Worksheet To Determine Estimated Tax Payments - Minnesota Department Of Revenue

ADVERTISEMENT

Insurance Premium Estimated Tax Instructions

For property, casualty and title insurance companies filing Form M11, for life insurance companies filing M11L and for

township mutual insurance companies filing Form M11T (M.S. 297I.05, subd. 1-4)

Filing Requirements

Worksheet Instructions

name, password and bank routing and ac-

count numbers. When paying electronically,

You must make estimated tax payments if

Step 2

you must use an account not associated with

you estimate your Minnesota insurance pre-

If you choose to pay the estimated tax in

any foreign banks.

mium tax (as reported on Form M11, M11L

full, enter the amount from step 1 on step 2,

or M11T) to be more than $500 this year.

If you use other electronic payment methods,

Column A. Otherwise, divide step 1 by four,

such as ACH credit method or Fed Wire,

and enter the result in Columns A, B, C and

Required Annual Payment. To avoid

instructions are available on our website or

D.

penalties and interest, your required annual

by calling Business Registration Office at

payment of estimated tax must equal 100

Step 3

651-282-5225 or 1-800-657-3605.

percent of last year’s tax liability or 80

If you elected to have all or a portion of your

percent of the actual tax due for the current

Check Payment

previous year’s refund applied as a credit

year, whichever is less. If you did not have

If you’re not required to pay electronically

to your estimated tax, enter the amount in

an insurance premium tax liability last year,

and are paying by check, visit our website

Column A.

you are not required to pay estimated tax

at and click on

for the current year.

If step 3 is more than step 2 for any quarter,

“Make a Payment” and then “By check” to

include the difference as an overpayment

To determine your estimated tax payment

create a voucher. Print and mail the voucher

credit in step 3 of the next quarter’s column.

amounts, complete the worksheet below.

with your check payable to Minnesota Rev-

Any overpayment credit resulting from the

enue.

Due Dates. Payments are due quarterly

fourth installment will be refunded when

on March 15, June 15, Sept. 15 and Dec.

When you pay by check, your check autho-

you file Form M11, M11L or M11T.

15. When the due date falls on a Saturday,

rizes us to make a one-time electronic fund

Sunday or legal holiday, payments elec-

Payments

transfer from your account. You may not

tronically made or postmarked on the next

receive your cancelled check. Do not send a

Electronic Payments

business day are considered timely.

payment voucher if you pay electronically or

If your total insurance taxes and surcharges

no amount is due.

No billings or reminders will be sent.

due for the last 12-month period ending

Note: Express deliveries only should be

June 30 is $10,000 or more, you are required

Underpaying Installments. If you un-

addressed to Minnesota Revenue, Insurance

to pay your tax electronically in all subse-

derpay any installment or did not pay by

Taxes Section, 600 North Robert Street,

quent years.

the due dates, an additional charge will be

St. Paul, MN 55101.

added to your tax at a specified percentage

You must also pay electronically if you’re

per year for the period of underpayment.

required to pay any Minnesota business tax

Information and Assistance

electronically, such as sales or withholding

Before You Can Make a Payment. To

Website:

tax.

ensure your payment is processed correctly,

Email:

insurance.taxes@state.mn.us

you must have a Minnesota tax ID num-

Phone:

651-556-3024

To pay electronically, go to the department’s

ber. To register, go to

website at and

This material is available in alternate formats.

mn.us or call 651-282-5225 or 1-800-657-

log in to e-Services. If you do not have

3605.

Internet access, you can pay by phone at

1-800-570-3329. You’ll need your user

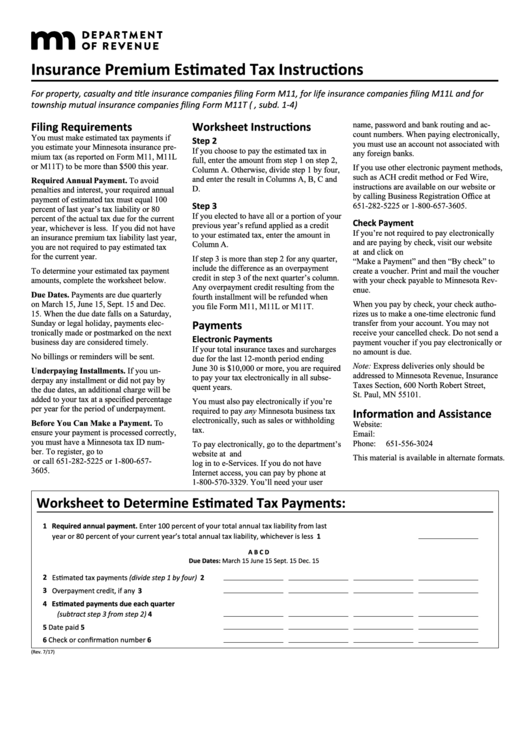

Worksheet to Determine Estimated Tax Payments:

1 Required annual payment. Enter 100 percent of your total annual tax liability from last

year or 80 percent of your current year’s total annual tax liability, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . 1

A

B

C

D

Due Dates:

March 15

June 15

Sept . 15

Dec . 15

2 Estimated tax payments (divide step 1 by four) . . . . 2

3 Overpayment credit, if any . . . . . . . . . . . . . . . . . . . . 3

4 Estimated payments due each quarter

(subtract step 3 from step 2) . . . . . . . . . . . . . . . . . . 4

5 Date paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Check or confirmation number . . . . . . . . . . . . . . . . 6

(Rev . 7/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1