Schedule Nrc Instructions - Income Of Nonresident Partners Or Shareholders Included In Composite Return

ADVERTISEMENT

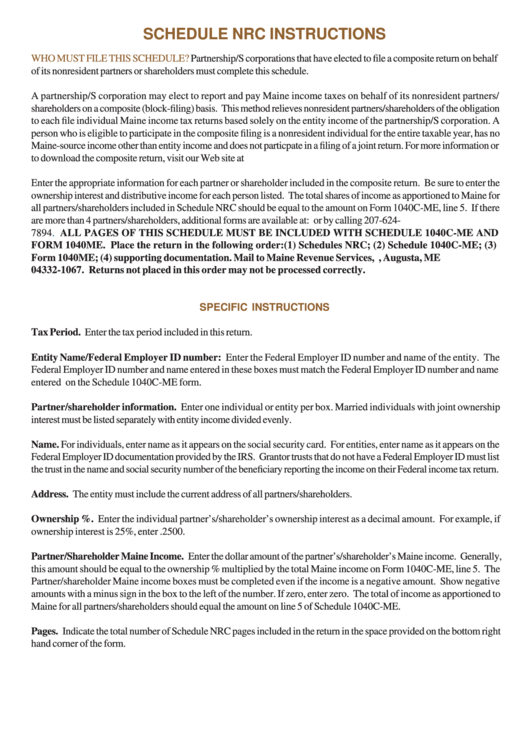

SCHEDULE NRC INSTRUCTIONS

WHO MUST FILE THIS SCHEDULE?

Partnership/S corporations that have elected to file a composite return on behalf

of its nonresident partners or shareholders must complete this schedule.

A partnership/S corporation may elect to report and pay Maine income taxes on behalf of its nonresident partners/

shareholders on a composite (block-filing) basis. This method relieves nonresident partners/shareholders of the obligation

to each file individual Maine income tax returns based solely on the entity income of the partnership/S corporation. A

person who is eligible to participate in the composite filing is a nonresident individual for the entire taxable year, has no

Maine-source income other than entity income and does not particpate in a filing of a joint return. For more information or

to download the composite return, visit our Web site at

Enter the appropriate information for each partner or shareholder included in the composite return. Be sure to enter the

ownership interest and distributive income for each person listed. The total shares of income as apportioned to Maine for

all partners/shareholders included in Schedule NRC should be equal to the amount on Form 1040C-ME, line 5. If there

are more than 4 partners/shareholders, additional forms are available at:

or by calling 207-624-

7894.

ALL PAGES OF THIS SCHEDULE MUST BE INCLUDED WITH SCHEDULE 1040C-ME AND

FORM 1040ME. Place the return in the following order:(1) Schedules NRC; (2) Schedule 1040C-ME; (3)

Form 1040ME; (4) supporting documentation. Mail to Maine Revenue Services, P.O. Box 1067, Augusta, ME

04332-1067. Returns not placed in this order may not be processed correctly.

SPECIFIC INSTRUCTIONS

Tax Period. Enter the tax period included in this return.

Entity Name/Federal Employer ID number: Enter the Federal Employer ID number and name of the entity. The

Federal Employer ID number and name entered in these boxes must match the Federal Employer ID number and name

entered on the Schedule 1040C-ME form.

Partner/shareholder information. Enter one individual or entity per box. Married individuals with joint ownership

interest must be listed separately with entity income divided evenly.

Name. For individuals, enter name as it appears on the social security card. For entities, enter name as it appears on the

Federal Employer ID documentation provided by the IRS. Grantor trusts that do not have a Federal Employer ID must list

the trust in the name and social security number of the beneficiary reporting the income on their Federal income tax return.

Address. The entity must include the current address of all partners/shareholders.

Ownership %. Enter the individual partner’s/shareholder’s ownership interest as a decimal amount. For example, if

ownership interest is 25%, enter .2500.

Partner/Shareholder Maine Income. Enter the dollar amount of the partner’s/shareholder’s Maine income. Generally,

this amount should be equal to the ownership % multiplied by the total Maine income on Form 1040C-ME, line 5. The

Partner/shareholder Maine income boxes must be completed even if the income is a negative amount. Show negative

amounts with a minus sign in the box to the left of the number. If zero, enter zero. The total of income as apportioned to

Maine for all partners/shareholders should equal the amount on line 5 of Schedule 1040C-ME.

Pages. Indicate the total number of Schedule NRC pages included in the return in the space provided on the bottom right

hand corner of the form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1