 of the 4 units) the percentage used as

primary residency is 50%.

Trust/Life Estate Information

Indicate if the property is owned by a trust or held by a life estate holder. Note that if the property is held in trust, the

exemption may be allowed if the beneficiary of the trust qualifies. If a person holds a life estate in the property, that

person is the owner for SCHE eligibility purposes.

Additional Properties Owned

If you or your spouse own additional/multiple properties, please complete Section 4, “Additional Properties” on page

3 of the application. If you no longer receive benefits on additional properties located outside of NYC, you must

submit a letter from the county/state local assessor’s office indicating that there are no benefits on those properties.

1

SCHE Initial Rev. 12/4/2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6