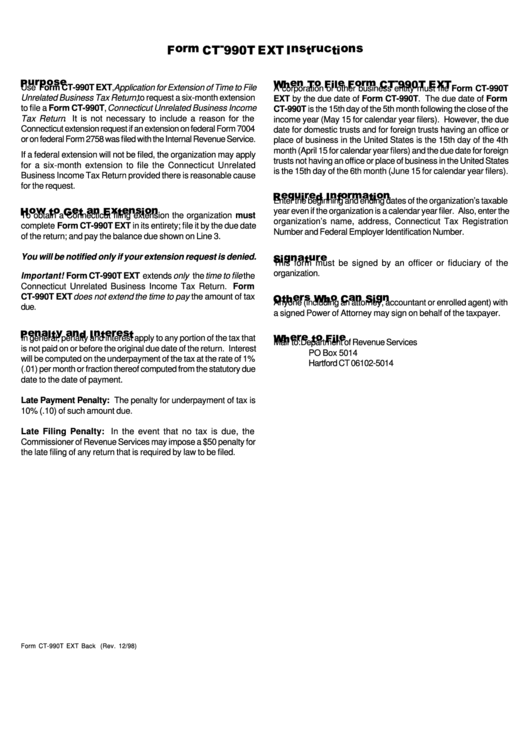

Form Ct-990t Ext Instructions

ADVERTISEMENT

Use Form CT-990T EXT, Application for Extension of Time to File

A corporation or other business entity must file Form CT-990T

Unrelated Business Tax Return, to request a six-month extension

EXT by the due date of Form CT-990T. The due date of Form

to file a Form CT-990T, Connecticut Unrelated Business Income

CT-990T is the 15th day of the 5th month following the close of the

Tax Return . It is not necessary to include a reason for the

income year (May 15 for calendar year filers). However, the due

Connecticut extension request if an extension on federal Form 7004

date for domestic trusts and for foreign trusts having an office or

or on federal Form 2758 was filed with the Internal Revenue Service.

place of business in the United States is the 15th day of the 4th

month (April 15 for calendar year filers) and the due date for foreign

If a federal extension will not be filed, the organization may apply

trusts not having an office or place of business in the United States

for a six-month extension to file the Connecticut Unrelated

is the 15th day of the 6th month (June 15 for calendar year filers).

Business Income Tax Return provided there is reasonable cause

for the request.

Enter the beginning and ending dates of the organization’s taxable

year even if the organization is a calendar year filer. Also, enter the

To obtain a Connecticut filing extension the organization must

organization’s name, address, Connecticut Tax Registration

complete Form CT-990T EXT in its entirety; file it by the due date

Number and Federal Employer Identification Number.

of the return; and pay the balance due shown on Line 3.

You will be notified only if your extension request is denied.

This form must be signed by an officer or fiduciary of the

organization.

Important! Form CT-990T EXT extends only the time to file the

Connecticut Unrelated Business Income Tax Return. Form

CT-990T EXT does not extend the time to pay the amount of tax

Anyone (including an attorney, accountant or enrolled agent) with

due.

a signed Power of Attorney may sign on behalf of the taxpayer.

In general, penalty and interest apply to any portion of the tax that

Mail to: Department of Revenue Services

is not paid on or before the original due date of the return. Interest

PO Box 5014

will be computed on the underpayment of the tax at the rate of 1%

Hartford CT 06102-5014

(.01) per month or fraction thereof computed from the statutory due

date to the date of payment.

Late Payment Penalty: The penalty for underpayment of tax is

10% (.10) of such amount due.

Late Filing Penalty: In the event that no tax is due, the

Commissioner of Revenue Services may impose a $50 penalty for

the late filing of any return that is required by law to be filed.

Form CT-990T EXT Back (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1