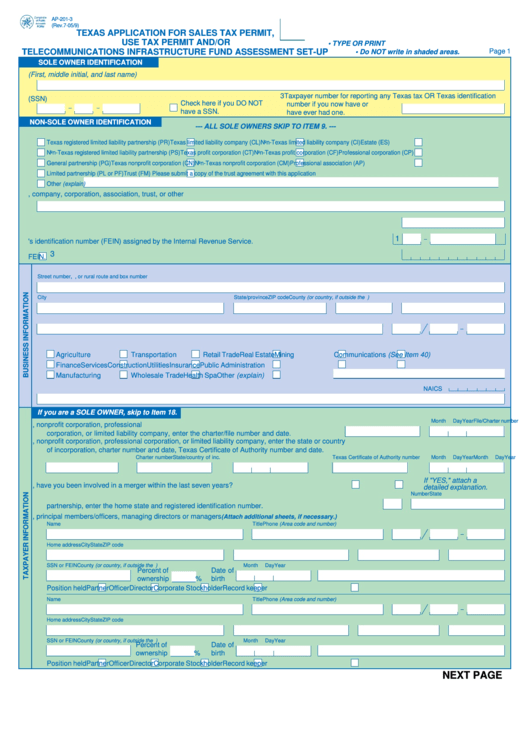

AP-201-3

(Rev.7-05/9)

TEXAS APPLICATION FOR SALES TAX PERMIT,

CLEAR FORM

USE TAX PERMIT AND/OR

• TYPE OR PRINT

TELECOMMUNICATIONS INFRASTRUCTURE FUND ASSESSMENT SET-UP

Page 1

• Do NOT write in shaded areas.

SOLE OWNER IDENTIFICATION

1. Name of sole owner (First, middle initial, and last name)

3 Taxpayer number for reporting any Texas tax OR Texas identification

2. Social security number (SSN)

Check here if you DO NOT

number if you now have or

have a SSN.

have ever had one.

NON-SOLE OWNER IDENTIFICATION

--- ALL SOLE OWNERS SKIP TO ITEM 9. ---

4. Business organization type

Texas registered limited liability partnership (PR)

Texas limited liability company (CL)

Non-Texas limited liability company (CI)

Estate (ES)

Non-Texas registered limited liability partnership (PS)

Texas profit corporation (CT)

Non-Texas profit corporation (CF)

Professional corporation (CP)

General partnership (PG)

Texas nonprofit corporation (CN)

Non-Texas nonprofit corporation (CM)

Professional association (AP)

Limited partnership (PL or PF)

Trust (FM) Please submit a copy of the trust agreement with this application

Other (explain)

5. Legal name of partnership, company, corporation, association, trust, or other

6. Taxpayer number for reporting any Texas tax OR Texas identification number if you now have or have ever had one.

1

7. Federal employer's identification number (FEIN) assigned by the Internal Revenue Service ......................................

3

8.

Check here if you do not have an FEIN. ......................................................................................................................

9. Mailing address

Street number, P.O. Box, or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

10. Name of person to contact regarding day to day business operations

Daytime phone

11. Principal type of business

Agriculture

Transportation

Retail Trade

Real Estate

Mining

Communications (See Item 40)

Finance

Services

Construction

Utilities

Insurance

Public Administration

Manufacturing

Wholesale Trade

Health Spa

Other (explain)

12. Primary business activities and type of products or services to be sold

NAICS

If you are a SOLE OWNER, skip to Item 18.

File/Charter number

Month

Day

Year

13. If the business is a Texas profit corporation, nonprofit corporation, professional

corporation, or limited liability company, enter the charter/file number and date. ..........................

14. If the business is a non-Texas profit corporation, nonprofit corporation, professional corporation, or limited liability company, enter the state or country

of incorporation, charter number and date, Texas Certificate of Authority number and date.

State/country of inc.

Charter number

Month

Day

Year

Texas Certificate of Authority number

Month

Day

Year

If "YES," attach a

15. If the business is a corporation, have you been involved in a merger within the last seven years? ...

YES

NO

detailed explanation.

State

Number

16. If the business is a limited partnership or registered limited liability

partnership, enter the home state and registered identification number. .......................................................

17. General partners, principal members/officers, managing directors or managers

(Attach additional sheets, if necessary.)

Name

Title

Phone (Area code and number)

Home address

City

State

ZIP code

SSN or FEIN

Month

Day

Year

County (or country, if outside the U.S.)

Percent of

Date of

ownership ______ %

birth

Position held

Partner

Officer

Director

Corporate Stockholder

Record keeper

Name

Title

Phone (Area code and number)

Home address

City

State

ZIP code

SSN or FEIN

Month

Day

Year

County (or country, if outside the U.S.)

Percent of

Date of

ownership ______ %

birth

Position held

Partner

Officer

Director

Corporate Stockholder

Record keeper

NEXT PAGE

1

1 2

2 3

3