Refund Request Form Kentucky - Occupational Tax Office Page 2

ADVERTISEMENT

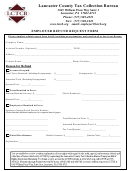

WARREN COUNTY SCHOOLS

OCCUPATIONAL TAX OFFICE

P. O. BOX 51530

BOWLING GREEN, KY 42102-5830

PHONE: 270/ 842-7168

FAX: 270/842-3411

REFUND APPLICATION PROCESS

If you do not live in the Warren County Public Schools attendance area but have had county

occupational tax withheld from your wages, you may receive a refund of that withholding. You

will be required to provide certain documents to assist us with your request.

I.

A W2 WILL BE REQUIRED FOR EACH YEAR REFUND IS REQUESTED.

Your W2 must clearly indicate the amount of county tax withheld from your

earnings. The county occupational tax should be shown separately from the

Bowling Green city occupational tax.

II.

PROOF OF ADDRESS

If you are a property owner, your utility company will be able to provide a

statement showing the date utilities were activated in your name and that you are

currently at that address. If you are not a property owner and cannot obtain such a

statement, you should call this office to discuss other forms of proof. A driver’s

license is not acceptable.

III.

MAIL REQUEST TO

Finance Officer, Warren County Schools Occupational Tax Office, P.O. Box

51530, Bowling Green, KY 42102-5830.

Please be aware that “annexed areas” are within the county school district.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2