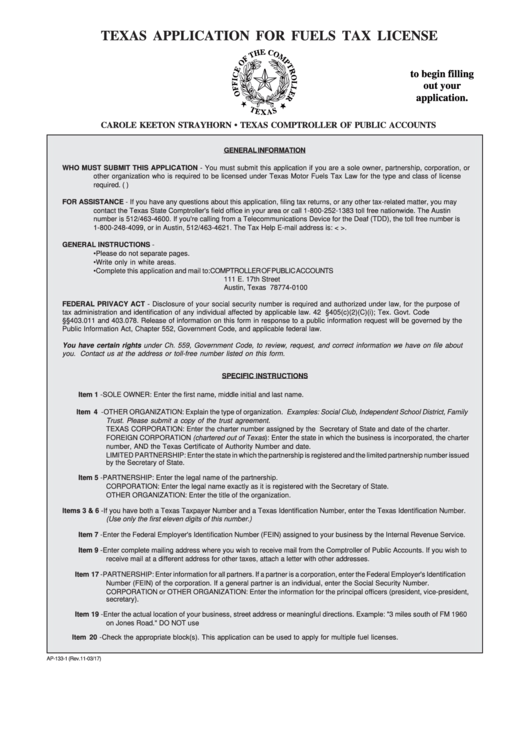

TEXAS APPLICATION FOR FUELS TAX LICENSE

CLICK HERE

to begin filling

out your

application.

CAROLE KEETON STRAYHORN • TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

GENERAL INFORMATION

WHO MUST SUBMIT THIS APPLICATION - You must submit this application if you are a sole owner, partnership, corporation, or

other organization who is required to be licensed under Texas Motor Fuels Tax Law for the type and class of license

required. (TEX.TAX CODE ANN. ch. 162)

FOR ASSISTANCE - If you have any questions about this application, filing tax returns, or any other tax-related matter, you may

contact the Texas State Comptroller's field office in your area or call 1-800-252-1383 toll free nationwide. The Austin

number is 512/463-4600. If you're calling from a Telecommunications Device for the Deaf (TDD), the toll free number is

1-800-248-4099, or in Austin, 512/463-4621. The Tax Help E-mail address is: <tax.help@cpa.state.tx.us>.

GENERAL INSTRUCTIONS -

• Please do not separate pages.

• Write only in white areas.

• Complete this application and mail to:

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, Texas 78774-0100

FEDERAL PRIVACY ACT - Disclosure of your social security number is required and authorized under law, for the purpose of

tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code

§§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the

Public Information Act, Chapter 552, Government Code, and applicable federal law.

You have certain rights under Ch. 559, Government Code, to review, request, and correct information we have on file about

you. Contact us at the address or toll-free number listed on this form.

SPECIFIC INSTRUCTIONS

Item 1 - SOLE OWNER: Enter the first name, middle initial and last name.

Item 4 - OTHER ORGANIZATION: Explain the type of organization. Examples: Social Club, Independent School District, Family

Trust. Please submit a copy of the trust agreement.

TEXAS CORPORATION: Enter the charter number assigned by the Secretary of State and date of the charter.

FOREIGN CORPORATION (chartered out of Texas): Enter the state in which the business is incorporated, the charter

number, AND the Texas Certificate of Authority Number and date.

LIMITED PARTNERSHIP: Enter the state in which the partnership is registered and the limited partnership number issued

by the Secretary of State.

Item 5 - PARTNERSHIP: Enter the legal name of the partnership.

CORPORATION: Enter the legal name exactly as it is registered with the Secretary of State.

OTHER ORGANIZATION: Enter the title of the organization.

Items 3 & 6 - If you have both a Texas Taxpayer Number and a Texas Identification Number, enter the Texas Identification Number.

(Use only the first eleven digits of this number.)

Item 7 - Enter the Federal Employer's Identification Number (FEIN) assigned to your business by the Internal Revenue Service.

Item 9 - Enter complete mailing address where you wish to receive mail from the Comptroller of Public Accounts. If you wish to

receive mail at a different address for other taxes, attach a letter with other addresses.

Item 17 - PARTNERSHIP: Enter information for all partners. If a partner is a corporation, enter the Federal Employer's Identification

Number (FEIN) of the corporation. If a general partner is an individual, enter the Social Security Number.

CORPORATION or OTHER ORGANIZATION: Enter the information for the principal officers (president, vice-president,

secretary).

Item 19 - Enter the actual location of your business, street address or meaningful directions. Example: "3 miles south of FM 1960

on Jones Road." DO NOT use P.O. Box or Rural Route Number.

Item 20 - Check the appropriate block(s). This application can be used to apply for multiple fuel licenses.

AP-133-1 (Rev.11-03/17)

1

1 2

2 3

3