Form Mw-1 - Employer'S Return Of Tax Withheld

ADVERTISEMENT

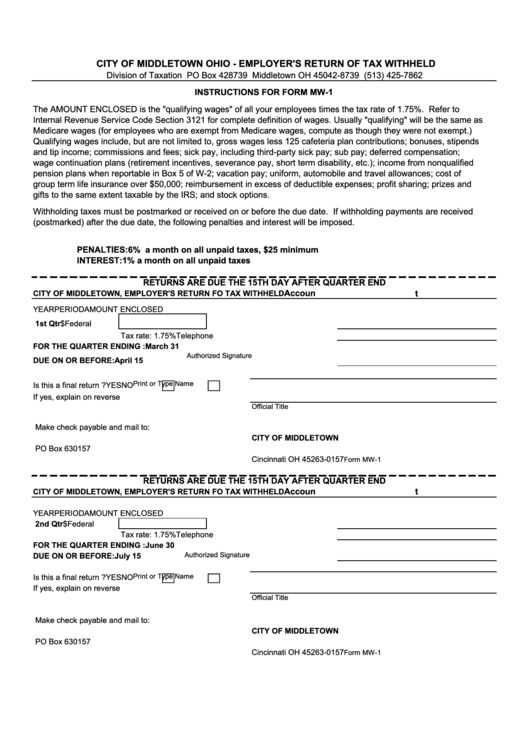

CITY OF MIDDLETOWN OHIO - EMPLOYER'S RETURN OF TAX WITHHELD

Division of Taxation PO Box 428739 Middletown OH 45042-8739 (513) 425-7862

INSTRUCTIONS FOR FORM MW-1

The AMOUNT ENCLOSED is the "qualifying wages" of all your employees times the tax rate of 1.75%. Refer to

Internal Revenue Service Code Section 3121 for complete definition of wages. Usually "qualifying" will be the same as

Medicare wages (for employees who are exempt from Medicare wages, compute as though they were not exempt.)

Qualifying wages include, but are not limited to, gross wages less 125 cafeteria plan contributions; bonuses, stipends

and tip income; commissions and fees; sick pay, including third-party sick pay; sub pay; deferred compensation;

wage continuation plans (retirement incentives, severance pay, short term disability, etc.); income from nonqualified

pension plans when reportable in Box 5 of W-2; vacation pay; uniform, automobile and travel allowances; cost of

group term life insurance over $50,000; reimbursement in excess of deductible expenses; profit sharing; prizes and

gifts to the same extent taxable by the IRS; and stock options.

Withholding taxes must be postmarked or received on or before the due date. If withholding payments are received

(postmarked) after the due date, the following penalties and interest will be imposed.

PENALTIES:

6% a month on all unpaid taxes, $25 minimum

INTEREST:

1% a month on all unpaid taxes

RETURNS ARE DUE THE 15TH DAY AFTER QUARTER END

Account

CITY OF MIDDLETOWN, EMPLOYER'S RETURN FO TAX WITHHELD

YEAR

PERIOD

AMOUNT ENCLOSED

1st Qtr

$

Federal I.D.

Tax rate: 1.75%

Telephone

FOR THE QUARTER ENDING :

March 31

Authorized Signature

DUE ON OR BEFORE:

April 15

Print or Type Name

Is this a final return ?

YES

NO

If yes, explain on reverse

Official Title

Make check payable and mail to:

CITY OF MIDDLETOWN

PO Box 630157

Cincinnati OH 45263-0157

Form MW-1

RETURNS ARE DUE THE 15TH DAY AFTER QUARTER END

Account

CITY OF MIDDLETOWN, EMPLOYER'S RETURN FO TAX WITHHELD

YEAR

PERIOD

AMOUNT ENCLOSED

2nd Qtr

$

Federal I.D.

Tax rate: 1.75%

Telephone

FOR THE QUARTER ENDING :

June 30

Authorized Signature

DUE ON OR BEFORE:

July 15

Print or Type Name

Is this a final return ?

YES

NO

If yes, explain on reverse

Official Title

Make check payable and mail to:

CITY OF MIDDLETOWN

PO Box 630157

Cincinnati OH 45263-0157

Form MW-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3