Instructions For Form - Schedule Nrc Income Of Nonresident Partners Or Shareholders Included In Composite Return

ADVERTISEMENT

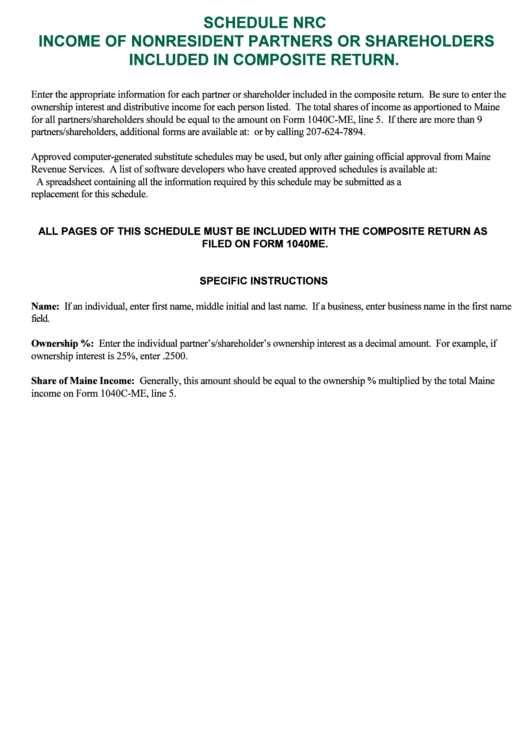

SCHEDULE NRC

INCOME OF NONRESIDENT PARTNERS OR SHAREHOLDERS

INCLUDED IN COMPOSITE RETURN.

Enter the appropriate information for each partner or shareholder included in the composite return. Be sure to enter the

ownership interest and distributive income for each person listed. The total shares of income as apportioned to Maine

for all partners/shareholders should be equal to the amount on Form 1040C-ME, line 5. If there are more than 9

partners/shareholders, additional forms are available at:

or by calling

207-624-7894.

Approved computer-generated substitute schedules may be used, but only after gaining official approval from Maine

Revenue Services. A list of software developers who have created approved schedules is available at:

.

A spreadsheet containing all the information required by this schedule may be submitted as a

replacement for this schedule.

ALL PAGES OF THIS SCHEDULE MUST BE INCLUDED WITH THE COMPOSITE RETURN AS

FILED ON FORM 1040ME.

SPECIFIC INSTRUCTIONS

Name: If an individual, enter first name, middle initial and last name. If a business, enter business name in the first name

field.

Ownership %: Enter the individual partner’s/shareholder’s ownership interest as a decimal amount. For example, if

ownership interest is 25%, enter .2500.

Share of Maine Income: Generally, this amount should be equal to the ownership % multiplied by the total Maine

income on Form 1040C-ME, line 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1