Instructions For Form Mw-1 - Employer'S Return Of Tax Withhold Page 2

ADVERTISEMENT

Space left blank for office use.

DATE RECEIVED:

ACCOUNT # _______________

Rev. 12/21/10

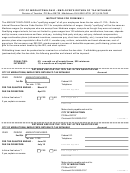

INSTRUCTIONS FOR FORM MW-1

CITY OF SPRINGFIELD

EMPLOYER S RETURN OF TAX WITHHOLD

Income Tax Division, PO Box 5200, Springfield, OH 45501-5200 937/324-7357

The AMOUNT ENCLOSED is the gross compensation of all

Withholding taxes must be received by the City of Springfield

your employees multiplies by the tax rate 2%.

Income Tax Division Office on or before the due date. It

withholding payments are received (postmarked) after the

Qualifying wages for withholding are defined by the Ohio

due date, the following penalties and interest will be imposed

Revised Code Sec. 718.03. An employer is required to

in compliance with the City of Springfield Ordinances.

withhold only on qualifying wages , which are wages as

defined in the Internal Revenue Code Sec. 3121(a),

PENALTIES: 10% if paid during the first month, 15% if paid

generally the Medicare Wage Box of the W-2 form.

during the second month, 20% if paid during the third month,

and 25% if paid more than three months after becoming due.

Payments may be made electronically (please call

937/328-3402 to set up), or online at:

INTEREST: 1% per month on all unpaid taxes.

https://

Form MW-1, Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2