Lawful Gambling Expense Calculation Worksheet Ec - Minnesota Department Of Revenue

ADVERTISEMENT

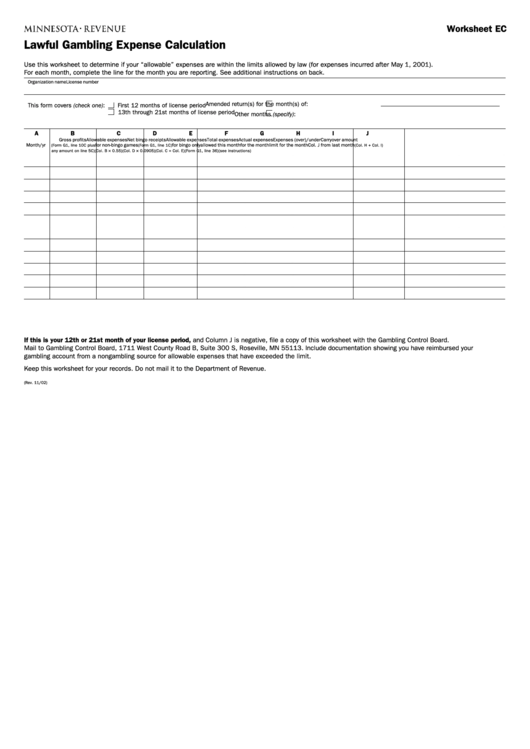

Worksheet EC

Lawful Gambling Expense Calculation

Use this worksheet to determine if your “allowable” expenses are within the limits allowed by law (for expenses incurred after May 1, 2001).

For each month, complete the line for the month you are reporting. See additional instructions on back.

Organization name

License number

Amended return(s) for the month(s) of:

This form covers (check one):

First 12 months of license period

13th through 21st months of license period

Other months (specify):

A

B

C

D

E

F

G

H

I

J

Gross profits

Allowable expenses

Net bingo receipts

Allowable expenses

Total expenses

Actual expenses

Expenses (over)/under

Carryover amount

Month/yr

(Form G1, line 10C plus

for non-bingo games

(Form G1, line 1C)

for bingo only

allowed this month

for the month

limit for the month

Col. J from last month

(Col. H + Col. I)

any amount on line 5C)

(Col. B × 0.55)

(Col. D × 0.0905)

(Col. C + Col. E)

(Form G1, line 36)

(see instructions)

If this is your 12th or 21st month of your license period, and Column J is negative, file a copy of this worksheet with the Gambling Control Board.

Mail to Gambling Control Board, 1711 West County Road B, Suite 300 S, Roseville, MN 55113. Include documentation showing you have reimbursed your

gambling account from a nongambling source for allowable expenses that have exceeded the limit.

Keep this worksheet for your records. Do not mail it to the Department of Revenue.

(Rev. 11/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1