Form Ct-1120 Ext - Instructions

ADVERTISEMENT

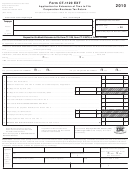

Form CT-1120 EXT

Instructions

Complete this form in blue or black ink only.

Interest and Penalty

Interest is assessed at 1% per month or fraction of a month on

Use Form CT-1120 EXT, Application for Extension of Time to

any underpayment of tax computed from the first day of the

File Corporation Business Tax Return, to request a six-month

fourth month following the close of the income year. The penalty

extension to file Form CT-1120, Corporation Business Tax

for underpayment of tax is 10% of the tax due or $50, whichever

Return, Form CT-1120CR, Combined Corporation Business

is greater.

Tax Return, or Form CT-1120U, Unitary Corporation Business

Tax Return. It is not necessary to include a reason for the

A taxpayer that has been granted a filing extension may avoid

Connecticut extension request if an extension on federal

a late payment penalty if the outstanding balance due is 10%

Form 7004, Application for Automatic 6-Month Extension of

or less and is paid with the filing of the Connecticut corporation

Time to File Certain Business Income Tax, Information, and

business tax return. If no tax is due, the Commissioner of

Other Returns, was filed with the Internal Revenue Service.

Revenue Services may impose a $50 penalty for the late filing

of any return or report that is required by law to be filed.

If federal Form 7004 was not filed, the corporation may apply

for a six-month extension to file the Connecticut corporation

Limit on Credits

business tax return if there is reasonable cause for the request.

The amount of tax credit(s) otherwise allowable against the

To get a Connecticut filing extension the corporation

corporation business tax for any income year shall not exceed

70% of the amount of tax due under the corporation business

MUST:

tax prior to the application of tax credits.

• Complete Form CT-1120 EXT in its entirety;

Conn. Gen. Stat. §12-217zz

• File it by the first day of the fourth month following the close

of the income year; and

Minimum Tax

No tax credit allowed against the corporation business tax shall

• Pay the amount shown on front, Line 13.

reduce a company’s minimum tax to an amount less than $250.

Form CT-1120 EXT only extends the time to file the

Conn. Gen. Stat. §12-219

Connecticut Corporation Business Tax Return. Form

CT-1120 EXT does not extend the time to pay the amount of

Tax Credit Recapture

tax due.

If the corporation is subject to recapture of tax credits, include

When to File

the tax credit recapture amount in the total amount of tax due

File Form CT-1120 EXT on or before the first day of the month

for the current income year.

following the due date of the company’s corresponding federal

Special Instructions - Combined Tentative Corporation

income tax return for the income year (April 1 for calendar year

Business Tax Return

taxpayers). In the case of any company that is not required to

file a federal income tax return for the income year, the

If two or more affiliated corporations electing to file a combined

Connecticut corporation business tax return must be filed on

corporation business tax return apply for an extension, Form

or before the first day of the fourth month following the end of

CT-1120CC, Combined Return Consent, must be attached to

the income year. If the due date falls on a Saturday, Sunday,

this Form CT-1120 EXT for the initial income year an affiliate is

or legal holiday, the next business day is the due date.

included. The election to file a combined corporation business

tax return will require the filing of a combined corporation

Electronic Options

business tax return for five successive income years.

The electronic Taxpayer Service Center

Required Information

(TSC) is an interactive tool that can be

accessed through the Department of Revenue

Enter the beginning and ending dates of the corporation’s

Services (DRS) website at for a free, fast,

income year, corporate name, address, Connecticut Tax

easy, and secure way to conduct business with DRS.

Registration Number, and Federal Employer Identification

Number (FEIN).

Where to File

Signature

Form CT-1120 EXT can be filed electronically through the TSC.

Visit the DRS website to register and file electronically. If you

An officer of the corporation must sign this form.

file electronically you must also pay electronically.

Paid Preparer Signature

Mail paper returns to:

Anyone who is paid to prepare the return must sign and date it.

Paid preparers must also enter their Social Security Number

Department of Revenue Services

(SSN) or Preparer Tax Identification Number (PTIN), their firm’s

State of Connecticut

FEIN, and their firm’s address and telephone number in the

PO Box 2974

spaces provided.

Hartford CT 06104-2974

Others Who May Sign

If making payment by mail, make check payble to:

Anyone (including attorneys, accountants, and enrolled

Commissioner of Revenue Services. DRS may submit your

agents) with a signed Power of Attorney may sign for the

check to your bank electronically.

corporation in place of a corporate officer.

Form CT-1120 EXT Back (Rev. 12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1